Illustrative image

Bao Viet Corporation (BVH) recently announced its financial report for the fourth quarter of 2023, with consolidated assets as of the end of 2023 reaching nearly 221,206 billion dong, an increase of 19,542 billion dong compared to the end of 2022 (equivalent to a 9.7% increase).

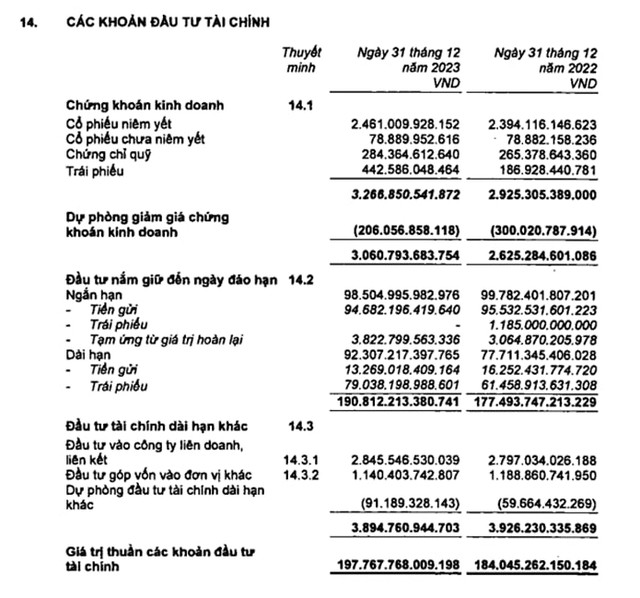

Specifically, financial investment is the largest asset category. In particular, the net value of the investment portfolio as of December 31, 2023, reached nearly 197,768 billion dong, an increase of 13,722 billion dong (equivalent to a 7.5% increase) compared to the end of 2022 and accounted for 89.4% of BVH’s total assets.

Going deeper into the investment portfolio, bank deposits reached nearly 108,000 billion dong, accounting for almost half of BVH’s total assets. Specifically, short-term deposits were 94,682 billion dong and long-term deposits were 13,269 billion dong.

According to BVH, short-term VND-denominated deposits in credit institutions with a principal term of over 3 months and a maturity period of less than 1 year have an interest rate of up to 10.6% per annum; deposits with a term of more than 1 year enjoy an interest rate of up to 10.4%.

In addition to the large amount of bank deposits, BVH also invested nearly 79,500 billion dong in bonds, mainly bonds held until maturity. Specifically, government bonds worth over 62,000 billion dong and corporate bonds worth nearly 17,500 billion dong.

BVH stated that in addition to Vinashin’s bonds, corporate bonds held by the Group have interest rates of 6.55 – 8.9% per annum with a principal term of 5 to 10 years, while government bonds have a term of 10 – 30 years.

As for stocks, BVH held 2,461 billion dong of listed stocks (including: VNR is 266 billion dong, CTG is 386 billion dong, VNM is 415 billion dong, and other listed stocks are 1,394 billion dong), unlisted stocks are 78.9 billion dong, and investment certificates are 284.4 billion dong.

In addition, the cash and cash equivalents category of the Group also recorded nearly 637 billion dong of bank deposits, 389 billion dong of funds in transit, and 3,726 billion dong in deposits with financial institutions with a maturity period of not more than 3 months and an annual interest rate from 2.5% to 3.5%.

Therefore, Bao Viet Corporation has a total of over 112,000 billion dong of bank deposits as of December 31, 2023. With this figure, BVH is the company with the largest amount of bank deposits on the Vietnamese stock market.

Source: Q4 financial report

In 2023, the “massive” financial investment portfolio brought BVH nearly 13,547 billion dong. Specifically, interest on deposits was nearly 8,642 billion dong and interest on bond investments was 3,941 billion dong.

After deducting expenses, BVH earned nearly 10,710 billion dong from financial activities, an increase of nearly 33% compared to 2022.

Although the financial activities’ profit grew strongly, the insurance business operated at a loss and the overhead costs of the enterprise increased significantly, BVH’s profit before tax in 2023 increased by a modest 7.5% to nearly 2,160 billion dong.

In 2023, BVH’s consolidated revenue reached 57,899 billion dong, a 6.2% increase compared to 2022, achieving the annual plan.

If only the parent company is considered, its revenue reached 1,577 billion dong, after-tax profit reached 1,120 billion dong, with growth rates of 1% and 1.6% respectively compared to 2022. The total assets of the parent company reached 18,371 billion dong, and the equity reached 17,672 billion dong as of December 31, 2023.

Regarding subsidiaries, Bao Viet Life Insurance Company continued to contribute the largest proportion to the overall profit with after-tax profit reaching 1,068 billion dong, a 9.6% increase compared to 2022. Bao Viet Life Insurance continued to lead in terms of total life insurance premium revenue in 2023 with total revenue of 44,713 billion dong, a 7.3% increase.

The non-life insurance business also achieved a growth of 5.2% in total revenue compared to the previous year, reaching 11,804 billion dong. The after-tax profit of the company reached 275 billion dong, a growth of 12.1% compared to 2022.

In addition, other subsidiaries such as Bao Viet Securities (BVSC) recorded 870 billion dong in revenue and achieved 158 billion dong in after-tax profit. Bao Viet Fund Management Company (BVF) recorded revenue of 157.3 billion dong in 2023, with after-tax profit reaching 61.3 billion dong; an increase of 17.9% and 21.4% respectively compared to 2022.