The stock market had a relatively positive first trading session of the year of Giap Thin 2024. The increase of many stock groups, with a focus on the banking sector, helped the main index maintain a green color throughout the trading time. VN-Index closed up 3.97 points to 1,202.5 points, officially surpassing the 1,200 milestone. Foreign trading was a downside, with a net selling value of more than 360 billion dong across the market.

In this context, securities firms recorded strong net selling with a value of 401 billion dong.

On HoSE floor, securities firms recorded net selling of 399 billion dong, with a net selling of nearly 424 billion dong on the matching order channel but a net buying of 25 billion dong on the negotiated channel.

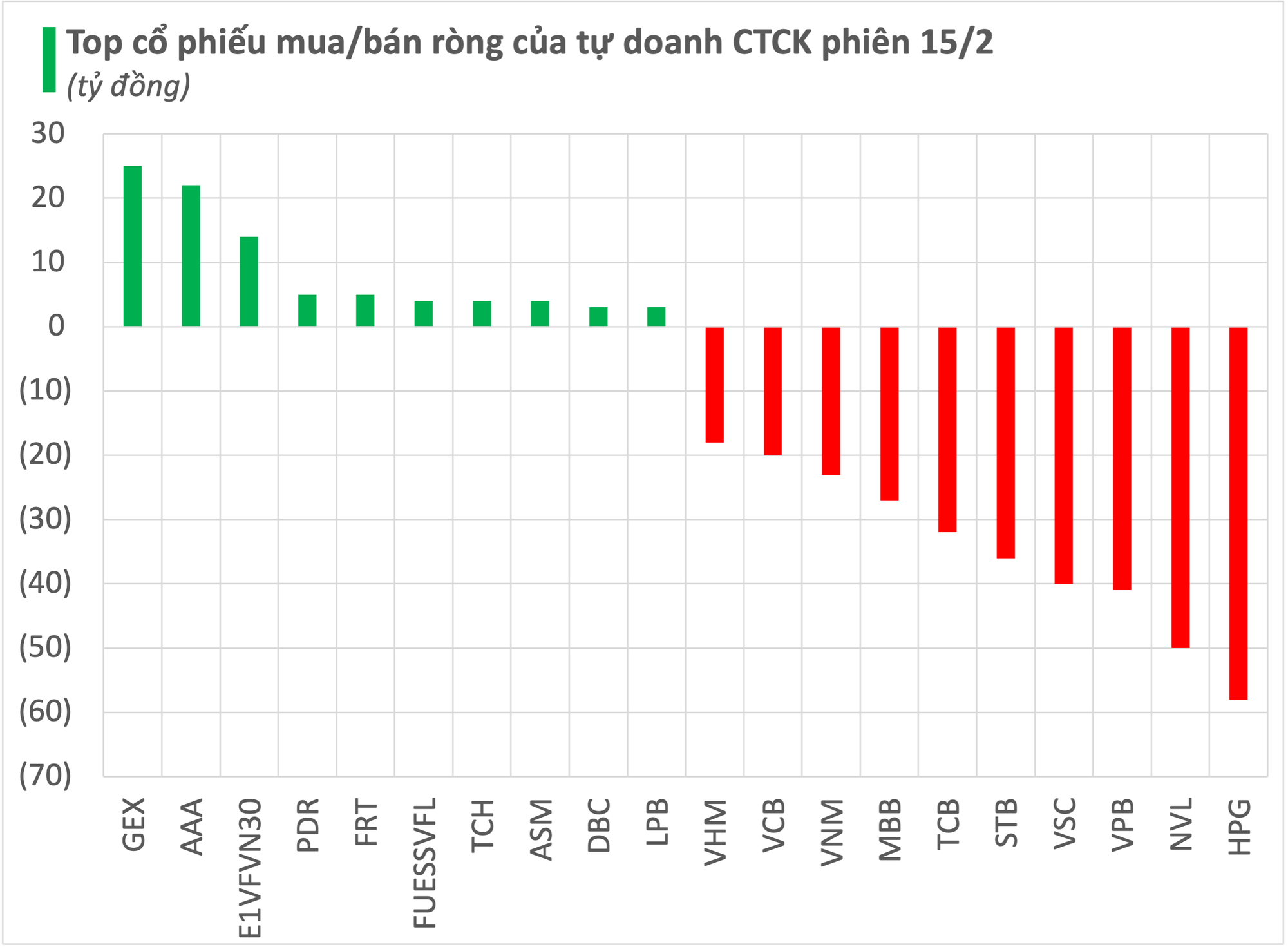

Specifically, the transactions of securities firms focused on net selling HPG and NVL stocks with 58 billion dong and 50 billion dong respectively. In addition, VPB also had a net selling of 41 billion dong. The stocks that were net selling in today’s session included a series of codes such as VSC, STB, TCB, MBB…

On the contrary, securities firms’ strongest net buying group were GEX and AAA stocks with 25 billion dong and 22 billion dong respectively. In addition, the E1VFVN30 fund certificates were also net bought with 14 billion dong for each code.

On UPCoM, securities firms had a net selling of nearly 2 billion dong, with BSR having a net selling of nearly 2 billion dong.