This afternoon, the leadership team welcomed several recovering banks, adding strength to the VN-Index. The highest closing index of the day, increasing by 15.27 points (+1.26), the strongest increase since November 8, 2023. The total trading value of the three exchanges reached over 29 trillion dong, the highest in 50 sessions.

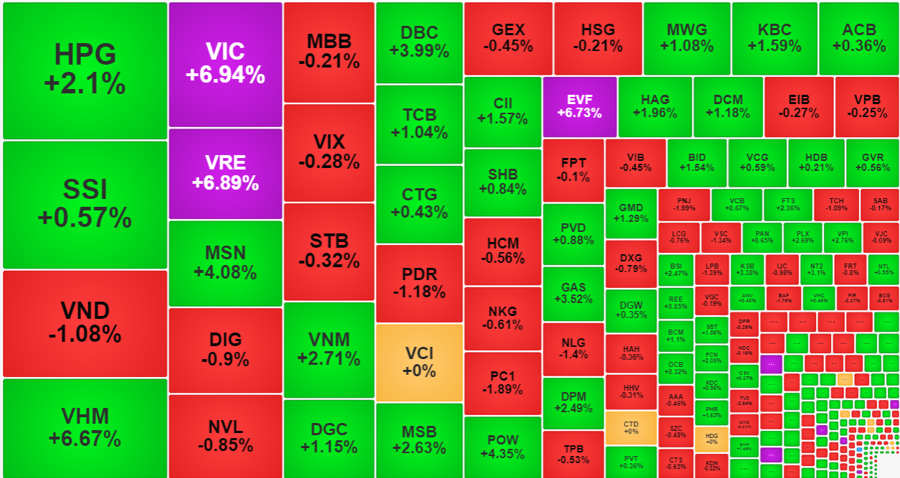

Compared to the morning session, stocks such as VIC, VHM, GAS, MSN all became stronger, but the notable ones are still the large banks that are recovering. VCB successfully reversed, turning to an increase of 0.67% compared to reference. BID rallied strongly this afternoon to +1.86%, changing the price to an increase of 1.54% at closing. CTG recovered to 2.31% to close above the reference by 0.43%… Overall, almost all bank stocks in the VN30 basket were stronger in the afternoon, although some were not enough to exceed the reference.

The convergence of the pulling force of the banking group naturally has a positive impact on the VN-Index. This is not to mention VIC also increased by 1.08% compared to the morning session to reach the ceiling level. VHM increased by an additional 3.41%, expanding the overall increase to 6.67%. MSN increased by an additional 1.62%, closing with a 4.08% increase… The closing index increased by 1.26% to 1,224.97 points. The highest closing level of the VN-Index in 2023 was 1,245.5 points on September 6, meaning the distance to touch the old peak is only 1.65% left, roughly a day of strong increase like today.

The market has a great opportunity to return to the most recent medium-term peak as new leading stocks have emerged. VIC, VHM, GAS, VNM, MSN are all “forgotten” blue-chips over the past few months: VIC hit bottom and hovered since November last year, VHM also struggled for 3 months; MSN, GAS were no better, going down throughout January 2024… These stocks, for many reasons, have not been able to increase at the same pace as the VN-Index, but mostly due to poor money flow.

Today, many stocks in this group have exploded in liquidity. VHM rose to the third place in the entire market with nearly 20.2 million shares worth 896.5 billion dong traded. In terms of both volume and value, this is a record liquidity level since the end of 2021. VIC stands right after VHM with 16.6 million shares worth 772.3 billion dong, a record high since mid-September 2023. MSN ranks 7th in the market with 7.83 million shares worth 533.6 billion dong, not counting agreements, setting a record since the beginning of 2022…

These aforementioned stocks along with many other stocks attracted impressive liquidity have helped drive the overall trading volume of the market high. On HoSE, the liquidity of the banking stock group increased by about 807 billion dong compared to the previous session, but the matching volume of this exchange increased to 5,379 billion dong, equivalent to 31%. HoSE had 26 stocks matching over 300 billion dong today while banks contributed only 6 stocks: MBB, STB, TCB, CTG, MSB and ACB. Also thanks to the strong money attraction of the leading stocks, the liquidity of the VN30 basket had a rare high session surpassing the Midcap group, reaching nearly 10,407 billion dong, accounting for 45.5% of this exchange’s total matching.

Although the VN-Index increased very well, its breadth is not too hot: HoSE ended the session with 298 gainers/217 losers. In terms of the ratio of increase to decrease of 1:1.37, this is not a tense trading state. Indeed, the final session before Tet holiday, the breadth ratio was even 1:3.64 even though the index increased by only 10 points. Moreover, the entire exchange only had 97 stocks increasing more than 1%. Although it accounted for less than 26% of the number of traded stocks on HoSE during the day, it accounted for 42% of the liquidity. This is a very high concentration of capital.

Foreign investors also bought positively this afternoon, disbursing an additional 996.4 billion dong on HoSE while selling 795.3 billion dong, equivalent to a net purchase of 201.1 billion dong. This group had a net sell of 63.3 billion dong in the morning session. Stocks that were bought well were VHM +194.3 billion, VRE +116.1 billion, VIC +111.2 billion, MSN +86.4 billion, EVF +48.3 billion, HPG +46.3 billion, GAS +35.7 billion, SSI +27.4 billion, FRT +23.9 billion. On the selling side, there were VND -145.7 billion, DBC -62 billion, MWG -60.8 billion, VNM -49.5 billion, CTG -37.1 billion, PDR -32.1 billion…