The market capitalization of the Magnificent 7 – a group of 7 large technology companies – is now larger than the stock market capitalization of most countries in the world, according to a new study from Deutsche Bank cited by CNBC.

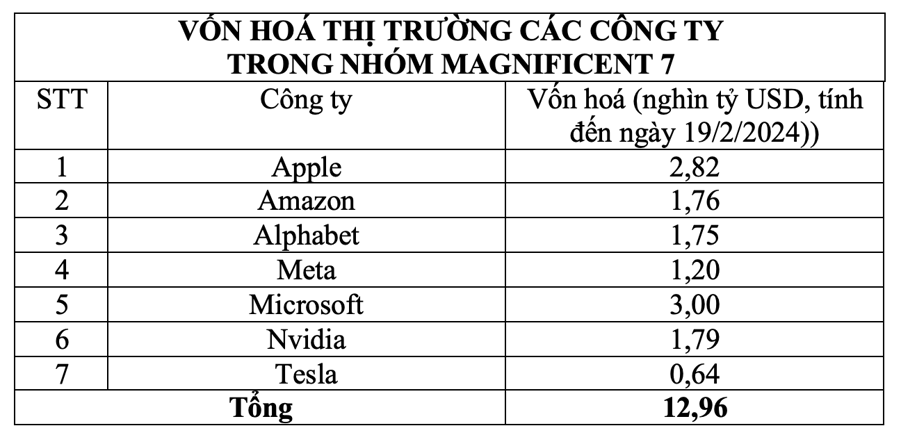

This massive group of listed companies includes the likes of Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla.

Deutsche Bank found that the total market capitalization of this group is equivalent to the market capitalization of the second largest stock exchange in the world, while being twice the size of the stock market capitalization of Japan – the fourth largest stock market in the world. The market capitalization of Microsoft or Apple alone matches the total market capitalization of all listed companies in France, Saudi Arabia, and the UK.

In terms of profits, the total profits of the Magnificent 7 are only slightly behind the total profits of all listed companies in the US, China, and Japan.

However, as all of these companies are listed in the US, the high level of concentration of market capitalization and profits has led some analysts to express concerns about the risks posed to the US market in particular and the global market in general. In a separate report, Deutsche Bank’s global economic research head Jim Reid warned that “the level of market capitalization concentration in the US stock market is currently second only to 2000 and 1929.”

Reid noted that while large companies in the US tend to eventually move out of the top 5 largest market capitalization companies due to investment trends and profit prospects, 20 of the top 36 largest companies in the US stock market in 2000 still remain in the top 50 currently.

“Among the companies in the Magnificent 7 group currently present in the top 5 in market capitalization in the US market, Microsoft has maintained its position since 1997 except for a 4-month period. Apple has been present since December 2009. Alphabet has been present from August 2012 until now with only 2 months of absence, while Amazon has maintained its position since January 2017. The newest addition to the group, Nvidia, has maintained its position in the top 5 since the first half of last year,” the expert said.

After being in the top 5 most valuable companies in the US for 13 months in 2021/2022, Tesla has now dropped to 10th place as the company’s stock price has fallen by about 20% from the beginning of 2024 until now. In contrast, Nvidia’s stock continues to rise strongly, recording a 47% increase since the beginning of the year.

“The companies on the outskirts of the Magnificent 7 have had some fluctuations in market capitalization positions, so one can doubt the total capitalization of the group. But at the heart of the group are the largest and most successful companies in the US and the world over the past many years,” emphasized Reid.

Despite the gloomy global economic outlook, this group of companies is benefiting greatly from the artificial intelligence (AI) technology boom and the expectation that the US Federal Reserve and other major central banks will begin to cut interest rates this year.

In a report last week, asset management firm Evelyn Partners stated that the return on investment from the Magnificent 7 stock group for investors in 2023 is 107%, far surpassing the 27% return on investment of stocks in the MSCI USA Index – a broad measure of the US stock market.

However, Evelyn Partners strategist Daniel Casaly believes that this year, the stock market’s gains will occur broadly rather than just focusing on the Magnificent 7 group. Casaly believes that such market gains are due to the resilience of the US economy despite high interest rates.