Illustration photo

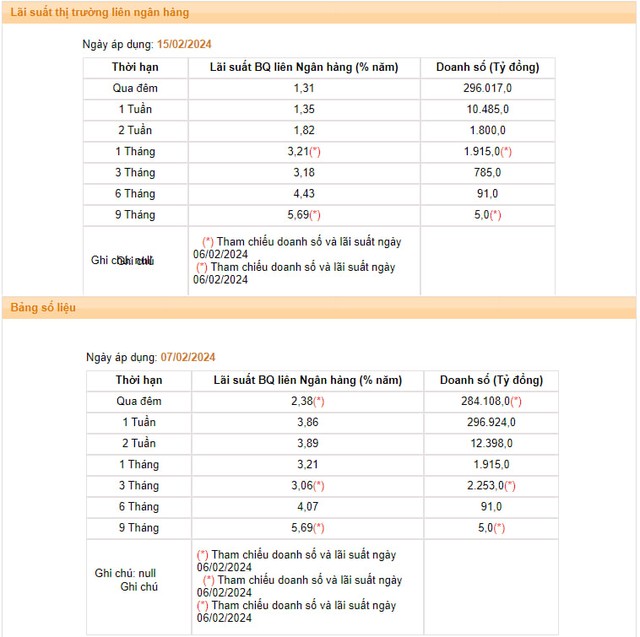

According to the latest data from the State Bank of Vietnam (SBV), the average interbank VND interest rate has sharply declined in the first trading session after the Lunar New Year holiday. Specifically, the overnight interest rate (the main term, accounting for about 90% of the transaction value) in the session on February 15th decreased to 1.31%, from 2.38% before the holiday.

Along with the overnight term, interest rates in the other two key terms also dropped significantly: the 1-week term decreased from 3.86% to 1.35%; the 2-week term decreased from 3.89% to 1.82%.

Prior to that, interbank interest rates had continuously increased in the days leading up to Tet holiday. The overnight term jumped from 0.12% per year in the session on January 29th to 2.38% in the sessions on February 6th and 7th, or nearly 20 times higher after just one week. The short terms also saw significant increases.

Source: SBV

The cooling down of interbank interest rates after the Tet holiday is in line with the trend of previous years and analysts’ predictions. The main reason for the sharp increase in interbank interest rates in the days leading up to Tet is mainly due to the seasonal nature of increased payment and spending during the Lunar New Year holiday.

Analysts expect interbank interest rates to continue to decline and remain low in the first months of 2024 as system liquidity remains abundant and credit demand is usually low after the Tet holiday.

According to MBS Securities, interbank interest rates skyrocketed in the last days of January, especially in the short terms, due to the seasonal factors of the year. MBS believes that interest rates will not increase too much and will cool down immediately after the holiday ends, as liquidity needs are not too tense.

Prior to that, Vietcombank Securities also predicted that interbank interest rates could increase due to seasonal factors surrounding the Lunar New Year, but the increase would not be significant and would end immediately after the holiday.

In reality, the trading volume in the interbank market has increased in recent weeks, consistently staying above 300,000 billion VND per session, even reaching nearly 400,000 billion VND on January 31st. However, no market member requires support from the Operations Department through the Open Market Operations channel.

The lack of trading in the OMO support channel shows that the system liquidity can still “sustain” itself even during the peak period of year-end payment. This is quite different from previous years when the SBV usually had to inject tens of thousands of billion VND through the OMO channel to support system liquidity in the days leading up to Tet holiday.

In another aspect, reducing the overnight interbank interest rates increases pressure on exchange rates – which face significant pressure in the context of the strong recovery of the greenback in the international market.

According to Vietcombank, the bank with the largest volume of foreign exchange transactions in the system, the USD price is currently bought and sold at the levels of 24,310 – 24,680 VND/USD, increasing by 110 dong in both directions compared to the level before the Tet holiday. Previously, the USD price at banks had decreased significantly in the days leading up to Tet holiday after experiencing a strong increase in January.

In its newly published macro report, VCBS said that in January, the foreign exchange demand started to increase again thanks to the improvement of import and export activities, which significantly pushed up the transaction exchange rate at the banking system with an increase that reached over 1% at certain times. At the end of January, the VND depreciated by about 0.72% against the USD. Among them, the price decrease was significantly narrowed at the time close to the Lunar New Year holiday mainly due to the favorable factor from the remittances reaching 16 billion USD in 2023 (+30%).

VCBS believes that the interest rate landscape continues to break the deep bottom threshold, putting constant pressure on exchange rates as the DXY still maintains a high level. Accordingly, the likelihood of the VND depreciating will still exist, and the exchange rate situation will depend largely on the foreign currency supply at each period with controlling factors belonging to direct and indirect investment flows, remittances, etc.