“Four Emperors” dominate Vietnam’s beer market

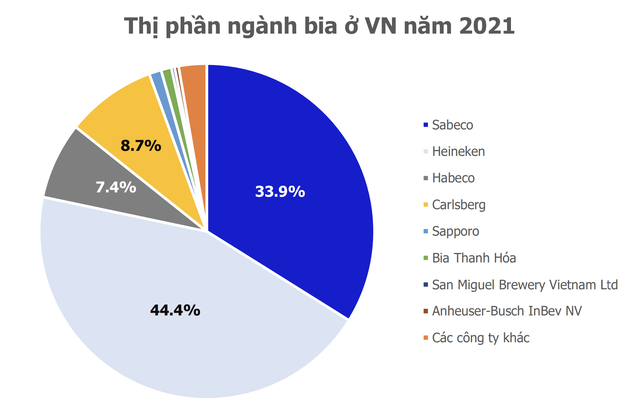

Over the years, the Vietnamese beer market has been dominated by a group of four major breweries: Heineken, Sabeco, Carlsberg, and Habeco.

According to a report by MB Securities Joint Stock Company (MBS), these four breweries operate strongly in different regions: Sabeco has a strong presence in the southern region, Habeco focuses on the northern region, and Carlsberg holds an advantage in the central region due to its brewery located in Hue.

Source: MBS.

Heineken, originally dominant in the southern market with a premium-to-super-premium segment, has gradually expanded its distribution network to all provinces, focusing on major cities and targeting young, dynamic consumers.

With a large population, high income levels, and a distinct drinking culture, the southern region accounts for over half of Vietnam’s total beer consumption, followed by the northern region and finally the central region. This is also the reason why Sabeco and Heineken, the two popular breweries in the south, together accounted for 78.3% of the total market in 2021, surpassing the remaining two breweries.

Other breweries hold only a small market share, including names such as Japanese brewery Sapporo and Belgium-Brazilian brewery AB InBev.

Due to the significant gap in market share and popularity among consumers, as well as their well-established distribution networks and strong presence in Vietnam, other breweries find it difficult to compete with Sabeco and Heineken, who have built a loyal customer base over the years.

According to Kirin Holdings, Vietnam ranks 9th in the world in terms of beer consumption, with over 4 billion liters consumed in 2020, accounting for 2.2% of global consumption. In the region, according to data from the Ministry of Information and Communications, Vietnam ranks 2nd in Southeast Asia and 3rd in Asia in terms of average alcoholic beverage consumption per capita. The average annual beer consumption per capita (over 15 years old) in Vietnam is 8.3 liters, equivalent to 170 liters per person per year.

Struggling with alcohol concentration regulations: Heineken takes marketing risks on expressways, Sabeco invests in Rap Viet, Sea Games

Heineken’s “Alcohol-Free Station” at the Ho Chi Minh – Long Thanh – Dau Giay Expressway Rest Area (Photo: NLĐ)

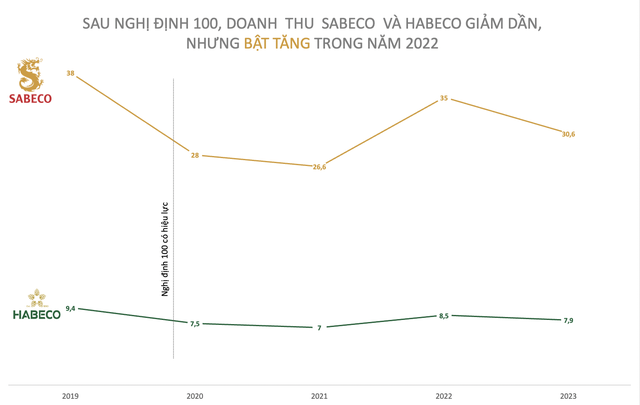

According to statistics, continuous decline in consumption has led to a decrease in the full-year revenue of beer industry businesses to more than VND 45,000 billion, down from over VND 55,000 billion in 2022. After-tax profit also decreased sharply at a rate of over 23%, to less than VND 5,100 billion.

One of the units that experienced the most significant decline is Saigon Alcohol – Beer – Beverage Corporation (Sabeco), with revenue falling from VND 35.2 trillion in 2022 to VND 30.7 trillion in 2023. As for beer sales revenue, Sabeco also decreased by 12%, from VND 30.6 trillion in 2022 to VND 29.6 trillion in 2023.

According to Kantar, although consumer sentiment has improved slightly, people are still cautious, resulting in continued careful management of expenses and reduction in dining and entertainment activities outside the home.

In addition, Sabeco’s leadership also believes that strict enforcement of Decree 100 on Alcohol Concentration has put pressure on consumers.

Graphic: Bao Bao.

In order to adapt to business operations when Decree 100 took effect, Heineken launched the alcohol-free beer product Heineken 0.0. Recently, the brand took a marketing risk by promoting the product at a highway rest area, amid increased enforcement actions against drivers violating alcohol concentration regulations.

On the other hand, Sabeco stated that it has not yet seen a significant shift in the consumption behavior of Vietnamese consumers towards non-alcoholic beverages.

According to MBS’s report, through its Saigon Chill brand, Sabeco became a gold sponsor for the Rap Viet All-Star 2021 program, a music program that attracted the attention of many young people. Sabeco is also the exclusive sponsor of the Vietnam National Football Team in domestic and international competitions from June 2021 to June 2022.

The Saigon beer brand of the company is also a diamond sponsor at the 31st Sea Games. Sabeco has signed a 3-year strategic partnership with the Vietnam National Administration of Tourism to organize promotional activities for Vietnam’s cultural, sports, and tourism values in December 2021.

In a recent meeting with investors held in early February 2024, Sabeco expects to shift its consumption channel from on-trade to off-trade. The company is focusing on increasing sales on e-commerce platforms such as Shopee, Lazada, and Tiki.

Looking at 2024, Sabeco is cautiously optimistic about the recovery of beer sales volume in Vietnam.