After years of unsuccessful merger negotiations between Grab and GoTo – the parent company of Gojek, sources say that the two rival competitors are reopening discussions.

If an agreement is reached, the intense and lengthy competition between the two aforementioned companies would come to an end. In this scenario, Grab would acquire GoTo, using both cash and stock. This is significant as Grab’s market capitalization reached USD 13.8 billion on February 16, which is currently double that of GoTo.

However, the changing status of the companies in recent years indicates that such an agreement is often “easier said than done.”

Other factors such as the financial position of the two companies, regulatory concerns, and the complexity of combining two different business operations also create new barriers.

Furthermore, GoTo has denied any such agreement. Meanwhile, Grab has stated that they “have no comment on the rumors.”

EASIER SAID THAN DONE?

Outwardly, it appears to be a good time for GoTo to pursue a deal with Grab. Gojek co-founder Kevin Aluwi resigned from the GoTo board last year, and he is also the last person in the trio of co-founders to leave the company.

Patrick Walujo – who assumed the CEO position of GoTo in June 2023 – is a co-founder of Northstar Group, an early investor in Gojek. Unlike Andre Soelistyo, former CEO of GoTo, Walujo never belonged to the original Gojek management team – the ones who always considered selling out to Grab as an act of surrendering to their competitor.

Furthermore, Walujo has not shied away from making decisive steps to improve the prospects of GoTo. The biggest example is his decision to let TikTok take control of shares in Tokopedia, creating the Tokopedia-TikTok alliance despite Tokopedia being the larger e-commerce platform in Indonesia.

While some analysts note that Tokopedia was sold at a “bargain price,” Walujo stated that this deal protected the company from intense competition among domestic e-commerce businesses.

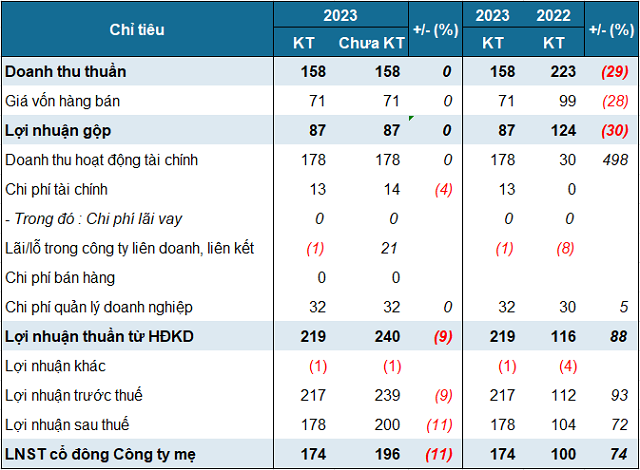

Meanwhile, Grab has net cash liquidity of over USD 5 billion as of September 2023.

Although this may not be enough for the company to fully acquire GoTo based on the current market valuation of USD 6.4 billion as of February 16, Grab could seek additional financial resources and pay part of the deal with its own stocks.

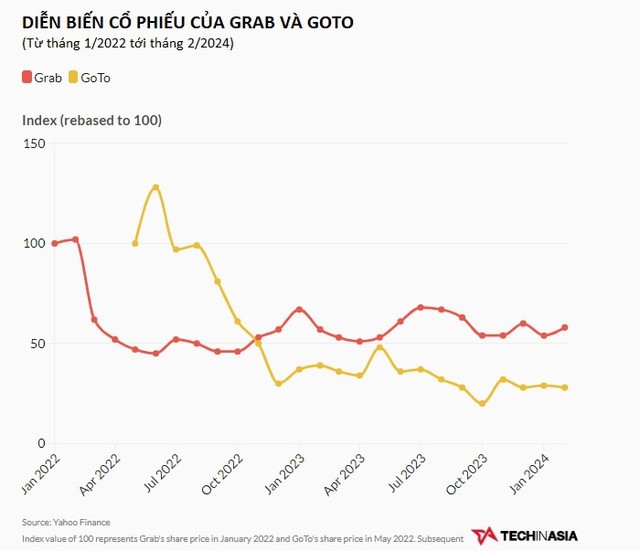

Although it has decreased by over 70% since its listing in the US in December 2021, Grab’s stock price has remained relatively stable since March 2022. This would be a significant factor if any deal involves a stock payment by the company.

However, this raises the question of why Grab needs to acquire GoTo and how the Grab-GoTo merger could create value for each company’s shareholders. And even assuming that these two questions have been answered, any deal could face significant legal opposition due to the dominance that a combined entity would have in Indonesia and Singapore.

NOT SHORT OF CASH

A year ago, Nirgunan Tiruchelvam, equity capital analyst at investment consultancy Alethia Capital, raised the possibility that GoTo may face a cash crunch, with net cash expected to run out by the end of 2023.

That prediction has not materialized: GoTo and Grab have seen their financial positions improve since then.

At the group level, Grab reported positive adjusted EBITDA in the three months ending September 2023.

Meanwhile, GoTo achieved the same in the last quarter, according to the company’s disclosure on January 31, 2024, regarding the merger with TikTok Shop. As for the Indonesian rival, they are expected to announce official Q4 results in March.

While adjusted EBITDA doesn’t replace operating profit or actual cash flow from operations, both companies have demonstrated that they are moving in the right direction.

In terms of cash, GoTo appears to be in a secure position. They have USD 1.6 billion in cash and equivalents as well as time deposits on the balance sheet as of September 2023. Meanwhile, over the 12 months ending in September 2023, they spent USD 484 million in cash for operating activities.

From January to September last year, most of GoTo’s operating losses stemmed from Tokopedia – along with the conglomerate’s fintech operations. Tokopedia has been facing increasingly fierce competition, especially after Sea Group committed to investing more in Shopee to take on competitors.

However, GoTo’s loss levels are starting to narrow, and the deal with TikTok has helped further reduce any burning cash from Tokopedia as they effectively removed a competing entity.

Thus, a deal with Grab is clearly not motivated by a fear of running out of cash.

Nailul Huda, digital economy director at the Center of Economic and Law Studies, agrees that there is no rush for both companies to merge with each other.

He predicted that a merger between the two “will not take place within the next 1 or 2 years,” especially as GoTo has managed to cut operating costs since the Tokopedia deal. However, Huda said the situation could change if GoTo’s financial position worsens.

POTENTIAL BENEFITS

Of course, a marriage between the two rivals could still bring significant financial benefits.

For example, from July to September 2023, GoTo and Grab collectively spent over USD 500 million on incentives for drivers and consumers. A potential merger could significantly reduce this amount. Assuming that incentive costs are halved, it could save USD 1 billion annually.

According to Roshan Raj, a partner at Redseer Strategy Consultants, a potential merger could also change the pricing power in favor of the companies. This would allow the merged entity to increase their service prices and improve profit margins.

A rationalized organization would be able to save duplicate costs such as administrative and R&D expenses.

The resulting savings would lead to better profitability for the merged entity, creating positive sentiment for public market investors.

However, Raj also added that the lack of competition could potentially reduce the companies’ long-term innovation capabilities.

LEGAL BARRIERS

Even if the business conditions were favorable, GoTo and Grab would have to overcome numerous legal barriers before the merger agreement can be realized, particularly in obtaining approval from competition regulatory authorities.

Grab is present in all key Southeast Asian markets, while GoTo’s main business operations are in Indonesia, although the company also operates in Singapore and Vietnam.

In Indonesia, a merged entity would have near-total control of the ride-hailing market, excluding taxi services.

Together, the two companies would also have an 88% market share in food delivery, based on Momentum Works research. ShopeeFood would be the only major competing entity left for the merged entity.

The merger law in Indonesia enforces a mandatory notification regime after the contract is concluded. This means that the parties involved in the merger do not need to notify regulatory authorities before they execute the agreement.

However, in practice, it was only the day after news of a potential Grab-GoTo deal emerged that KPPU noted that such a merger could lead to potential anticompetitive activities due to the “high market concentration” of the combined entity in certain areas.

A KPPU spokesperson added that the Business Competition Law in the country prohibits mergers and acquisitions for this reason. However, the spokesperson noted that the KPPU will have to conduct the appropriate evaluation before making any conclusions.

Meanwhile, Grab is currently awaiting a decision from the Competition and Consumer Commission of Singapore (CCCS), which is conducting a deep dive phase two assessment of its plan to acquire taxi company Trans-cab. Grab’s plan was first announced in July 2023.

In November last year, after the initial review stage, the regulatory body rejected Grab’s proposal, stating that the company needed to address concerns relating to competition.

Thus, Grab acquiring Gojek’s ride-hailing business in Singapore (though it is only rumored) would also subject them to even greater scrutiny from the CCCS.

NO LONGER THE “INDONESIAN TECH CHAMPION”

One last but equally important issue is that when Gojek merged with Tokopedia in 2021, the deal created what some called an “Indonesian tech champion.”

When GoTo continued to list on the Indonesia Stock Exchange, they sold the story of their rise as a homegrown tech icon to hundreds, if not thousands, of Indonesian investors.

Regardless of the actual figure, the notion of an Indonesian tech champion being acquired by a US-listed rival headquartered in Singapore is likely to sit uneasily with many locals. It is made worse by the fact that Tokopedia is essentially under the control of TikTok, owned by Chinese company ByteDance.

However, Celios’ Huda believes that from the industry’s perspective, the acquisition will benefit Indonesian startups. Huda said that any deal, including one involving foreign companies, provides more exits for local companies in the industry.

Another issue that this discussion hasn’t yet touched upon is how to integrate two different corporate cultures, which can lead to a lack of employee cohesion, demotivation, conflicts, and reduced productivity.

The relatively low stock price of GoTo may be comparatively attractive to Grab, but according to Techinasia, it is probably best to let everything “remain as is” and not create any unnecessary disruption.

Source: Techinasia