Ending the trading session on February 19, VRE shares of Vincom Retail Joint Stock Company unexpectedly rose to the ceiling price of 24,500 VND/share. This is also the fourth consecutive session of growth for this stock. Among those happiest are the shareholders of Vincom Retail.

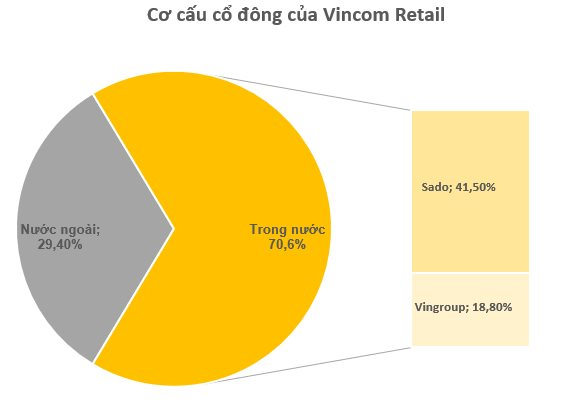

According to the ownership structure of this company, currently over 70% of Vincom Retail’s shares belong to domestic shareholders, with the rest being held by foreign shareholders.

Of these, Sado Trading Joint Stock Company is the largest shareholder of the company with 943.2 million VRE shares, equivalent to 41.5% of the company’s charter capital. According to research, Sado is a subsidiary owned 100% by Vingroup (stock code VIC).

In 2020, Vingroup conducted internal restructuring by separating the business of the Urban Development and Investment Corporation Sài Đồng. According to this, Sài Đồng Company transferred a part of the share capital of existing shareholders together with corresponding assets, rights, and obligations to establish a new company. The newly established legal entity is Sado with an initial charter capital of nearly 500 billion VND. However, by February 2023, the company’s charter capital had increased to 8,693 billion VND, an increase of 17.3 times after 5 years.

Sado mainly operates in the field of management consulting (excluding legal, financial, accounting, auditing, tax, and securities advice). In addition, the company has registered many other industries such as agency, brokerage, auction of goods; comprehensive office administrative services; trade promotion; creative activities, arts, and entertainment…

This company began to own VRE shares since February 2021 after merging with the South Hanoi Business and Development Investment Company Limited. Since April 2021, Sado has officially become the largest shareholder of Vincom Retail when receiving a further transfer of 751 million VRE shares.

Vingroup itself – the parent company of Sado also directly holds 427.8 million VRE shares, equivalent to 18.8% of the capital. Thus, Vingroup holds 60.33% of the voting rate in Vincom Retail.

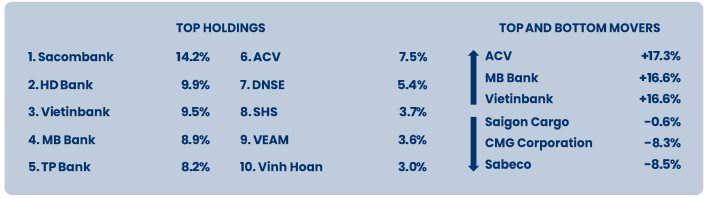

As one of the leading industry companies with top market capitalization, VRE is also held in large proportions by many domestic funds such as the DCVFM VNDIAMOND ETF fund holding nearly 10 million shares, DCVFM VN30 ETF fund holding 5.8 million shares, VLGF fund of SSIAM holding 4.6 million shares…

Foreign investors at Vincom Retail

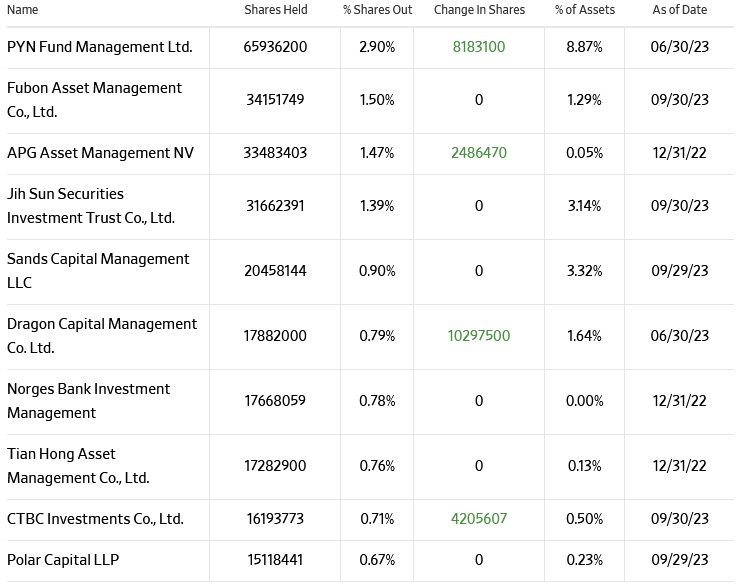

Regarding foreign shareholders, currently PYN Elite Fund is the organization that owns the most VRE shares. Specifically, the fund now owns about 65.9 million VRE shares, equivalent to 2.9% of the capital.

In late December 2023, the investment in Vincom Retail ranked 7th in the portfolio of PYN Elite Fund, accounting for 4.7% of the NAV. However, by January this year, this investment disappeared from the top 10 as the fund further disbursed money into other stocks.

Fubon Asseet Management – a familiar Chinese investment fund in Vietnam owns 1.5% of Vincom Retail’s capital. In addition, Dragon Capital – a billion-dollar foreign fund also owns more than 17.8 million VRE shares, equivalent to 0.79% of the capital.

Proportion of foreign institutions holding VRE shares. Source: Wall Steet Journal.

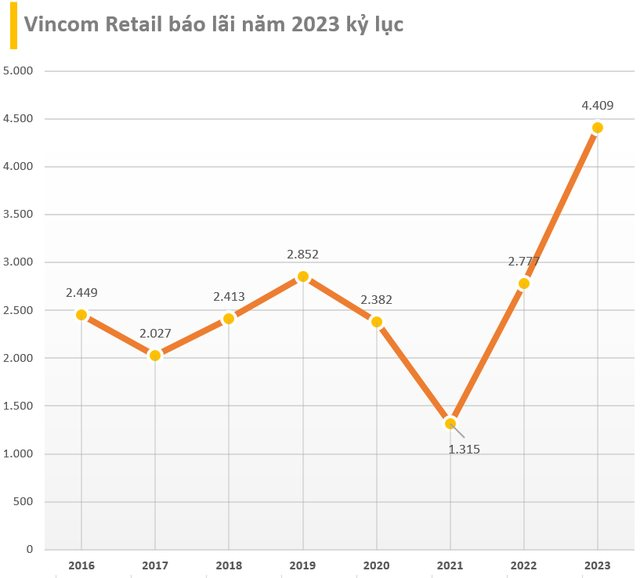

Undoubtedly, VRE is still a potential stock for investors when looking at the company’s business results. Specifically, in 2023, Vincom Retail recorded net revenue of 9,791 billion VND, after-tax profit reaching 4,409 billion VND, an increase of 33% and 58.8% respectively compared to the same period. Among them, total consolidated net revenue in the fourth quarter of 2023 reached 2,343 billion VND, an increase of 9.6% year on year thanks to recognizing revenue from real estate handover and other revenues, while the business operation of commercial centers (TTTM) maintained a stable status. After deducting costs, Vincom Retail recorded after-tax profit of 1,067 billion VND, an increase of 28.3% compared to the same period last year.

With the achievements in 2023, Vincom Retail will continue to optimize its operating model, seek and introduce new consumer trends in Vincom Shopping Centers. In 2024, Vincom Retail is expected to open 6 more TTTMs with a total floor area of about 160,000 m2, maintain its position as the leading retail real estate developer in Vietnam and the region.