In Vndirect Research’s 2024 strategy report, experts forecast that Vinhomes JSC (stock code VHM) will see a 10.5% increase in revenue in 2024, reaching VND 119,261 billion, and a 15.1% increase in net profit in the same period, reaching VND 43,538 billion. This is expected to be driven by a 29.4% increase in new sales in 2024.

This growth is mainly attributed to the launch of three major projects in the second half of 2024: Vinhomes Vu Yen (877ha, Hai Phong), Vinhomes Co Loa (385ha, Hanoi), and Vinhomes Wonder Park (133ha, Hanoi). In addition, sales of low-rise units in Vinhomes Ocean Park 2 and 3 will also contribute to the company’s growth.

According to Vndirect Research, compared to other companies in the industry, VHM has a strong balance sheet with a net debt-to-equity ratio of 0.2 as of the end of Q3/23, much lower than the industry average of 0.5 (VHM has maintained a net debt-to-equity ratio of around 0.1 – 0.2 in the past 3 years). Additionally, its interest coverage ratio reached 21.2 in the first 9 months of 2023, significantly higher than the industry average of 2.1.

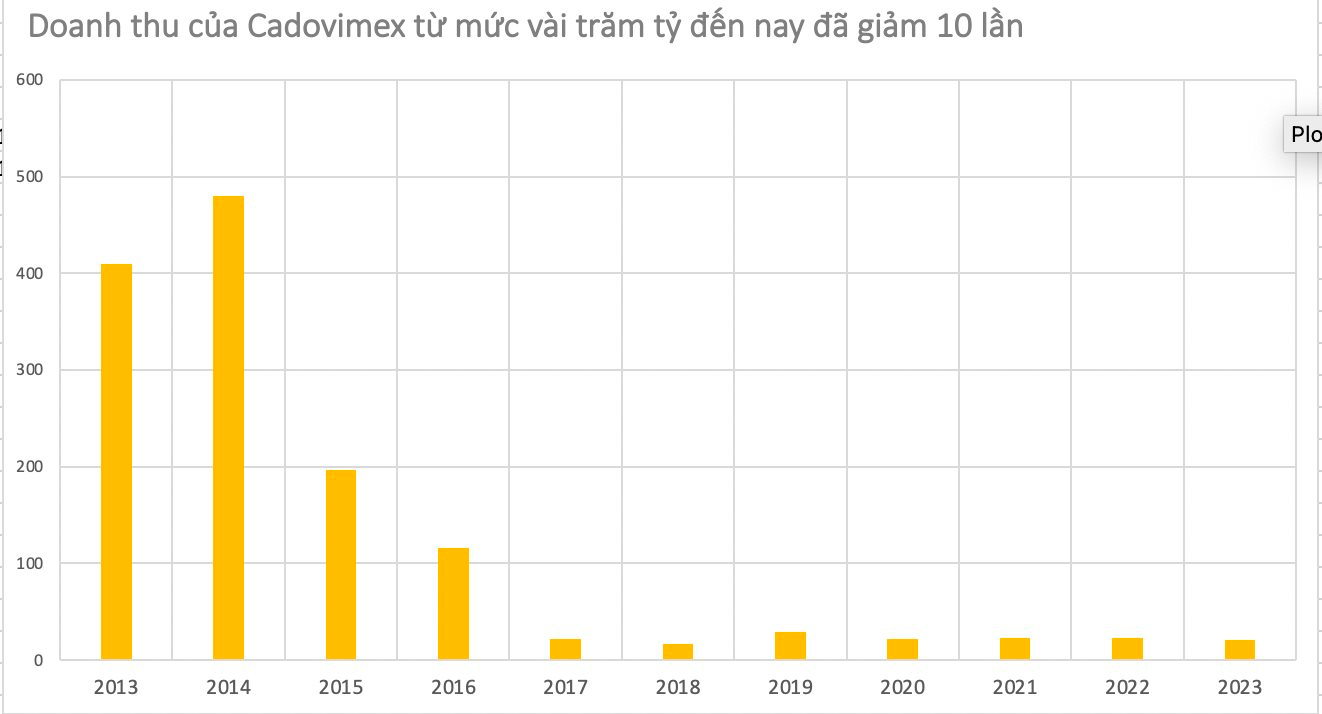

Vinhomes’ financial report for 2023 shows that its Q4/2023 revenue decreased by 72.1% compared to the same period last year, reaching VND 8,698 billion. The company’s full-year revenue reached VND 103,334 billion, a 65.6% increase from 2022. Vinhomes achieved 103.3% of its revenue target for 2023.

According to Vndirect Research, Vinhomes’ gross profit margin for 2023 decreased to 34.4% due to the delivery of more profit-sharing cooperative investment units in Vinhomes Ocean Park 2 and 3. Additionally, the readjustment and one-time allocation of costs for completed products led to a decrease in gross profit margin to 10.1% in Q4/2023.

Huge sales boosted financial revenue. Vinhomes’ financial income increased by 431.5% to VND 3,153 billion in Q4/2023, thanks to a profit of VND 2,831 billion from large-scale transactions and a 128.1% increase in interest income from deposits and lending. The accumulated financial income for 2023 increased by 33.1% to VND 16,366 billion.

As a result, the net profit for Q4/2023 reached VND 826 billion, a decrease of 91%. The net profit for the whole year of 2023 increased by 14.9% compared to the same period last year, reaching VND 33,126 billion.

In 2023, sales volume reached VND 87,000 billion, a 32.1% decrease compared to the previous year’s record level (when Vinhomes Ocean Park 2 was first launched and achieved a record sales volume). Sales in Vinhomes Ocean Park 2 and 3 accounted for 14% and 37% respectively. However, the Q4/2023 sales reached VND 30,300 billion, a 68.3% increase compared to the same period, and the highest quarterly sales since Q4/2021, driven by large-scale transactions during the period.

At the end of the trading session on February 19, VHM stocks increased by 6.67% to VND 45,550 per share, marking the fourth consecutive session of gains for Vinhomes.