Specifically, the Dai Phuoc River tourist urban area (Dai Phuoc River) project covers an area of 49.79 hectares, with a total investment of nearly 6.9 trillion VND. There is one investor participating in the project, which is a joint venture consisting of four companies: Ha Phu Riverland Investment Corporation, Thanh Loi Construction Investment and Trading Company (LLC), HB Grand Land Joint Stock Company, and G7 – Invest Joint Stock Company.

Meanwhile, the Dai Phuoc tourist urban area (Phong Phu Riverside) project covers an area of 75.47 hectares, with a total investment of nearly 8.5 trillion VND. One investor has registered to participate in the project, which is a joint consortium consisting of four companies: Phong Phu Investment Corporation, Thanh Loi Construction Investment and Trading Company – LLC, HB Grand Land Joint Stock Company, and An Phu Real Estate Business Investment Joint Stock Company.

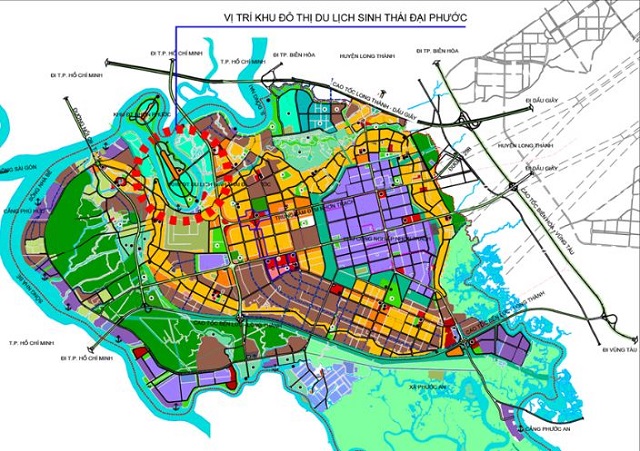

Location of the Dai Phu ecological tourist urban area. Source: Ministry of Construction

|

Who are the joint ventures?

The Dai Phuoc River project is located in Phuoc An commune, Nhon Trach district. The total investment capital is nearly 6,888 billion VND, including implementation costs of nearly 6,416 billion VND and compensation and support for resettlement costs of 472 billion VND.

The investor must complete the investment, construction, and put the project into operation within 6 years from the date of being selected to implement the project.

The joint venture registered to implement the project includes Ha Phu Riverland Investment Corporation, Thanh Loi Construction Investment and Trading Company – LLC, HB Grand Land Joint Stock Company, and G7 – Invest Joint Stock Company.

Among them, Ha Phu Riverland Investment Corporation was established in March 2021, headquartered in Bien Hoa City, Dong Nai Province. The initial charter capital is 250 billion VND, with founding shareholders including Thanh Loi Construction Investment and Trading Company – LLC (40%), Kamala World Nhon Trach Trading Limited Liability Company (29.4%), and Van Phu – Invest Joint Stock Company (30.6%). Mr. Mai Xuan Vinh is the Director cum legal representative. In mid-December 2023, the company increased its charter capital to 300 billion VND.

|

In October 2020, Mr. Loi registered to buy 3.15 million shares of Investment and Construction Joint Stock Company No. 4 (UPCoM: CC4), but he later submitted a request to withdraw the transaction. Mr. Loi is the husband of Ms. Ha. At CC4, Ms. Ha served as a member of the Board of Directors (from October 2020 to January 2021). |

Thanh Loi Construction Investment and Trading Company – LLC was established in 2006, headquartered in Bac Ninh City, Bac Ninh Province. The latest updated information as of December 21, 2021, shows that the company has a charter capital of 1,890 billion VND (an increase from the previous figure of 568 billion VND), with 60% owned by Mr. Nguyen Dinh Loi (Director cum legal representative) and 40% owned by Ms. Nguyen Thi Ha.

HB Grand Land Joint Stock Company was established in July 2019, headquartered in Hanoi. Its charter capital is 950 billion VND, contributed by three individuals including Mr. Le Tung Hoa (71%), Mr. Nguyen The Hung (17%), and Ms. Phan Vinh Thuy (12%). Mr. Hung currently serves as the Director cum legal representative of the company.

Mr. Le Tung Hoa was a member of the Board of Directors cum Deputy Director at Song Da Urban Development and Construction Investment Joint Stock Company (HNX: SDU) during the period 2015-2016, representing SDU’s ownership of 400,000 shares in Song Da Hanoi Joint Stock Company (ASD).

G7 – Invest Joint Stock Company was established in 2015, headquartered in Hanoi. The company has a charter capital of 230 billion VND, and Ms. Tran Thi Thu Thuy serves as the Chairman of the Board cum legal representative.

The Phong Phu Riverside project is located in Dai Phuoc commune, Nhon Trach district. The total investment capital is nearly 8,488 billion VND, including implementation costs of nearly 7,778 billion VND and compensation and support for resettlement costs of over 710 billion VND.

According to Decision No. 31/QD-UBND approving the capacity of the investor of Phong Phu Riverside urban area, Dong Nai requires a minimum equity capital of 1,166 billion VND for the investor.

The joint consortium registered to implement the project includes four companies: Phong Phu Investment Corporation, Thanh Loi Construction Investment and Trading Company – LLC, HB Grand Land Joint Stock Company, and An Phu Real Estate Business Investment Joint Stock Company.

| Mr. Trinh Thanh Phong previously served as Deputy Chairman of the Board of Directors of Vinafco Joint Stock Company and Director of Anh Sang Trading Company. |

Among them, Phong Phu Investment Corporation was established in 2019, headquartered in Ho Chi Minh City. The charter capital is 150 billion VND, with founding shareholders including Mr. Tran Minh Viet (holding the position of General Director cum legal representative) with 51.27%, Mr. Trinh Thanh Phong with 47.18%, and Mr. Phan Huy Tuan with 1.55%. In November 2019, the company increased its capital to 625 billion VND, and the shareholder structure was not disclosed. In May 2020, the company changed its General Director to Mr. Nguyen Hong Phong.

According to VPI’s financial statements, as of the end of 2023, VPI holds 30% of the capital in Phong Phu Investment.

Thanh Loi Construction Investment and Trading Company – LLC and HB Grand Land Joint Stock Company are two companies that are part of the joint venture interested in the mentioned Dai Phuoc River Project.

An Phu Real Estate Business Investment Joint Stock Company, previously known as Van Phu Real Estate Business Investment Joint Stock Company, used to be an affiliate of VPI with a 43.9% stake. In 2021, VPI completed the divestment from this company. As of the end of January 2024, the company has a charter capital of 180 billion VND, with Ms. Ha Thi Thu Thao serving as the General Director cum legal representative.