Market liquidity increased compared to the previous trading session, with the trading volume of VN-Index reaching over 886 million shares, equivalent to a value of over 20.5 trillion VND; HNX-Index reached over 64 million shares, equivalent to a value of over 1.2 trillion VND.

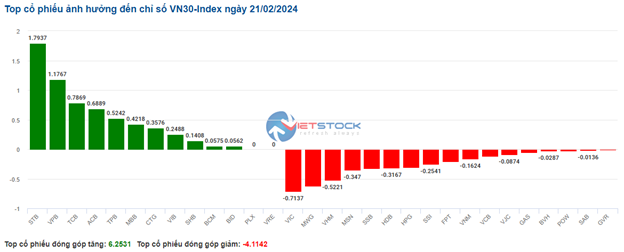

VN-Index opened the afternoon session positively as buying pressure appeared right from the beginning of the session, pushing the index to rebound and close near the reference level. In terms of impact, BCM, FPT, BID, and CTG were the most positive stocks for VN-Index with an increase of nearly 2 points. On the contrary, VHM, VIC, HPG, and GAS were the most negative stocks, reducing over 3.4 points from the index.

| Top 10 stocks influencing VN-Index on 21/02/2024 (Based on points) |

HNX-Index also had a similar trend, with the index being positively influenced by stocks such as DDG (3.77%), DTD (2.08%), NVB (1.8%), L18 (1.47%),…

|

Source: VietstockFinance

|

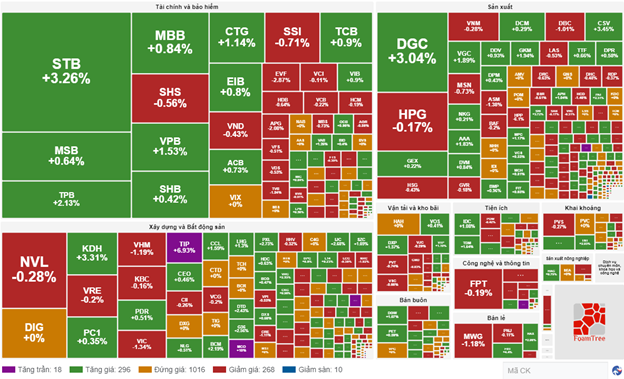

The rubber industry is the most resilient sector with a growth of 3.43%, mainly driven by stocks such as DRC (+4.27%) and SRC (+6.87%). Following that is the technology and information sector and the retail sector with growth rates of 1.23% and 0.95% respectively. On the contrary, the construction materials industry has the most significant decline in the market with -1.16%, mainly from stocks such as HPG (-1.37%), HSG (-1.52%), and NKG (-1.03%).

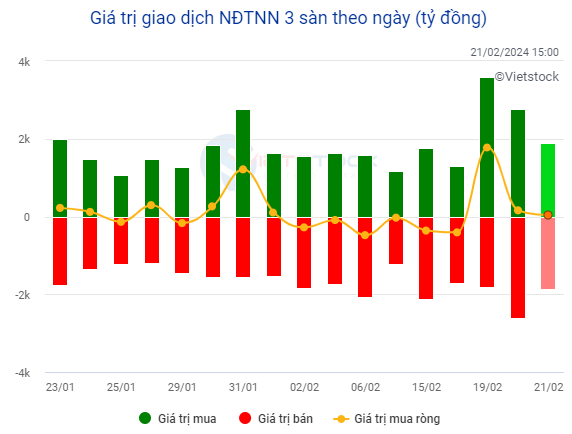

In terms of foreign trading, this group continued to be net buyers with nearly 60 billion VND on HOSE, focusing on stocks such as MSB (480.1 billion), STB (191.47 billion), AAA (83.14 billion), and BID (44.59 billion). On HNX, foreign investors net sold over 40 billion VND, focusing on stocks such as SHS (23.94 billion), PVS (19.77 billion), and CEO (17.76 billion).

Source: VietstockFinance

|

Morning session: VN-Index returns to red

At the end of the morning session, the green color was no longer maintained, leading to the reversal of the main indices. VN-Index decreased by 4.96 points to reach 1,225.1 points; HNX-Index decreased by 0.68 points to reach 232.82 points. The temporary advantageous number of declining stocks was 241, compared to 393 advancing stocks.

The trading volume of VN-Index recorded in the morning session was over 481 million units, with a value of over 11 trillion VND. HNX-Index recorded a trading volume of nearly 34 million units, with a trading value of over 642 billion VND.

Source: VietstockFinance

|

At the end of the morning session, VHM, VIC, GAS were the most negative stocks, taking away over 2.5 points from the index. On the contrary, CTG, STB, DGC were the most positive stocks, contributing over 1.1 points back to the index.

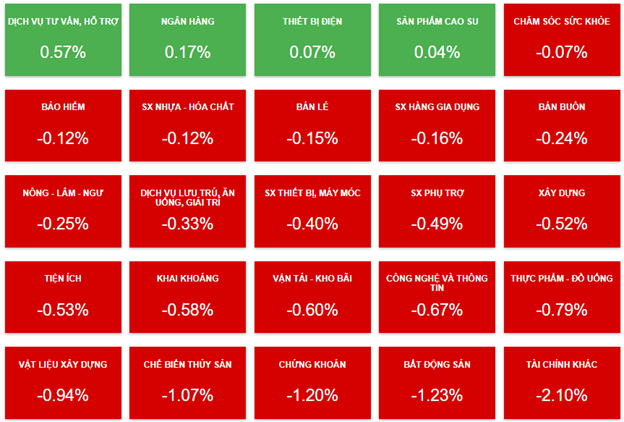

The banking sector is one of the most positive sectors in the morning session today, with most remaining sectors showing little optimism. Although the growth rate is relatively modest at 0.17%, some stocks in this group still performed well such as CTG (+1.14%), STB (+2.61%), TPB (+1.87%). Most of the remaining stocks increased slightly.

On the contrary, the real estate sector has a rather negative trend after a strong increase in recent sessions. Stocks such as VHM, VIC, VRE, NVL, KBC, DIG, DXG all declined significantly. Only KDH had the most positive growth with an increase of 3.15%.

Foreign investors returned to net selling after strong buying at the beginning of the morning session. This had a negative impact on the momentum of VN-Index as it could not maintain stability and reversed to a decrease in points. Specifically, MWG, GEX, and DIG were the most heavily sold stocks, with a higher proportion compared to stocks below such as HPG, VCG, MSN, NVL,…

End-of-morning sector performance on 21/02. Source: VietstockFinance

|

At the end of the morning session, red temporarily had an advantage when looking at the overall industry. Specifically, the consulting and support services sector had the most outstanding performance with an increase of 0.57%. On the contrary, another financial sector had the most negative performance with a decrease of 2.1%.

10:40 AM: Still uncertainty

Investors remained cautious, causing the main indices to have a slight increase and fluctuate around the reference level. By 10:30 AM, VN-Index increased by 0.89 points, trading around 1,230 points. HNX-Index increased by 0.39 points, trading around 233 points.

A slight decrease in the number of stocks in the VN30 basket appeared in red. Specifically, VIC, MWG, HPG, and HDB contributed to a negative decrease of 0.66 points, 0.51 points, 0.46 points, and 0.42 points respectively. On the contrary, most of the banking stocks such as STB, ACB, VPB, MBB… contributed positively to the VN30 with over 6 points.

Source: VietstockFinance

|

The banking stock group is being heavily bought, noteworthy stocks are STB up 3.26%, CTG up 1.28%, TPB up 2.13%, and SHB up 0.42%… By 10:30 AM, over 2.633 trillion VND had poured into this sector and the trading volume reached over 109 million units.

Following that is the real estate group, also with an impressive increase, with stocks such as FDC up to the ceiling price, BCM up 2.19%, CCL up 1.71%, and KDH up 3.15%…

However, the securities group had a mixed trend with slight selling pressure from most stocks such as SSI, VND, VCI, SHS, and HCM with a decrease of around 0.22%-0.71%…

Compared to the opening of the session, buyers still had an advantage. The number of stocks increased was 314 (including 18 limit up stocks) and the number of stocks decreased was 278 (including 10 floor down stocks). The total trading volume on all 3 exchanges reached over 398 million units, equivalent to over 8.8 trillion VND.

9:30 AM: Cautious at the start of the session

A slight red color appeared at the beginning of the trading session, showing the caution of investors in the market. The main indices fluctuated around the reference level.

VN-Index decreased by over 2 points and foreign investors continued to be net buyers, trading around 1,227 points; HNX-Index reached 234 points.

Red had a temporary advantage in the VN30 basket with 21 decreasing stocks, 9 increasing stocks, and 0 unchanged stocks. Specifically, VIC, SSB, HDB were the most negative stocks. On the contrary, STB, TPB, VPB were the stocks with the strongest price increase.

The plastic-chemical manufacturing sector was one of the most uncertain sectors in the market. Other stocks like DGC, DCM, DPM, AAA, and CSV were all in positive green.

The real estate sector sank into red at the start of the trading session. Mainly from leading companies in the industry such as VHM decreased by 0.98%, VIC decreased by 1.44%, VRE decreased by 0.39%, and KBC decreased by 0.47%.