The trading volume of VN-Index recorded in the morning session reached over 481 million units, with a value of over 11 trillion Vietnamese dong. HNX-Index recorded a trading volume of nearly 34 million units, with a trading value of over 642 billion Vietnamese dong.

Source: VietstockFinance

|

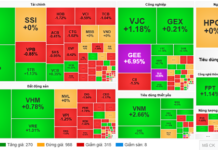

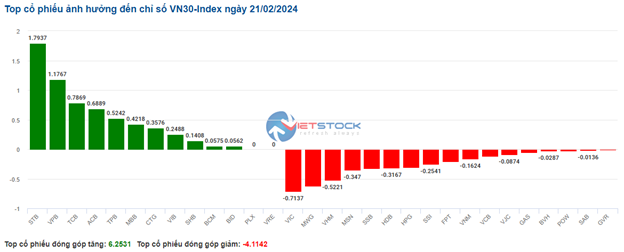

Pausing the morning session, the stocks VHM, VIC, GAS are the most negative impact stocks as they took away more than 2.5 index points. On the contrary, the stocks CTG, STB, DGC are the most positive impact stocks as they compensated for over 1.1 index points.

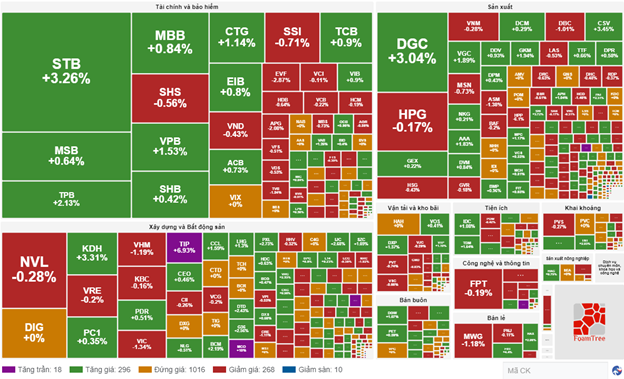

The banking sector is one of the most positive sectors in this morning session as most of the remaining sectors are not optimistic. Although the growth rate is modest at 0.17%, some stocks in this group still perform well such as CTG (+1.14%), STB (+2.61%), TPB (+1.87%). Most of the remaining stocks increased slightly.

On the contrary, the real estate sector shows a somewhat negative situation as it has been rising strongly in recent sessions. Stocks such as VHM, VIC, VRE, NVL, KBC, DIG, and DXG have all declined pessimistically. However, KDH is the most positive with a growth rate of 3.15%.

Foreign investors have returned to net selling after strong buying at the beginning of this morning session. This has negatively affected the upward trend of VN-Index as it could not maintain and reversed to decline. In which, MWG, GEX, and DIG are the stocks with the strongest net selling, which account for a dominant proportion compared to stocks such as HPG, VCG, MSN, NVL, etc.

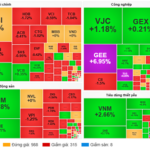

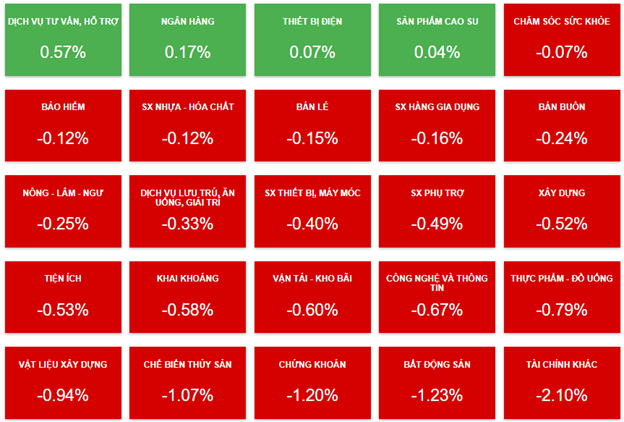

Development of industry groups at the end of the morning session on 21/02. Source: VietstockFinance

|

At the end of the morning session, red is temporarily dominant when looking at the overall industry. In which, consulting and support services are the most outstanding sector with an increase of 0.57%. On the contrary, other financial services are the most negative sector with a decrease of 2.1%.

10:40: The hesitant sentiment remains

Investors appear cautious, which led to slight increases and fluctuations around the reference level of the main indexes. As of 10:30, VN-Index increased by 0.89 points, trading around the 1,230 level. HNX-Index increased by 0.39 points, trading around the 233 level.

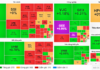

The number of stocks in the VN30 basket tinted in red is slightly more dominant. Specifically, VIC, MWG, HPG and HDB contributed to the declines of 0.66 points, 0.51 points, 0.46 points, and 0.42 points from the overall index. On the contrary, most stocks in the banking group such as STB, ACB, VPB, MBB… contributed positively to VN30 with over 6 points.

Source: VietstockFinance

|

The banking group is being strongly bought, notable stocks are STB increased by 3.26%, CTG increased by 1.28%, TPB increased by 2.13% and SHB increased by 0.42%… As of 10:30, over 2,633 billion Vietnamese dong has been poured into this group, and the trading volume reached over 109 million units.

Following is the real estate group, which also shows an impressive increase with stocks such as FDC increased limit up, BCM increased by 2.19%, CCL increased by 1.71%, and KDH increased by 3.15% and NLG increased by 0.51%…

However, the securities group has a mixed performance with slight selling pressure on most stocks such as SSI, VND, VCI, SHS and HCM with a decrease of around 0.22% – 0.71%…

Compared to the opening of the session, buyers still have an advantage. The number of gainers is 314 stocks (18 stocks reached the ceiling price) and the number of decliners is 278 stocks (10 stocks hit the floor price). The total trading volume on all three exchanges reached over 398 million units, equivalent to over 8.8 trillion Vietnamese dong.

9:30: Caution at the beginning of the session

Slight red appears at the beginning of the trading session, showing investors’ caution in the market. The main indexes are fluctuating around the reference level.

VN-Index decreased by more than 2 points, accompanied by continuous net buying from foreign investors, trading around 1,227 points; HNX-Index reached 234 points.

Red temporarily dominates in the VN30 basket with 21 decliners, 9 gainers, and 0 unchanged stocks. In which, VIC, SSB, HDB are the most negative stocks. Conversely, STB, TPB, VPB are the stocks with the strongest price increase.

The plastics-chemical manufacturing sector is one of the most volatile sectors in the market. The other stocks such as DGC, DCM, DPM, AAA, and CSV all show positive signs.

The real estate sector is immersed in red at the beginning of the trading session. Mostly from the leading companies in the industry such as VHM decreased by 0.98%, VIC decreased by 1.44%, VRE decreased by 0.39%, and KBC decreased by 0.47%.