Illustrative image

Decreasing oil prices due to weak demand

Oil prices turned lower in a quiet trading session, along with the US Presidents’ Day and worries about global demand which offset price support from the Israel-Hamas conflict.

Brent futures were down $1.22, or 1.5%, at $82.34 a barrel. US. West Texas Intermediate (WTI) crude was down $1.01, or 1.3%, at $78.18 a barrel. April WTI contract fell $1.30, or 1.4%, to $77.04 a barrel.

Shipping has been disrupted as Iran-backed Houthi forces, supporting the Palestinians, increased attacks on shipping routes in the Red Sea and the Bab al-Mandab Strait. Unmanned aerial vehicles and missiles had hit at least four ships since Friday.

Despite the Middle East conflict, one of the world’s major oil-producing regions, investors seemed more concerned about declining global demand.

A report by the International Energy Agency (IEA) last week adjusted its 2024 oil demand growth forecast down to nearly 1 million bpd below the prospect of OPEC, and worldwide oil demand is expected to rise by 1.22 million bpd this year. OPEC forecasts growth of 2.25 million barrels per day. The IEA, representing the developed industrialized countries, predicts that demand will peak in 2030, while OPEC expects oil consumption to continue to grow over the next two decades.

US refineries are operating on a weak level due to seasonal maintenance and unplanned outages, but warmer winter weather could boost refinery costs, analysts said.

US crude stockpiles rose last week, while refinery usage rates are expected to increase 1.1 percentage points from 80.6% of total capacity in the previous week.

Gold rises over 1 week as USD falls

Gold prices have risen to their highest level in over a week as the USD has weakened, while attention is focused on the latest Fed monetary policy meeting minutes for further interest rate cut signals, scheduled for release today.

Spot gold rose 0.5% to $2,027.19 an ounce at 18:52 GMT. US gold futures rose 0.8% to $2,039.8.

The US dollar index fell 0.2%, making gold ingots priced in greenbacks cheaper for foreign buyers.

US consumer price data and producer prices last week were hotter than expected, dampening hopes of a further interest rate cut in March. The market is currently pricing in a 78% chance of a rate cut in June, according to the CME Fed Watch Tool .

Silver rose 0.2% to $23.06 an ounce. white gold rose 0.6% to $904.15 an ounce and palladium rose 2.8% to $980.14.

Dong rises slightly as China cuts mortgage rates

Copper prices rose as the dollar weakened and China’s top metal consumer cut its mortgage rates in an effort to revive the property market.

Three-month copper futures on the London Metal Exchange rose 1.2% to $8,531.50 a tonne. LME copper has rebounded 5% since touching a near three-month low on February 9, 2024, and US Comex copper futures rose 0.8% to $3.87 a pound.

China announced its biggest cut to mortgage rates on Tuesday, cutting the five-year base rate by 25 basis points to 3.95%, which was below the expected cut of between 5 and 15 basis points.

“A larger-than-expected cut to mortgage rates is clearly good (for the Chinese economy and metal demand), but people are looking for more aggressive action from the central bank,” Ole Hansen, Head of Commodity Strategy at Saxo Bank in Copenhagen said.

Analysts have forecast a deficit for copper this year as signs that supply may not be as robust as previously predicted after Panama ordered the closure of First Quantum’s 350,000-tonne mine and producers like Anglo American have cut annual targets .

LME aluminium rose 1.3% to $2,224.50 a tonne even though LME stocks climbed to their highest level in six weeks at 564,675 tonnes.

With China returning from the Lunar New Year holiday, traders and analysts will look for demand clues in the coming weeks and prospects of a recovery in construction activity as winter ends.

On the LME, nickel prices rose 1.2% to $16,545 a tonne and lead rose 0.3% to $2,049.50 while zinc fell 0.5% to $2,389.50 and tin fell 0.2% to $26,370.

Iron ore lowest in over 3 months on weak Chinese demand

Iron ore futures hit their lowest level in over three months on increasing concerns about Chinese demand prospects despite new measures to boost the property market.

China has lowered its benchmark lending rate for the fifth year, down 25 basis points to 3.95%, compared to forecasts of a cut of 5 to 15 basis points.

However, this is not enough to counter the lingering weakness in the base metals’ market.

May 2024 iron ore futures on the DCE gave up 5.41% to settle at 909.5 Chinese yuan ($126.35) per tonne, the lowest since November 1.

Iron ore futures on SGX for March 2024 were down 4.39% at $121.8 per tonne at 0722 GMT, the lowest since November 8, 2023.

Coke and coking coal prices fell 1.82% and 2.25% respectively.

In Shanghai, rebar steel prices fell 2.14%, hot-rolled coil lost 2.29%, wire rod fell 0.17% and stainless steel declined 0.22%.

CBOT wheat rises 4% on short-covering

Chicago wheat futures rose 4% off lows on short-covering as the weak USD and political tension and spring planting season were in focus.

CBOT soft red winter wheat futures for May 2024 rose 22-1/4 cents to settle at $5.82-3/4 a bushel, while May 2024 wheat contracts also rose 20-1/4 cents to $5.79-1/4. May 2024 hard red winter wheat settled up 19-1/2 cents at $5.81 a bushel and May 2024 spring wheat rose 10 cents to $6.65-1/2.

Commodity funds held a relatively large net short position in CBOT wheat contracts, making the market susceptible to short-term price hikes.

Analysts say that Russian wheat export prices continued to decline last week amid a weak global market and some growing exports.

Corn rebounds after touching multi-year lows

Corn prices in Chicago rebounded slightly at the end of the trading session after hitting their lowest level in over three years, traders said.

CBOT corn futures for March 2024 gained 2-1/2 cents to $4.18-3/4 a bushel, after falling to $4.14-3/4, the lowest since December 2020.

Ample US corn supply and bigger-than-expected forecasts for this year’s harvest have put pressure on prices. US Department of Agriculture reported last week’s export of 918,610 tonnes of US corn. Of these, the United States sold 155,000 tonnes of corn to Japan in the 2024/25 marketing year starting September 1, 2024.

London cocoa hits record high, raw sugar hits 1-month low

London cocoa futures hit record highs on supply concerns while raw sugar fell to its lowest level in a month.

May 2024 London cocoa futures rose 3.1% to 4,741 pounds per tonne, after reaching an all-time high of 4,819 pounds.

Prospects for crops in West Africa, a major producing region, continue to deteriorate, possibly increasing the scale of the global shortfall that was already large in the 2023/24 crop year.

Worries about the upcoming crop season are also mounting, with more people accepting the view that the market could see a fourth consecutive deficit in the coming season.

High temperatures and insufficient rain in the past week in most of the cocoa growing areas of Côte d’Ivoire may delay the start and reduce the scale of the April to September crop, farmers said.

May 2024 New York cocoa futures rose 5% to $5,608 per tonne.

March 2024 raw sugar futures were down 1.5% at 22.737 cents a pound, having touched a one-month low of 22.49 cents. White sugar futures for May 2024 were down 1.1% at $624.90 per tonne.

Output in Brazil’s leading producer is expected to remain strong in the coming season, with high rainfall potential in the country’s coffee and sugarcane regions this month boding well for crop development.

May 2024 arabica coffee was down 0.7% at $1.8545 per pound, after losing 2.5% last week. May 2024 robusta coffee was down 1.1% at $3,137 per tonne.

Japanese rubber falls on profit-taking Japanese benchmark rubber falls as traders take profit, but hovers near a seven-year high as supply tightens and the yen weakens

Japanese rubber futures reversal as traders take profit, but still near their highest level in seven years due to tightening supplies and a weaker yen.

Contract rubber for July 2024 ended down 2.4 yen, or 0.8%, at 296.1 yen ($1.97) a kilogram, recording the lowest in two days.

Prices had earlier touched 304.4 yen ($2.02) in the session, the highest intraday price since February 2022.

Rubber prices on the Shanghai Futures Exchange (SHFE) for delivery in May 2024 rose 30 yuan, settling at 13,555 yuan ($1,883.08) a tonne.

Thailand’s meteorological agency has warned of severe weather from February 23-25 in northeastern, eastern and central Thailand that could cause crop damage.

Previous-month rubber prices on Singapore’s Sicom Exchange for March 2024 delivery closed at 155.20 US cents per kg, up 0.39%.

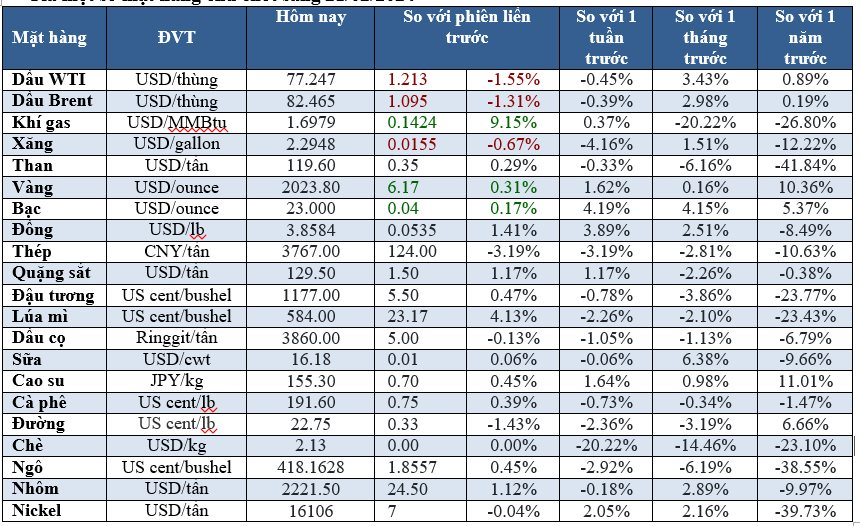

Prices of some key commodities as of 21/02/2024