According to the Five Elements Feng Shui, the year of Giap Thin 2024 (Fire element) will be relatively favorable for investors with a Fire destiny. BIDV Securities (BSC) believes that stocks with good fundamentals in the Fire and Wood industries will be suitable for Fire destiny investors this year, as the Wood element supports and strengthens the Fire element.

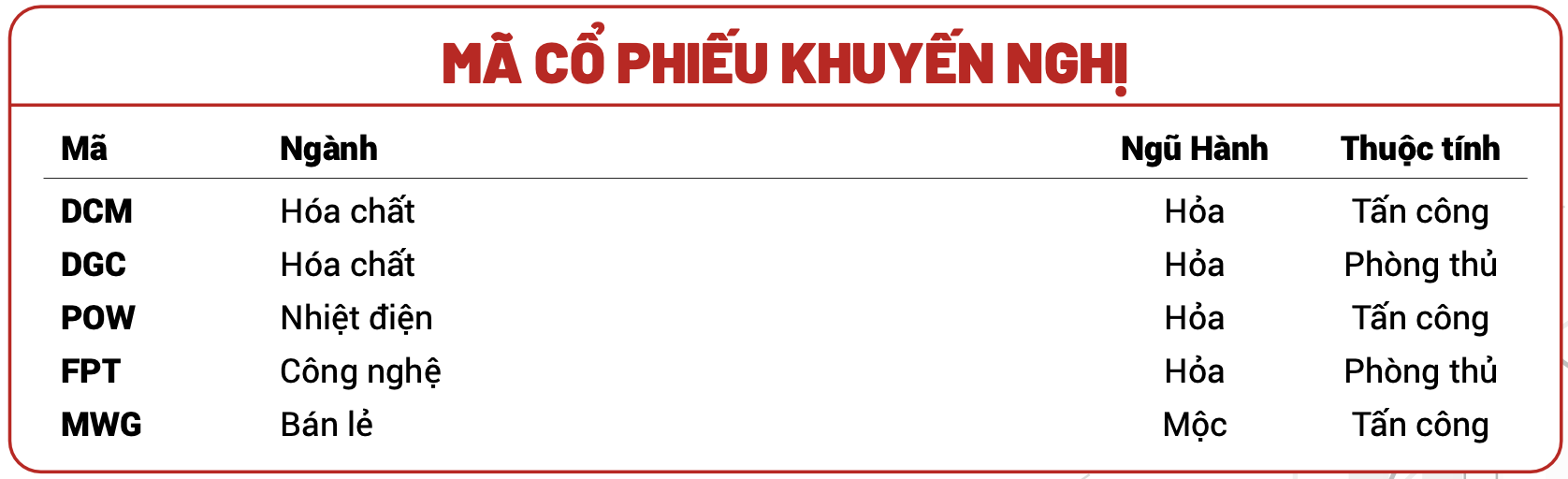

Based on the following criteria: (1) Prioritize sectors with high growth rates due to government policies or the overall economic growth forecast for Vietnam in the coming years, and (2) Prioritize leading companies within the industries to maximize growth potential, BSC has identified 5 stocks that match the criteria for Water destiny investors, both offensive (DCM, POW, MWG) and defensive (DGC, FPT).

The offensive stocks are projected to have more than 20% revenue and profit growth in 2024. The defensive stocks are reasonably priced, with P/E and P/B ratios close to the average of the past 3 years, or stable dividends with a good market share within the industry.

Ca Mau Fertilizer (DCM) is a biotechnology company specializing in the production of fertilizers and chemicals, as well as providing chemical analysis testing services. According to BSC, the urea plant will be fully depreciated in Q4/2023, helping DCM save approximately VND 160 billion in costs in 2023 and around VND 1,000 billion/year thereafter (+42% PAT for 2024).

DCM has a strong financial position and a large amount of cash. The company currently has no debt and holds nearly VND 9,200 billion in cash & short-term financial investments, equivalent to 66% of market capitalization. The large cash balance also ensures stable cash dividends for DCM in the past 2 years (30% in 2023 and 18% in 2022).

Duc Giang Chemicals (DGC) provides various chemical products including fertilizers, phosphates, phosphoric acid, and animal feed additives, with yellow phosphates being the main product. BSC expects the price of yellow phosphates to recover in 2024 (+15%) due to (i) improved demand for yellow phosphates with the recovery of the semiconductor demand, and (ii) the expected tightening of phosphate supply in China due to high energy costs and energy control policies.

The medium-term growth potential comes from: (i) the implementation of the Nghi Son – Duc Giang project, which will enhance DGC’s value chain, and (ii) capacity expansion through M&A strategy with a large cash base. After successfully acquiring a majority stake in two companies, Tia Sang Battery JSC and Pho Phosphate Co., DGC continues to pursue M&A deals to increase its value chain and maintain its leading position in the phosphate segment.

PV Power (POW) is a leading electricity producer and distributor in Vietnam. According to BSC, electricity output is expected to grow 19% YoY and gross profit margin to improve from 7.8% to 11% in 2024 thanks to (1) increased deployment of coal and gas thermal power plants due to the impact of El Niño, (2) stable operation of Vung Ang 1, Ca Mau 2, and Nhon Trach 2 power plants after maintenance in 2023, and (3) Vung Ang 1 power plant being prioritized for deployment due to the downward trend of coal prices, which are expected to decrease by 5% in 2024.

In addition, the extraordinary profit in Q1/2024 will include (1) insurance compensation of VND 300 billion for the incident at Vung Ang 1 power plant, and (2) foreign exchange revenue of VND 155 billion from Nhon Trach 2 power plant when the production volume is not fully deployed.

FPT is a leading Vietnamese company in the international information technology market, serving customers from 29 countries and territories worldwide. According to BSC, the growth momentum from the Japanese and APAC markets is expected to remain strong in 2H.2023/2024 thanks to (1) cost-saving IT solutions, and (2) high IT spending in Japan/APAC.

IT spending in the U.S. shows signs of recovery, based on (1) the IT spending index for August 2023 in the U.S. increased by 11.7 points compared to the previous month, nearing the peak of 2023, and (2) the wave of IT staff layoffs in the U.S. has ended, with a total of 7,452 IT staff members laid off in August (-30% MoM, -42% YoY).

In addition, the education sector continues to maintain high growth in 2H.2023/2024 thanks to (1) high enrollment demand due to a shortage of high-quality IT workforce in Vietnam, and (2) FPT’s continued expansion of educational institutions in local provinces in Vietnam.

Mobile World (MWG) owns the retail chains Thế Giới Di Động and Điện Máy Xanh, which account for approximately 50% of the market share in the electronics and information and communications technology (ICT) sector, as well as the Bach Hoa Xanh grocery chain and the PharmaValue pharmaceutical chain, which are in the top 3 in terms of scale and value in the modern grocery and pharmaceutical market in Vietnam.