According to data from Dataroma, in Q4/2023, the Bill & Melinda Gates Foundation Trust sold all of its tech stocks such as Apple, Meta (Facebook’s parent company), Alphabet (Google’s parent company), Amazon, and Nvidia.

The trust also sold a number of other well-known stocks such as Walt Disney, Morgan Stanley, Johnson & Johnson, Unilever, Goldman Sachs, Exxon Mobil, Lockheed Martin, PepsiCo, and more. In addition, Bill Gates’ trust also reduced its holdings in Microsoft and Berkshire Hathaway, which were the two largest positions in its portfolio.

Source: Dataroma

The Bill & Melinda Gates Foundation Trust is the financial management entity of the Bill & Melinda Gates Foundation (BMGF) – a philanthropic organization funded by Bill Gates, the founder of Microsoft, and Melinda Gates. Established in 2000, the total grant amount of BMGF as of the end of 2022 reached $71.4 billion.

BMGF previously had a very famous trustee, legendary investor Warren Buffett. Although he stepped down from his position in July 2021, Buffett continues his commitment to donate all of his shares in Berkshire Hathaway (which account for over 99% of his assets) as pledged in 2006.

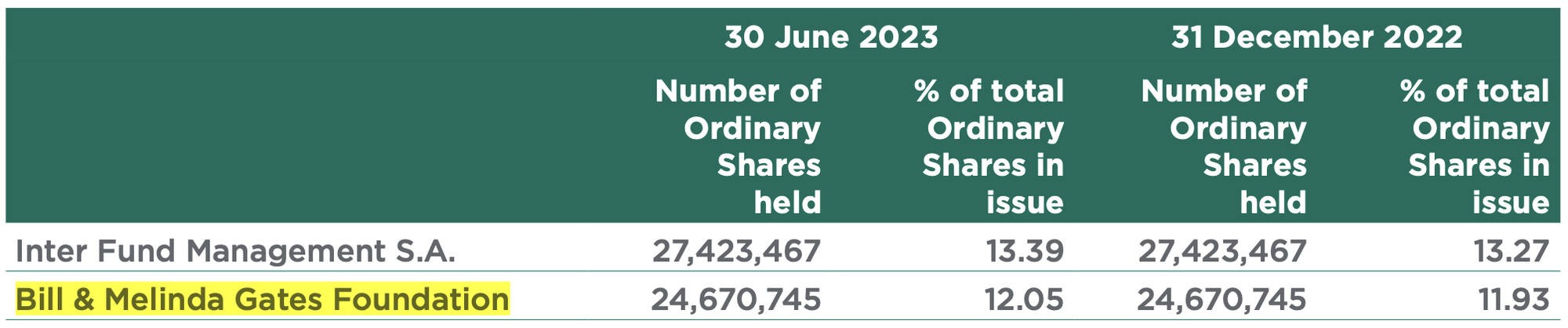

Bill Gates and Warren Buffett are well-known names in the global investment community. However, not many people know that these two billionaires are also heavily investing in the Vietnamese stock market through Vietnam Enterprise Investments Limited (VEIL) – managed by Dragon Capital. As of June 30, 2023, BMGF is one of the two shareholders holding over 10% of this foreign fund’s capital.

Source: VEIL’s 2023 interim financial statements

VEIL was established in 1995 by Dominic Scriven (founder of Dragon Capital) and his colleagues after successfully raising $16 million. As of the end of January 2024, VEIL’s net asset value (NAV) reached $1.76 billion, making it one of the largest foreign funds investing in the Vietnamese stock market. It is estimated that Bill Gates’ BMGF indirectly holds over $200 million worth of Vietnamese stocks through VEIL managed by Dragon Capital.

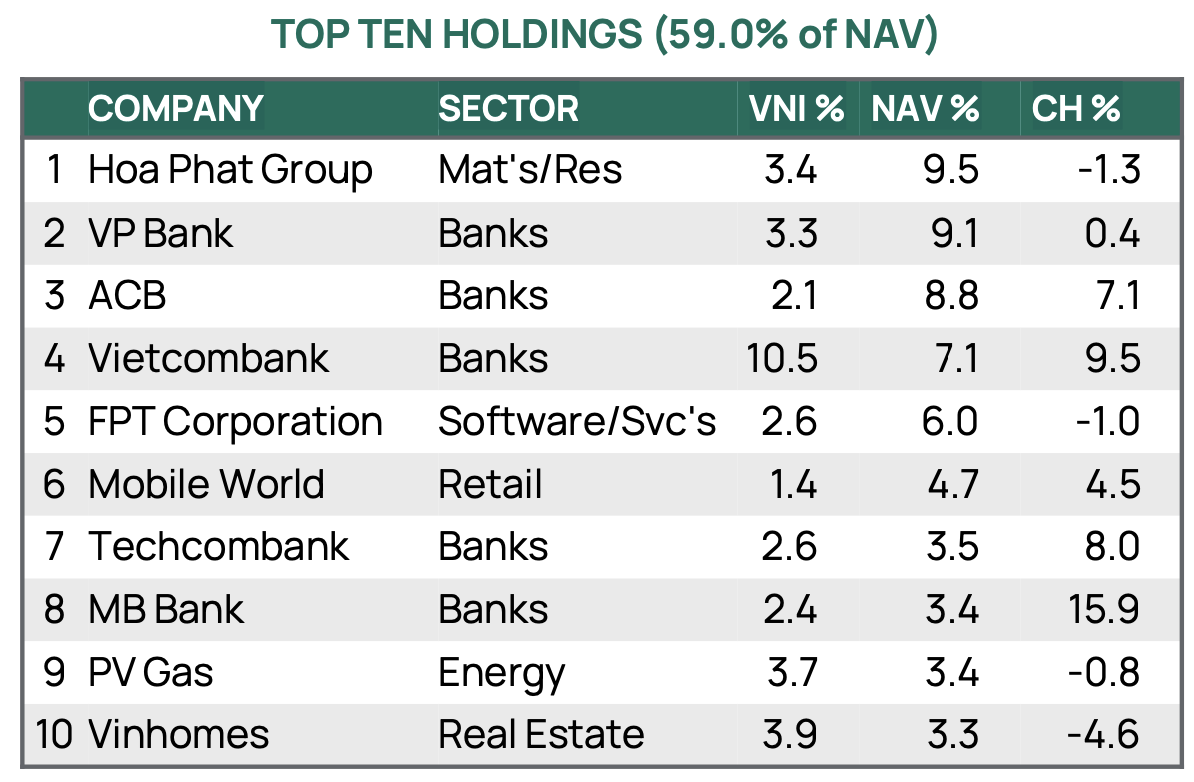

As of January 31, 2024, the top 10 stocks in VEIL’s portfolio accounted for about 59% of the fund’s NAV. Among them, the banking sector dominates both in terms of quantity and weight, with five names including VPB, ACB, VCB, TCB, and MBB. It is worth noting that the fund only holds one real estate stock, Vinhomes (VHM), among the top 10 largest investments, while the rest are blue-chip stocks in the technology sector (FPT), retail (MWG), commodities (HPG), and energy (GAS).

In 2024, Dragon Capital assesses that the global landscape still presents many challenges as global economic growth slows down. However, Vietnam will experience significant recovery as the low interest rate environment has enough time to permeate into the economy, stimulating consumer demand and igniting investment intentions of businesses and investors.

The government’s commitment to continue flexibly loosening monetary and fiscal policies is crucial to reinforce the confidence of private enterprises. The analysis team forecasts that the profit growth rate of the top 80 largest listed companies will be around 16-18%, which will be an important prerequisite for stocks to be the most attractive investment channel in 2024 (based on the estimated P/E ratio of 9.1 for 2024).

The 12-month deposit interest rate at banks is only about 4.7%, which is not attractive compared to the expected profit of 10.9% (based on the P/E ratio of 9.1 for 2024) from the stock market. Other investment channels such as real estate have certain limitations, such as large capital scale and low liquidity, especially when investors are still cautious about legal progress of projects. Therefore, Dragon Capital believes that large capital flows may seek opportunities in the stock market.

In addition, foreign capital flows may improve if there is any positive information about the market, such as unlocking pre-funding or new steps towards upgrading to an emerging market. In general, Dragon Capital evaluates 2024 as an attractive time to participate in the stock market.