Most stocks in the banking group decreased. Stocks like MSB, STB, HDB dropped more than 1%; other stocks like EIB, VPB, MBB, ACB decreased slightly. Notably, SHB stock performed impressively, maintaining a green color and increasing by 2.1%; followed by VIB and TCB.

The stock group of securities was almost engulfed in red, with the stock VND slightly increasing by 0.22%.

The real estate and construction group still stood out with green color almost throughout the morning session in stocks like PC1, LCG, BCG, ITA, HQC, BCM, HHV, VCG, CII and the duo belonging to Vingroup which are VHM and VIC.

The manufacturing group had many stars. Notably, the stock L88 increased the limit without clear reason, while the stock BMP also increased by nearly 4.5%, followed by the stock SBT. Large-cap stocks like VNM and MSN recorded an increase of over 1%, while the “national” stock HPG dropped by 0.35%.

PVD, PVS, and AAH of the mining group are doing well. In contrast, in the transport and warehousing group, VTP with an increase of nearly 5.4% should be mentioned.

In the agricultural production group, HAG increased slightly and HNG increased to the full extent.

The retail group was quite pessimistic as MWG decreased by more than 1%.

In the top stocks affecting the index, VNM, MSN, SHB made good contributions, trying to balance the sharp price drop of VCB on the other side.

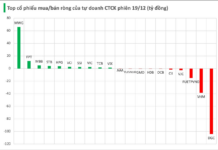

The group of foreign investors net sold over 440 billion VND in the morning session, mainly focusing on HPG, MSN, and MWG. In contrast, the most net bought were PVD, DGC, and LCG.

10:25 AM: Struggling

The market is fiercely struggling around the 1,230 points level. As of 10:15 AM, VN-Index fell into the price decline area, losing 0.65 points to 1,229.44 points.

The market liquidity today is lower than the average of the previous session as well as the average of the previous 5 sessions.

The stock groups of securities and banks are “red more than green”. In terms of price increase, SHB stock is showing prominence (+2%) and VND stock (+0.2%). On the contrary, stocks like MSB, HDB, STB decreased by about less than 1%.

The construction and real estate group looks more positive with many stocks impressively increasing in price such as LCG, ITA by nearly 4%; stocks PC1, BCG, HQC increased by over 2%.

PVD stock of the mining group increased by over 4%, while PVS stock of the same group also increased by over 1%. Notably, VTP stock of the transport and warehousing group increased by more than 5.5%.

The agricultural production group witnessed the full extent price increase of HNG stock, while the HAG stock also increased by nearly 0.8%.

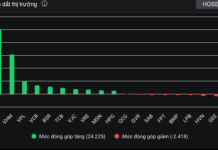

In the top stocks affecting the index, VCB continues to be the leading stock, creating considerable pressure on the index with a contribution of nearly -1.1 points; larger than the combined positive contribution of the 3 stocks GAS, SHB, and VHM, which are the 3 stocks that have the most positive impact on the index.

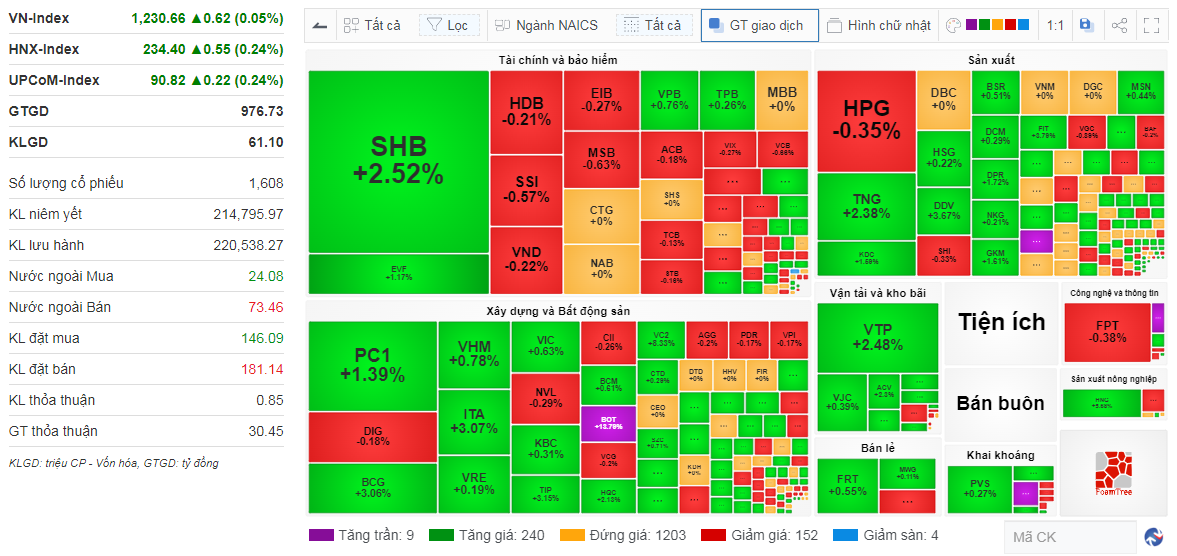

Market Opening: Slightly green

After a volatile session yesterday, VN-Index opened slightly green, up 0.6 points compared to the previous session to 1,230.66 points. Specifically, there are 9 stocks hitting the ceiling, 240 stocks increasing, 1,203 stocks staying unchanged, 152 stocks decreasing, and 4 stocks hitting the floor.

Market movement at 9:23 AM. Source: VietstockFinance

|

Similarly, Large Cap, Mid Cap, Small Cap, and Micro Cap groups are slightly green.

The pair of Vingroup siblings, VIC and VHM, are the two stocks that have the most positive impact on the index, followed by the GAS stock which is providing additional support for this pair. In contrast, VCB is the most negatively affecting stock on the index, standing out quite significantly compared to the other stocks in the top 10 stocks with the most negative impact.