The VN-Index experienced volatile fluctuations in most of the morning session before gradually recovering to near the reference threshold in the afternoon session. At the end of the trading session on February 21, the VN-Index closed at 1,230 points, almost unchanged from the previous session. The trading liquidity on the HSX reached VND 22,593 billion in the session, increasing by 7% compared to the previous session.

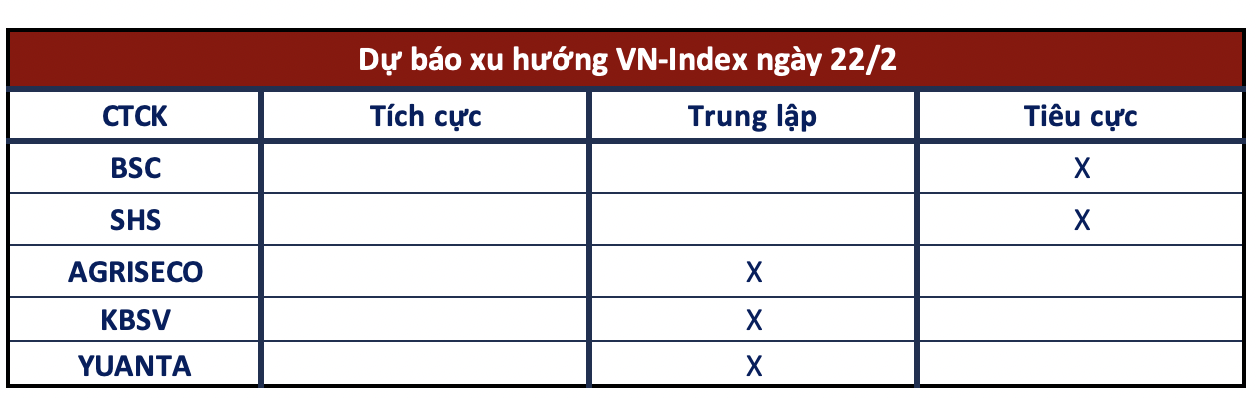

Regarding the market outlook in the coming sessions, most securities companies believe that the VN-Index will face pressure as it approaches the strong resistance zone of 1,250 points, and investors should be cautious during this period.

Volatility will occur before the strong resistance at 1,250 points

BSC Securities

The VN-Index is showing signs of consolidation after the uptrend. In the coming sessions, the index may continue to experience fluctuations as it returns to the previous strong resistance level of 1,250.

SHS Securities

In the short term perspective, the market in the first rising wave is moving within a wide accumulation channel, and currently the VN-Index has been very positive as it is approaching the mid-term strong resistance level of 1,250. However, at the current stage, the upward momentum of the VN-Index is facing a real challenge as this index is approaching the strong resistance level of 1,250, so short-term investors should be cautious at the current stage.

Consider reducing weight

Agriseco Securities

On the technical chart, the VN-Index continues to fluctuate within a narrow range around the reference threshold. The selling pressure is greater when the index approaches the important resistance zone around 1,240 – 1,250, causing the VN-Index’s uptrend to stall. Despite the ongoing upward trend, the market is facing a short-term correction risk to relieve profit-taking pressure after a relatively steep uptrend.

Investors should gradually reduce the weight of short-term trading positions when the index approaches the mentioned zone. Priority should be given to re-entering buying positions in low-volume correction waves back to the near support zone around 1,200-1,210 with some sectors such as banking, industrial park, and infrastructure.

KBSV Securities

The index forms a spinning top candlestick pattern with a longer lower shadow, which shows the trading battle between the two sides, but the buying side shows more determination. Although the short-term correction risk still exists, the bullish sentiment is expected to return soon in the upcoming waves thanks to the initiative of buyers. Investors are advised to gradually buy back in parts when individual target stocks return to important support zones or the index bounces down to the support point around 1,170 (+-10).

Yuanta Securities

The market may continue to fluctuate and maintain its upward trend in the next session. Although a correction appeared in the session on February 21, 2024, the short-term risk is still low and the market may continue to increase in a few upcoming sessions. However, according to observations, the opportunity for new purchases is very limited and investors do not have many choices at this stage. The flow of funds still mainly focuses on large-cap stocks and supply and demand seem to be balanced. This also indicates that short-term demand is still strong as many large-cap stocks have risen significantly. In addition, the increasing psychological indicator shows that investors are still optimistic about the current market situation.