In its recent Q1/2024 performance report, VEIL, Dragcon Capital’s $1.7 billion fund, recorded a 1.3% increase in performance compared to the VN-Index’s 2.5% profit. “The strong recovery of VEIL’s top 8.2% performing banking stocks has solidified the fund’s position and indicated that the worst is over,” the fund emphasized.

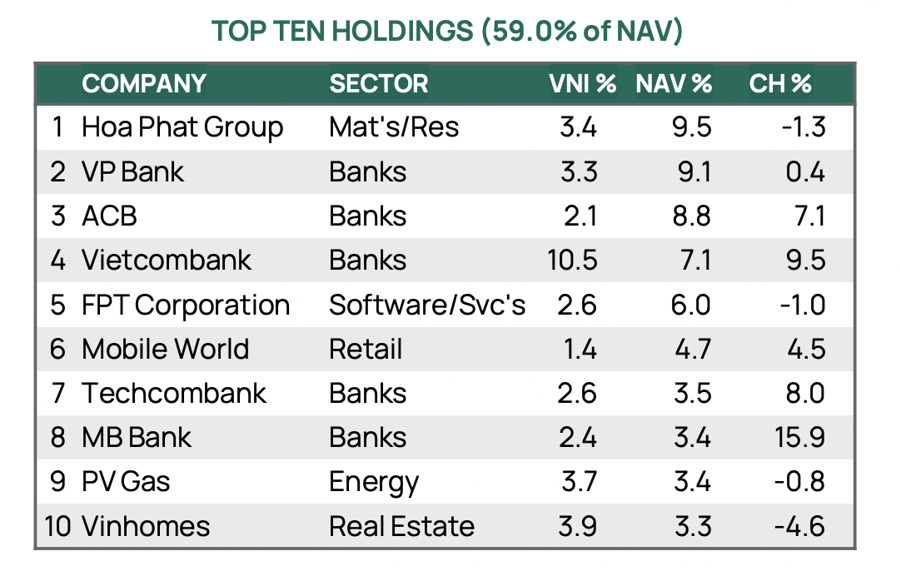

As of January 31, 2024, the top 10 stocks in VEIL’s portfolio accounted for about 59% of the fund’s NAV. Among them, the banking sector dominated both in terms of quantity and proportion, with 5 names: VPB, ACB, VCB, TCB, MBB. Most banking stocks have increased their weight in the portfolio compared to December 2023.

Notably, the fund now holds only 1 real estate stock in its top 10 largest investments, which is Vinhomes (VHM), while the rest are Bluechips in the technology (FPT), retail (MWG), commodities (HPG), and energy (GAS) sectors.

Regarding the 2.5% increase of the VN-Index in January, VEIL attributed it to the strong recovery of the banking and retail sectors, which achieved +7.1% and +5.6% growth, respectively. This is due to a combination of the Credit and Land Law amendments, December credit growth increasing to 13.7% from 9.2% in November, and foreign investors net buying ($48 million) for the first time in 10 months.

The State Bank of Vietnam has set a credit growth target of 15% for all banks for the whole year, and the Credit Institution Law has been approved. The amended law reduces ownership and borrowing limits for shareholders and requires individuals with ownership rights of over 1% to disclose them. The fund believes that this will help improve the long-term stability and transparency of the banking system.

VEIL was established in 1995 by Mr. Dominic Scriven (founder of Dragon Capital) and his colleagues after raising $16 million. By the end of January 2024, VEIL’s net asset value (NAV) reached $1.76 billion and it is one of the largest foreign funds investing in the Vietnamese stock market.

Regarding recent market prospects, the Director of Securities at Dragon Capital believes that only three pillars of analysis need to be grasped. First, monetary policy is the most important target. Second, stability in macroeconomic and political factors… Third, growth, not relying on GDP but transforming into enterprise profits, into the real activities of the economy.

In more detail, on monetary policy: lending and deposit interest rates are lower than in the Covid period. Will they go lower? Dragon Capital still believes that Vietnam’s interest rates will continue to have another period of decline in the next 4-5 months, although it is already at a record low level, the record will be broken.

Why? Interest rates and inflation always have a certain correlation. With the relatively weak economic recovery rate as it is currently, inflation is not a major concern, what matters is growth. Therefore, there is still room for monetary policy easing to stimulate growth.

Secondly, stability in exchange rates. Vietnam’s exchange rate should not be seen in terms of FDI, trade surplus, or trade deficit. Because the banking sector’s net asset and debt are only about $6-7 billion, while the public holds $50-100 billion in foreign currencies. If the central bank cannot control the psyche, our people can go buy dollars and create volatility, so the exchange rate is an important issue. Considering the overall picture, Vietnam is recovering, a 2024 exchange rate fluctuation within +-3% is normal. There is a certain stability in the economy.

Thirdly, economic recovery: Do not look at the GDP figure. In terms of the recovery rate from 2023 to 2024, look at container volume exports and consider it as part of the economy’s activities. This volume had a poor performance in Q1/Q2 but showed signs of recovery. Secondly, electricity consumption. In Q1, electricity consumption had a negative growth of 1.1%, gradually shifting to positive and a 3.3% increase compared to 2023. The bright spot is that we have a recovery.

“In summary, the prospect for 2024 is that we have an absolute monetary policy relaxation and should not expect a strong market downturn. Our resolute goal is growth, the only thing we are waiting for is enterprise profits. The monetary policy recorded low interest rates in September/October 2023, it will take 9-12 months to permeate into the business and corporate profits will recover,” this expert expects.

Currently, Dragon Capital experts believe that the VN-Index is in a recovery cycle with a convergence of factors such as low interest rates, stable macroeconomics, and the beginning of profit growth. In this cycle, investors can achieve superior performance of over 20%. In the recovery cycle, high beta industries with high volatility will have good performance, for example, non-essential consumer goods, real estate, and financial banking will grow and bring high profits. Conversely, industries such as essential consumer goods, healthcare, energy, and utilities like electricity and water are likely to have lower performance in this cycle.