The Ho Chi Minh City Branch of Vietnam Export Import Commercial Joint Stock Bank (VCBS – HCM) has received a judgment from the Higher People’s Court of Ho Chi Minh City on January 24, 2024 regarding the dispute over the share transfer agreement between GVR and Dak R’Tih Hydropower, in which VCBS – HCM has rights and obligations.

Accordingly, the Higher People’s Court of Ho Chi Minh City has ordered GVR and VCBS – HCM to jointly repay Dak R’Tih Hydropower more than VND 141 billion. This is the amount that Dak R’Tih Hydropower has deposited as earnest money at VCBS – HCM to guarantee the share purchase.

Prior to that, in September 2016, Dak R’Tih Hydropower, Bach Viet Production and Trading Limited Liability Company, Rong Viet Investment Corporation Limited, TAD Saigon Investment Limited Liability Company, and Mr. Dang Chinh Trung agreed to cooperate and contribute capital.

The parties agreed to contribute capital and entrust Dak R’Tih Hydropower to represent the parties participating in the agreement to purchase nearly 111 million shares of member hydropower companies under GVR, including Geruco Song Con Hydropower Joint Stock Company, VRG Bao Loc Joint Stock Company, VRG Dak Nong Joint Stock Company, VRG Phu Yen Joint Stock Company, and VRG Ngoc Linh Joint Stock Company, with a total transfer value of over VND 1,415 billion according to the contract.

The capital contribution ratio of the parties to implement the project is agreed as follows: Dak R’Tih Hydropower 15%; Bach Viet Production and Trading Limited Liability Company 47.5%; Rong Viet Investment Corporation Limited 17.5%; TAD Saigon Investment Limited Liability Company 10%; and Mr. Dang Chinh Trung 10%.

Afterwards, Dak R’Tih Hydropower won the bidding and signed a transfer contract with GVR on December 8, 2016. During the implementation of the contract, the Company sent many letters requesting GVR to implement and fulfill the committed terms of the contract but did not receive the desired results.

On December 20, 2019, Dak R’Tih Hydropower filed a lawsuit against GVR at the People’s Court of Ho Chi Minh City, demanding the return of the deposit and compensation for damages due to contract violations.

According to the decision of the first-instance judgment on April 26, 2021, the Court accepted the plaintiff’s request from Dak R’Tih Hydropower, including the cancellation of the share transfer agreement; ordering GVR to refund the deposit of over VND 141 billion; imposing a penalty for contract violation of over VND 113 billion and compensating for damages in the amount of over VND 45 billion.

However, the Company has not received any money according to the announced judgment, as GVR has submitted an appeal application to the Higher People’s Court of Ho Chi Minh City to appeal against the judgment of the Ho Chi Minh City People’s Court.

Photo: Dak R’Tih Hydropower

|

Dak R’Tih Hydropower was established in 2007, mainly engaged in the production, transmission, and distribution of electricity. Its headquarters is located at 88 Le Duan Street, Nghia Tan Ward, Gia Nghia City, Dak Nong Province.

Currently, the Company’s charter capital is VND 1 trillion, with major shareholders such as Construction Joint Stock Company No.1 (UPCoM: CC1) holding 40.07%; Bach Viet Production and Trading Limited Liability Company holding 20.81%; S.S.G Corporation Joint Stock Company holding 6.02%; Bach Viet Technology and Investment Corporation holding 5.59%.

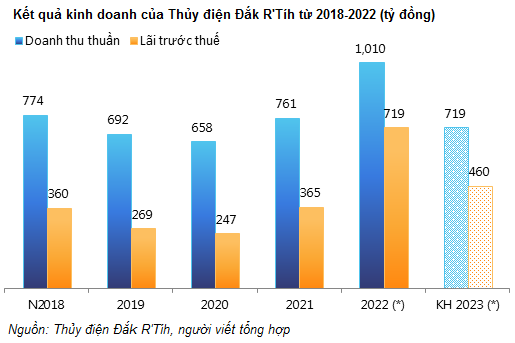

In terms of business performance, in 2022, thanks to favorable weather conditions, the total revenue reached VND 1,010 billion, an increase of 29% compared to the same period and exceeded the annual plan by 27%. Pre-tax profit increased by 200% to VND 719 billion, exceeding the target profit by 39%. Net profit was approximately VND 682 billion.

In 2023, the Company has set a cautious plan with a total revenue of VND 719 billion and pre-tax profit of VND 460 billion, a decrease of 29% and 36% respectively compared to 2022.

In the balance sheet, at the end of 2022, the Company’s total assets reached VND 2,451 billion, an increase of 11% compared to the beginning of the year. Cash and bank deposits decreased sharply from VND 137 billion to VND 16 billion; meanwhile, the Company generated accounts receivable of VND 370 billion from Ms. Hoang Thi Anh Trang (not recorded at the beginning of the year).

On the other side of the balance sheet, the payable debt reached VND 545 billion, a decrease of 9% compared to the beginning of the year. Total financial borrowings were nearly VND 300 billion, down 24%.

Thế Mạnh