Quarterly Net Profit of Habeco from 2020-2023

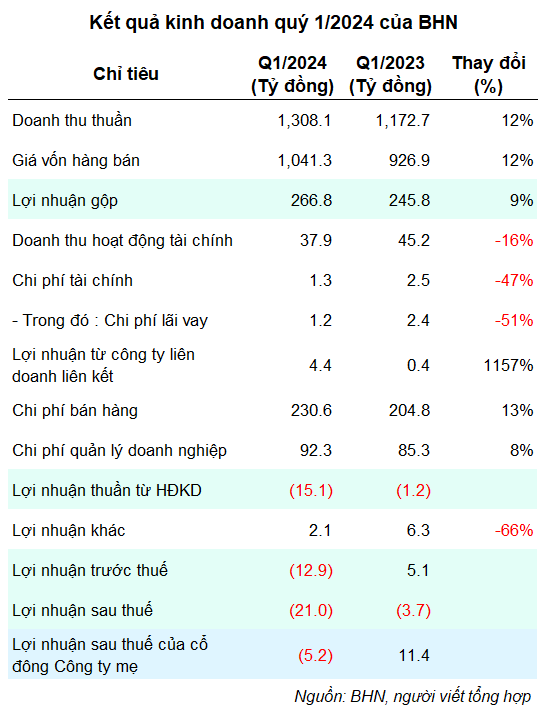

In the first quarter of 2024, the General Beer-Alcohol-Beverage Corporation of Hanoi (Habeco, HOSE: BHN) recorded a net revenue of more than VND 1,308 billion, an increase of 12% compared to the same period last year. After deducting the cost of goods sold, the company’s gross profit was nearly VND 267 billion, an increase of 9%; the gross profit margin decreased slightly from 21% to 20.4% in the same period.

However, after deducting expenses, Habeco made a net loss of more than VND 5 billion, while in the same period last year, it made a profit of more than VND 11 billion, and this is the first loss-making quarter after 16 profitable quarters since the second quarter of 2020, or the last 4 years.

Hanoi Beer explained the loss-making results due to the company’s increased investment in marketing activities. In the first quarter of 2024, sales expenses were nearly VND 231 billion, an increase of 13% compared to the same period, due to advertising, promotion, and support costs increasing by 42% to nearly VND 105 billion; personnel expenses increased by 21 % to over VND 34 billion. Besides, business management costs increased by 8% to over VND 92 billion.

In addition, the decrease in interest rates on mobilized capital resulted in a 16% decrease in financial revenue in the first quarter to nearly VND 38 billion, which also affected the business results of the northern beer company. As of March 31, 2024, BHN had deposited approximately VND 3,464 billion in the bank.

In fact, Habeco has spent heavily on advertising and promotions in the context of the State’s strict management measures to reduce the harmful effects of beer and alcohol. According to the Vietnam Beer-Alcohol-Beverage Association (VBA), the beer industry’s revenue in 2023 decreased by 11% compared to the previous year due to the alcohol concentration control policy in Decree 100. In addition, the beer industry is also affected by people tightening their spending, increasing the price of raw materials, and the increasing level of competition in the market.

Habeco’s 55% owned subsidiary, Hanoi – Hai Duong Beer JSC (HNX: HAD), also reported a first-quarter loss of more than VND 1 billion (a loss of more than VND 200 million in the same period), mainly due to the consequences of the increasing USD exchange rate when purchasing raw materials, and reduced consumption due to weather conditions and the impact of Decree 100.

Based on the forecast that the market will still be negative, in 2024, Habeco sets a conservative target with a revenue from the consumption of main products of over VND 6,543 billion and a profit after tax of VND 202 billion. With the loss in the first quarter of the year, BHN will find it very difficult to achieve the profit target assigned by the General Meeting of Shareholders.

In comparison with the “big player” in the southern beer industry, Saigon Beer-Alcohol-Beverage Corporation (Sabeco, HOSE: SAB) made a net profit of nearly VND 997 billion in the first quarter of 2024, a slight increase of 3% compared to the same period, due to the unfavorable business situation of its affiliated companies despite a strong increase in revenue.

As for the beer producer Saigon – Central Beer JSC (HoSE: SMB), its first-quarter net profit increased by 56% year-on-year to nearly VND 24 billion, despite a sharp increase in sales and business management expenses, due to the gross profit margin improving by nearly 24% thanks to increased consumption.