This afternoon, foreign investors sold over a thousand billion dong worth of shares on the HoSE with a total selling session of over 2,036 billion dong. Although this is not the largest number, the net amount of -938 billion dong on this floor is a record high for 9 weeks. In total, about 920 billion dong was withdrawn from the market across the 3 floors.

Today’s strong selling session completely reversed the net buying position of foreign investors in January. Specifically, according to statistics on the HoSE, the net value of stock purchases reached about 1,305 billion dong, but since the beginning of February until now, net selling has reached 1,893 billion dong.

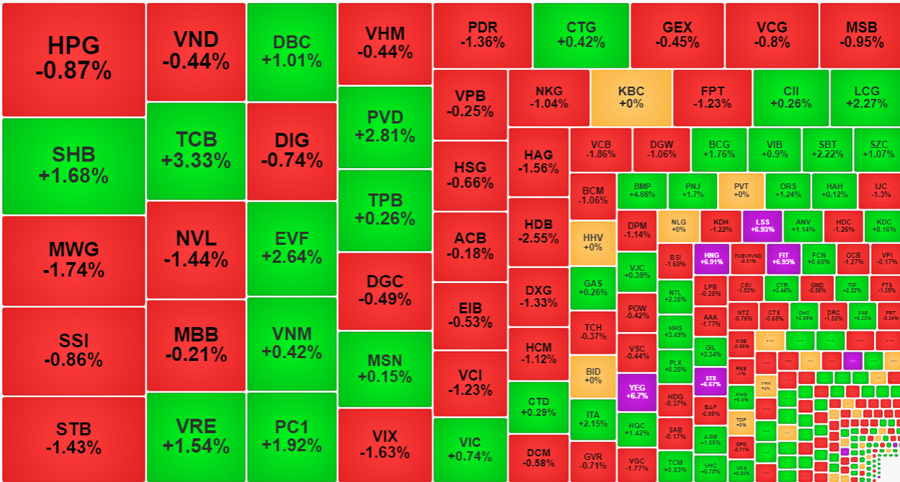

Many blue-chip stocks were heavily sold off in this session. HPG was heavily withdrawn, with sales volume accounting for 27.5% of total trading volume. HPG lost 0.87% and suffered its second consecutive decline. This stock is adjusting after reaching its peak in September 2023. VPB ranked second with a net selling value of 117 billion dong, with foreign net selling accounting for 60% of trading volume, and the price decreased slightly by 0.25%. MSN was net sold off 109.6 billion dong, with foreign selling volume accounting for 40.5% of trading volume, and the price increased by 0.15%. MWG was sold off 105.3 billion dong, with sales volume accounting for 25% of trading volume, and the price decreased by 1.74%. Other notable stocks that were sold off include STB (-96.3 billion dong), VNM (-63.7 billion dong), VCG (-54.5 billion dong), EVF (-49.4 billion dong), HDB (-45.1 billion dong), VRE (-37.7 billion dong), HSG (-36.4 billion dong), PDR (-35.6 billion dong), GEX (-33.7 billion dong)… Specifically for stocks in the VN30 group, they were net sold off over 844 billion dong, and the selling value accounted for 19.3% of the total trading volume.

Despite the significant pressure from foreign investors, not all stocks that were heavily sold off experienced price declines. Domestic capital still participated rather actively in bottom fishing. This resource helped maintain the state of differentiation. VN-Index closed down 0.22%, but there were still 217 gaining stocks and 263 declining stocks. Specifically, the selling pressure only caused 54 stocks to drop by more than 1%, accounting for 24% of trading volume on the HoSE. There were quite a few stocks with high trading volume such as MWG, STB, NVL, VIX, PDR with over 200 billion dong, and VCI, NKG, FPT, HAG, HDB, DXG, HCM, VCB, DGW with trading value over 100 billion dong.

In terms of gains, 88 stocks increased by over 1% with an accumulated trading volume of 25% of the market. SHB, TCB, VRE, DBC, EVF, PC1, PVD were stocks with trading volume all exceeding 300 billion dong. Small-cap stocks such as FIT, LSS, PTL, HNG, TNT, YEG, ST8 even hit the ceiling with good trading volume.

This development shows that differentiation is still the core of the current market situation. VN-Index is very difficult to make sudden and strong fluctuations in both directions when there are still many large-capitalized stocks wrestling with each other. Today, out of the top 10 largest-cap stocks, four stocks were in red, five stocks were in green, and the declining side had VCB, the largest-cap stock in the market, which declined by 1.86% and took away nearly 2.4 points. The rising side was slightly better in terms of the number of stocks, but only TCB increased by 3.33%, which is strong, and the remaining five stocks including CTG, VIC, GAS, VNM only made up for about 2 points, still not enough to “balance” with VCB. However, the declining side did not have many weak blue-chip stocks, VN30-Index closed down 0.18% with 13 gaining stocks and 16 declining stocks. This corresponds to the slight decline of the main index.

Nevertheless, looking at the overall market, it is still clearly taking profits and stocks with high liquidity are declining more than increasing. Specifically, the total value of trading of declining stocks accounted for nearly 57% of the value of the HoSE, while the trading of rising stocks accounted for 39%. Specifically, out of the 45 stocks with a trading volume of over 100 billion dong on this floor, only 15 stocks increased, the rest declined. The selling pressure was most evident in this group.