A recent statistics by FiinGroup shows that the P/E ratio of the Vietnamese stock market is currently at 13.7x, lower than the average level from 2015 to now (14.2x), mainly due to the low valuation of the Banking sector.

The Financial sector has a -7.6% decrease in P/E, and when excluding the Real Estate sector, the P/E decreases by -16% compared to the historical peak thanks to strong profit growth in Q4/2023. However, this is still a high valuation level for this sector.

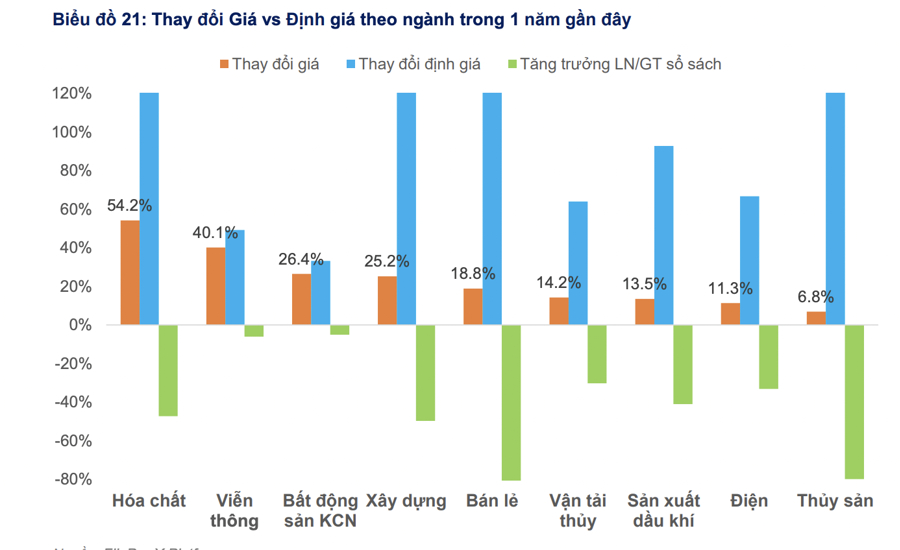

STOCK PRICES LEADING EARNINGS

Based on valuation and business analysis, FiinGroup provides a specific analysis of some industry sectors. Firstly, there are sectors with increasing stock prices due to recovery expectations, including chemicals, construction, retail, aquaculture, electricity, industrial real estate, water transport… These are sectors with stocks that have increased significantly in the past period but with declining profits.

The price increase is mainly due to expectations of early profit recovery and growth after the business interruption period due to Covid-19. These expected stories attract investment flows, pushing up valuations.

In reality, the expectation of a strong recovery in these industries has not yet become a reality in 2023. These are also the sectors that require outstanding profit growth in 2024 to compensate for the priced-in expectations in the past period.

However, looking into 2024, in the context of still relatively weak consumer demand, the profit prospects in most of these sectors are unlikely to recover strongly.

For industrial real estate, the continued support motive for prices is positive information related to FDI capital disbursement activities. For aquaculture, the recovery of export activities is facing obstacles as consumer demand is still weak in major export markets (USA, China) and transportation costs are increasing.

Secondly, there are sectors with increasing stock prices due to both valuation and profit growth. Securities, information technology, plastic pipes, express delivery, and steel are sectors with superior price performance compared to the overall market in 2023 thanks to a strong recovery in profit and high valuations.

The analysis group believes that the profit of most of these industries has gone through the recovery phase and is entering a growth phase, thus it is difficult to generate broad-based price momentum, especially in the current unstable market money.

Thirdly, there are sectors with increasing stock prices due to profit growth, with low or not yet increased valuation. Particularly, the banking sector is noteworthy with the expectation of strong profit recovery on the low level of 2023.

PROSPECTS FOR SECTOR GROUPS?

FiinGroup believes that a maintained low valuation for over a year will be a price incentive for the banking sector. Besides, the profit in 2024 is expected to be positive thanks to low interest rates and abundant liquidity supporting banks in reducing the cost of capital for credit activities and creating room for improvement in NIM.

However, it is still important to note the risks of economic growth not meeting expectations, weak credit demand, and a prolonged real estate market slowdown causing bad debts to increase and provisioning costs to rise.

For the steel industry, stock prices have risen sharply, but the potential for growth in 2024 is unlikely to see a breakthrough. Supporting factors: Recovery in export; Profit growth due to improved margin when (i) selling prices rise but input raw material prices (iron ore, pig iron) fluctuate slightly or flat and (ii) optimizing inventory.

Risks: Economic growth does not meet expectations; Prolonged real estate market slowdown; Increasing electricity prices.

Retail industry: Post-tax profit may have bottomed out, but the potential for profit growth in 2024 is low. Supporting factors: Manufacturing and exporting activities gradually recover, improving the income of workers, thereby improving consumer demand; Individual stories of each enterprise: Asset sales (MWG), New business chain (FRT).

Risks: Economic growth not meeting expectations, Weak consumer demand. The Electronics-Telecommunications business is in a saturation phase (the Electronics business is still negatively affected by the housing market) => increasing competition => pressure on Revenue growth and Profit margin; Prolonged real estate market slowdown.

Aquaculture industry: Slow recovery in demand and increasing transportation costs are hindering the recovery of the industry. Supporting factors: Recovery in consumer demand in major export markets (USA, Europe, China) and increased imports from retailers. Risks: Slower-than-expected recovery, Competition with low-price sources from Ecuador, India, Bangladesh; Increased transportation costs and prolonged delivery time due to political risks.

Industrial real estate industry: Positive profit prospects in 2024 thanks to the flow of FDI capital. Supporting factors: Expectations of improved FDI due to the shift of capital from China and recovery in capital flows from traditional countries (Singapore, Korea, Japan); Rent increase; Improved transportation infrastructure.

Risks: Economic growth not meeting expectations, Continued weak consumer demand. Low supply and increased land clearance costs.