Accordingly, on February 22, the Board of Directors of Khang Dien Investment and Trading Corporation (Khang Dien; stock code: KDH) approved the full and timely guarantee of the outstanding debt of VND 4,270 billion for Khang Phuc Investment Trading Company Limited (Khang Phuc) at Vietinbank – Hanoi Branch. The guarantee validity will be maintained until Khang Phuc fully fulfills its debt obligations to Vietinbank.

It is known that Khang Phuc is a direct subsidiary of Khang Dien, which is the largest subsidiary with a charter capital of VND 3,400 billion, of which Khang Dien owns 100% of the ownership and voting rights.

Khang Phuc is a real estate business, constructing houses, investing in construction, and infrastructure business. Currently, the company is the investor of The Privia project with a total area of 1.8 hectares, located on An Duong Vuong street, An Lac Ward, Binh Tan District, Ho Chi Minh City. In November 2023, this project was launched for sale, after all 1,043 apartments of the project were qualified for future residential sales.

Regarding industrial real estate, Khang Phuc is the investor of the expanded Le Minh Xuan Industrial Park project with an area of nearly 110 hectares, in Binh Chanh District, Ho Chi Minh City.

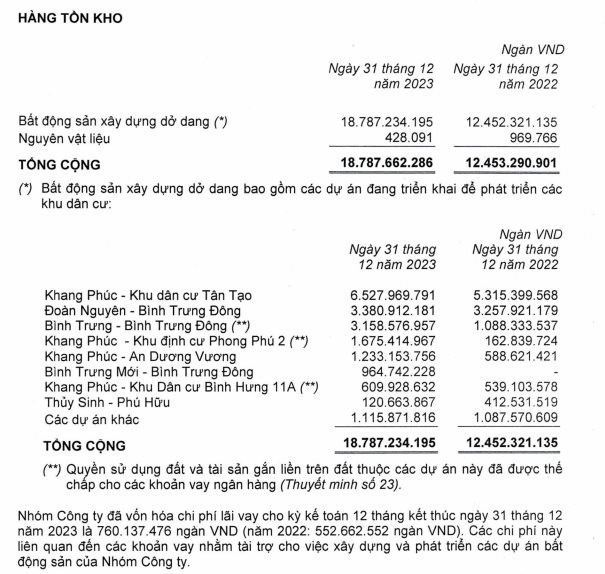

Another notable point is that Khang Phuc currently has inventory worth nearly VND 9,500 billion, including: Tan Tao residential area worth VND 6,527 billion, Phong Phu 2 settlement area worth VND 1,675 billion, and An Duong Vuong area worth VND 1,233 billion. Khang Phuc’s inventory currently accounts for more than 50% of the total inventory of the mother company Khang Dien.

In terms of business situation, in 2023, Khang Dien reported a post-tax profit of VND 730 billion, a 32.5% decrease compared to the previous year.

As of December 31, 2023, Khang Dien’s total assets were VND 26,417 billion, an increase of 22.7% compared to the beginning of the year. In which, short-term assets were VND 24,719 billion, an increase of 20.5%. Cash and cash equivalents were VND 3,729 billion, an increase of 35.5%. Inventory was VND 18,787 billion, an increase of 50.9%.

On the other side of the balance sheet, the company’s payable debt is VND 10,889 billion, an increase of 11.8% compared to the beginning of the year. In which, short-term debt is VND 5,328 billion, an increase of 52.1%. Financial debt is over VND 6,345 billion, including: short-term loans of over VND 1,067 billion at Vietinbank, long-term loans of nearly VND 4,200 billion at OCB Bank, and bond debt of VND 1,100 billion, with an interest rate of 12% per year, due in mid-2025.

In the stock market, at the end of the trading session on February 22, the price of KDH shares was VND 32,400 per share, a decrease of 1.22% compared to the previous trading session, with a trading volume of over 1.6 million units.