On the stock trading session of February 22, banking stocks showed mixed performance as among 27 stocks, there were 10 gainers, 12 losers, and 5 closed at the reference price.

Among them, TCB, a stock of Techcombank, unexpectedly stood out as it increased by 3.3%, closing at VND 40,300 per share.

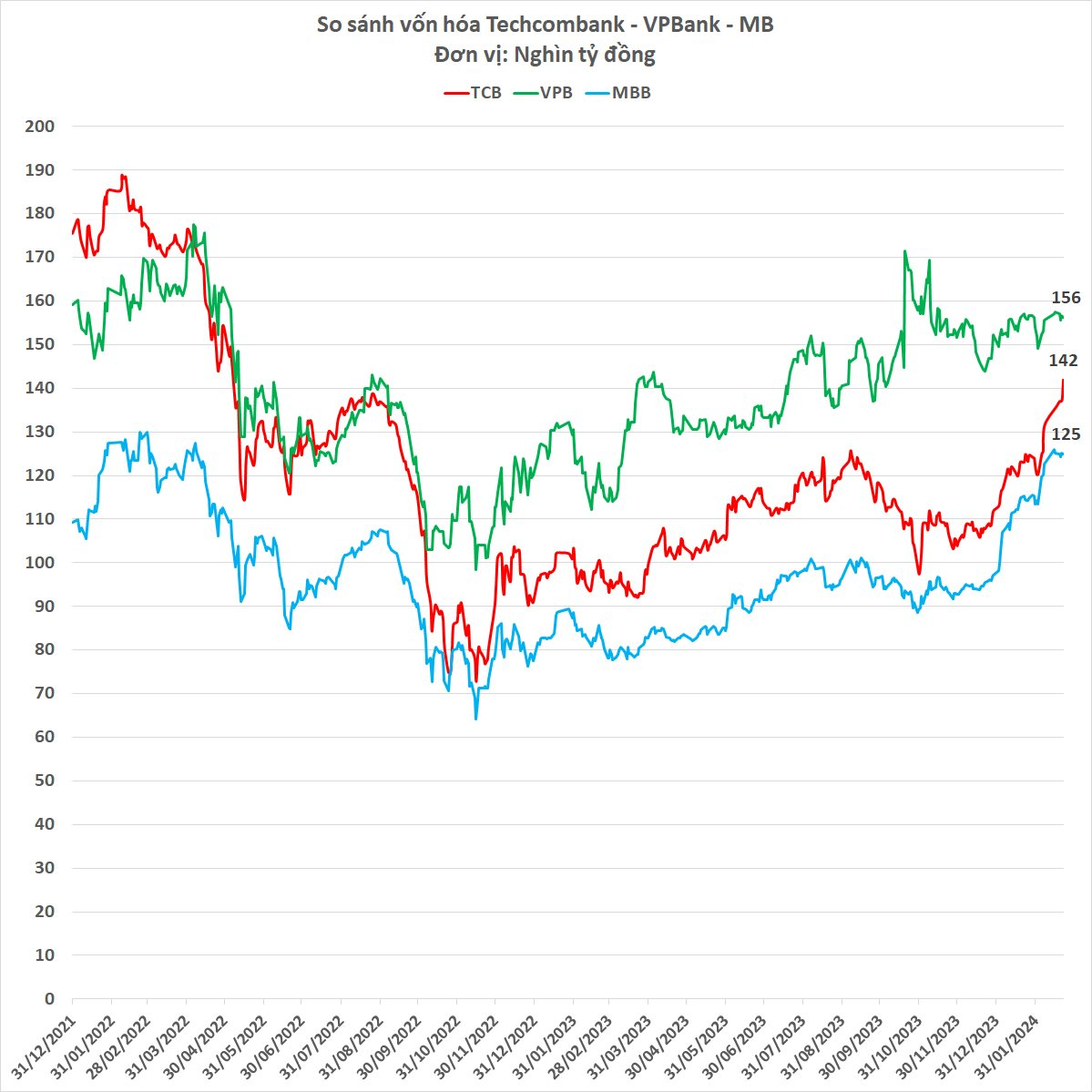

With this price, Techcombank’s market capitalization has risen to VND 142 trillion, the highest since May 2022.

Compared to two banks of equivalent size, VPBank and MB, the market capitalization of Techcombank is only VND 14 trillion less than VPBank and the gap with MB has widened to VND 17 trillion.

Before 2022, the market capitalization of Techcombank was always higher than that of VPBank, but this has changed since VPBank divested its stake in FE Credit. If it maintains its current price momentum, Techcombank will soon regain its position as the private bank with the largest market capitalization in Vietnam from VPBank.

According to observations, Techcombank’s stock has started to rise recently after the bank ended its 10-year policy of not paying cash dividends, and it is expected that at the 2024 shareholders’ meeting, a plan to distribute dividends of 20% of post-tax profit, equivalent to 15% of face value, will be proposed.

“This will ensure regular cash flow for shareholders, as they will have direct income from annual business results, while still optimizing the benefits from the potential for price increases based on the bank’s leading position in the Vietnamese financial market,” said Mr. Phung Quang Hung, Deputy General Director of Techcombank.