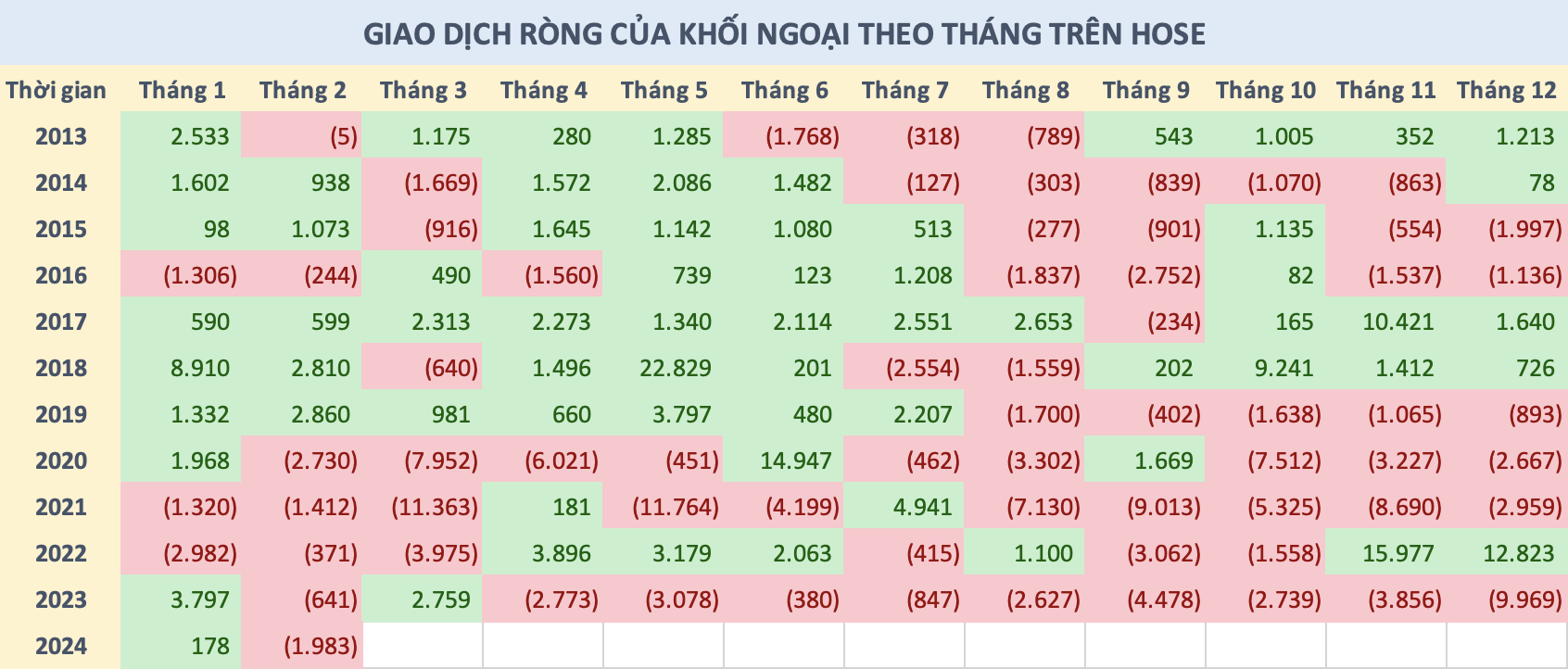

The Vietnamese stock market has just experienced a correction under strong selling pressure from foreign investors. Specifically, on HoSE, foreign investors sold nearly VND 940 billion on February 22, the strongest selling day since the beginning of 2024. The accumulated net selling value since the beginning of February reached nearly VND 2,000 billion. Previously, foreign investors had a slight net buying of nearly VND 180 billion in the first month of the year.

Statistics show that foreign investors have had four consecutive years of net selling in February and are likely to continue this trend this year as their selling activity has shown signs of increasing recently. In general, over the past 5 years since 2020, foreign investors tend to aggressively sell after the Lunar New Year (February-March Gregorian calendar).

The selling activity by foreign investors after the Lunar New Year is partly profit-taking as the market usually starts strong with the January effect. In fact, the VN-Index has already increased nearly 10% since the beginning of 2024. Therefore, the selling pressure from foreign investors is understandable after they have been net buyers in the period before Tet, which usually falls in January of the Gregorian calendar.

The net selling trend by foreign investors at the beginning of this year is partly contributed by the withdrawal of capital from ETFs. In the first month, ETFs have net withdrawn about VND 1,100 billion, with a focus on 2 domestic funds DCVFM VNDiamond ETF and SSIAM VNFinLead ETF. This trend continues in February but the pressure has significantly eased. Instead, active funds have increased their net selling.

Looking back at the past data, after the net selling period in February-March, foreign investors tend to have a strong net buying in the second quarter (except for last year with 9 consecutive net selling months). However, the “breathing” period does not last long as the second half of the year usually sees a strong selling activity from foreign investors, especially in the past 5 years.

In 2024, analysts are expecting foreign capital flow to reverse or at least reduce the net selling pressure compared to the previous year. In the newly published strategic report, SSI Research believes that the trend of foreign capital flow will reverse in 2024 following the Fed’s gradual interest rate cut and the opportunity for the Vietnamese stock market to be upgraded by FTSE Russell in 2024-2025. Although the foreign capital flow may not recover immediately, at least the net selling pressure may not be as strong as the previous year.

Meanwhile, Mr. Trinh Hoai Giang, CEO of HSC Securities, believes that foreign capital flow is still expected to net sell on the listed market due to the interest rate differential. In 2024, the interest rate differential between USD and VND will continue and the State Bank of Vietnam will maintain the current low interest rate.

“It is also possible that the interest rate in USD will remain high, and there is a possibility that it will increase instead of decreasing as people think” – the CEO of HSC Securities shared. However, Mr. Giang also evaluates that the trust in the stock market has improved and the net selling activity, if any, will be lighter.

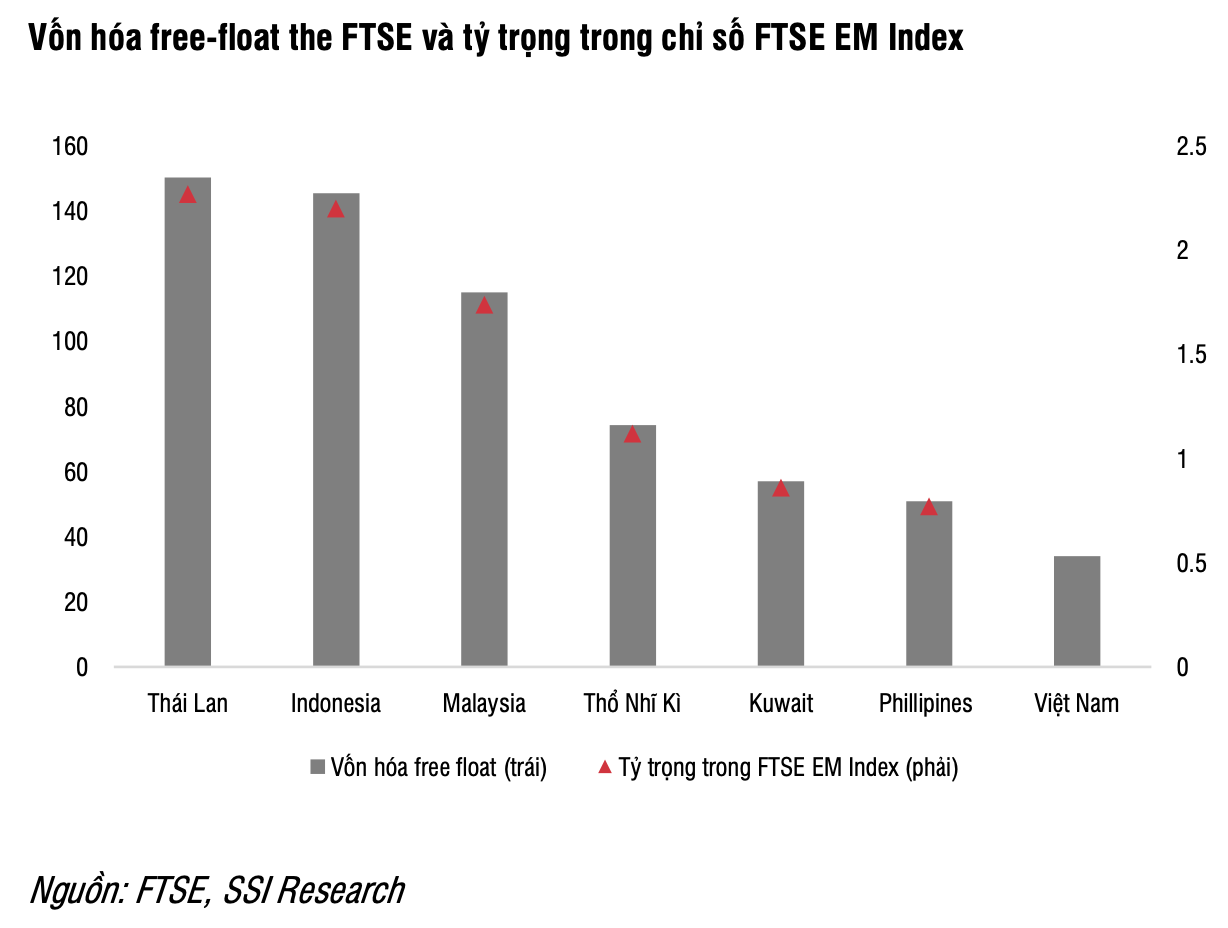

In the long run, the story of upgrading the market to a frontier market is expected to be an important factor contributing to attracting foreign capital to the Vietnamese stock market. With the free float market cap of Vietnam at about USD 35 billion, the estimated proportion of Vietnam in the FTSE EM Index is about 0.7-1% and in the FTSE Global is 0.1%. This could immediately attract about USD 1.7-2.5 billion to the Vietnamese stock market when the decision to upgrade by FTSE Russel takes effect.