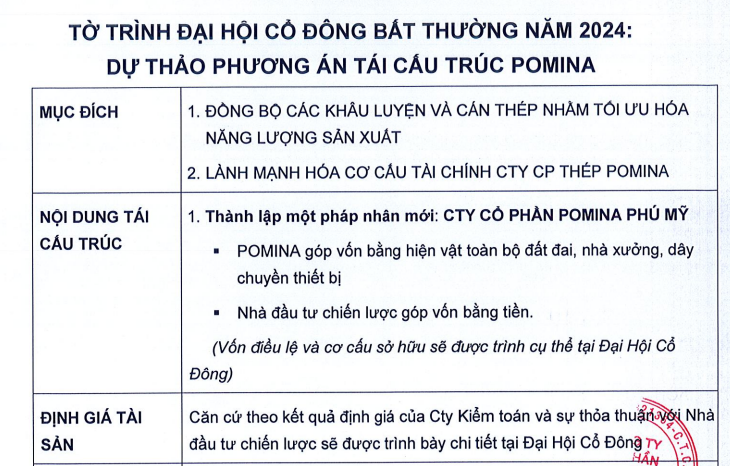

CTCP Thép Pomina (MCK: POM, HoSE floor) has just announced the addition of documents for the extraordinary general meeting in 2024, which is a draft plan for the company’s restructuring.

According to the newly added draft restructuring plan, Pomina Steel plans to establish a new legal entity called Pomina Phu My Joint Stock Company. Pomina will contribute capital through assets such as land, factories, and equipment, while strategic investors will contribute capital in the form of cash. Pomina will provide specific details about the charter capital and ownership structure of this new entity at the general meeting.

Source: POM

The value of the assets will be presented in detail at the general meeting, based on the valuation results of the company’s auditors and agreements with strategic investors.

The funds obtained will be used to repay short-term and long-term debts to banks, suppliers, and supplement working capital.

In the previously disclosed general meeting documents, Pomina Steel proposed to settle and increase the investment amount for the blast furnace at Pomina 3 branch from 4,975 billion VND to nearly 5,880 billion VND based on the actual investment capital of the blast furnace project. This figure is based on the audit results of AFC Vietnam Auditing Company, dated March 2, 2023. According to Pomina’s Board of Directors, this approval is intended to help Pomina complete the project’s procedures.

As of December 31, 2023, Pomina Steel stated that the construction cost of the blast furnace and electric arc furnace (EAF) project was 5,808 billion VND, accounting for 55.8% of total assets. This includes the purchase cost of machinery and equipment, and the construction cost of the blast furnace and EAF project with a steel ingot capacity of 1 million tons per year in the Phu My Industrial Zone, during the financial period before the transfer to assets.

Pomina Steel’s annual general meeting in 2024 is scheduled to be held on March 1 in Ho Chi Minh City, with the cutoff date for attendance on February 16.

Pomina Steel is currently facing multiple difficulties including losses, massive overdue debts, and the risk of delisting on HoSE.

In terms of business performance, in Q4/2023, Pomina Steel recorded a revenue of VND 333 billion, a decrease of 82% compared to the same period last year. The after-tax profit of the parent company recorded a loss of VND 313 billion, compared to a loss of VND 459 billion in the same period last year.

Explaining the continued loss in Q4/2023, Pomina Steel stated that Pomina 3 Steel Plant is still inactive but has to bear many costs, including interest expenses. The company is currently undergoing restructuring and has found new investors, with all procedures waiting for the approval of the General Meeting of Shareholders. After that, the company will put Pomina 3 Steel Plant back into operation, expected in Q2/2024.

In addition, Pomina Steel also stated that the real estate market is still frozen, steel consumption and revenue have sharply decreased, while fixed costs and high interest expenses have caused significant losses during the period.

Accumulated in 2023, Pomina Steel recorded a revenue of VND 3,281 billion, a decrease of 75% compared to the same period last year, and the after-tax profit of the parent company recorded an additional loss of VND 960 billion, compared to a loss of VND 1,167 billion in the same period last year.

It is known that in 2023, Pomina Steel set a revenue target of VND 9,000 billion and a net loss of VND 150 billion. Thus, the loss in 2023 has far exceeded the planned loss of VND 150 billion.

With the continued loss in 2023, as of December 31, 2023, Pomina Steel’s accumulated loss reached VND 1,271 billion, accounting for 45% of the shareholders’ equity.