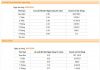

On the “black market”, the USD price is currently around 25,150 dong for buying and 25,220 dong for selling, an increase of about 120 dong for buying and 100 dong for selling compared to yesterday. Previously, on February 21st, the USD price in the free market also increased by about 50-60 dong.

At commercial banks, the USD price decreased slightly on February 21st, but today (February 22nd) it increased significantly by about 50-80 dong.

Specifically, at Vietcombank, the USD price is currently listed at 24,420-24,760 dong, an increase of 80 dong compared to yesterday.

BIDV also increased by 50 dong today to 24,430-24,740 dong. VietinBank increased the USD price by an additional 31 dong to 24,431-24,771 dong.

Techcombank raised it to 24,440-24,764 dong, an increase of 60 dong compared to yesterday. ACB listed 24,450-24,750 dong, an increase of 70 dong.

From the beginning of the year until now, the black market USD price has increased by about 380-400 dong, equivalent to a 1.5% increase. Meanwhile, the listed USD price at commercial banks increased by about 350 dong, equivalent to a 1.4% increase.

The central exchange rate announced by the State Bank of Vietnam on February 22nd is 23,981 dong, a decrease of 12 dong compared to yesterday. With a fluctuation range of +/-5%, the floor and ceiling exchange rates applied to commercial banks are 22,782-25,180 dong.

Internationally, the DXY index measuring the strength of the US dollar against major currencies decreased to its lowest level since the beginning of February, currently at 103.83 points.

According to the analysis of experts from Bao Viet Securities Company (BVSC), in 2024, the USD/VND exchange rate will be influenced by the movement of the DXY Index, as well as the monetary policy of the US Federal Reserve (Fed). With the Fed expected to cut interest rates in 2024, and based on past observations that the DXY tends to peak before the Fed’s last interest rate hike, the DXY is unlikely to strengthen significantly like last year, and therefore the exchange rate in 2024 will fluctuate within a range of +/-2%.