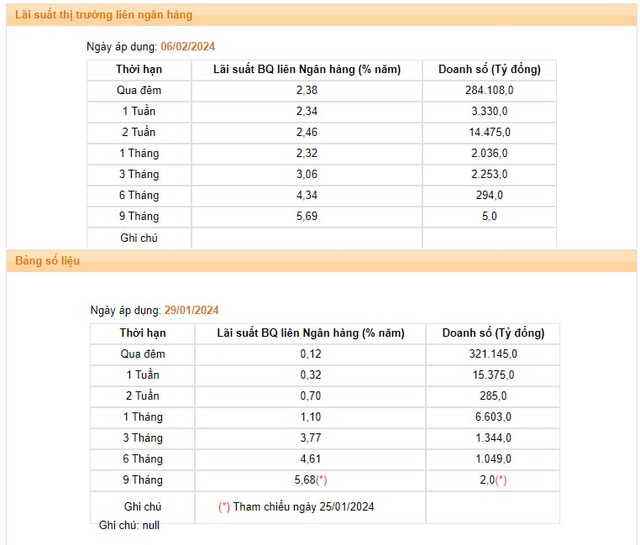

The latest data from the State Bank of Vietnam shows that the average interbank VND interest rate has surged in the days leading up to the Lunar New Year. Specifically, the overnight interest rate (the main term, accounting for about 90% of the transaction value) in the session on February 6 has increased to 2.38% – the highest level since late October 2023.

Prior to that, the interbank overnight interest rate had seen 5 consecutive sharp increases from 0.12% per annum in the session on January 29 to 1.78% in the session on February 5. Thus, within just over 1 week, the interbank overnight interest rate has increased nearly 20 times.

Along with the overnight term, interest rates at other key terms (1 month and below) have also increased sharply: 1-week term increased from 0.32% to 2.34%; 2-week term increased from 0.7% to 2.46%; 1-month term increased from 1.1% to 2.32%. Meanwhile, the 3-month term interest rate decreased from 3.77% to 3.06%.

Source: SBV

The higher overnight interest rate compared to 1-week and 1-month term interest rates and the decrease in 3-month term interest rate indicate short-term overheating trends and the market’s expectation that the interbank overnight interest rate will soon decrease in the coming time.

According to analysts, the sharp increase in interbank interest rates at short terms is mainly due to seasonal factors when payment needs and expenses increase during the Lunar New Year. Actually, the trading volume in the interbank market has increased significantly in recent days and consistently maintained at a level above 300,000 billion/session, even reaching nearly 400,000 billion on January 31.

To support banks with liquidity needs, SBV still maintains the channel for lending against valuable papers (OMO) and adjusts the bidding term up to 14 days. However, no market member needs support from the Operator.

The lack of new trading in the open market indicates that the system liquidity can still be “self-nourishing” even during the peak period of year-end payment. This is quite different from previous years – when SBV usually had to inject tens of thousands of billion VND through the OMO channel to support system liquidity in the days near the Lunar New Year.

With these developments, analysts expect that interbank interest rates will soon cool down when system liquidity is still abundant and credit demand is usually not high after the holiday.

“The sharp increase in interbank interest rates in the last days of January, especially at short terms due to seasonal factors. We believe that interest rates will not increase too strongly and will cool down immediately after the end of the holiday in the context of not too tense liquidity demand,” MB Securities said.

Domestic exchange rates, after escalating and reaching their peak in January, quickly cooled down in the days before the Lunar New Year. Interbank exchange rates returned to the starting point of the year and decreased by about 0.9% compared to the peak. USD prices at Vietcombank have also decreased by 0.8% compared to the peak recorded on January 26 and stopped at the range of 24,200 – 24,570 VND/USD before the Tet Holiday.