The market’s uptrend has stalled as selling pressure gradually increases when the VN-Index approaches the strong resistance level of 1,250 points. Closing the session on February 22, the VN-Index dropped 2.73 points (-0.22%) and closed at 1,227 points, with trading volume plummeting with a value of 16,800 billion VND.

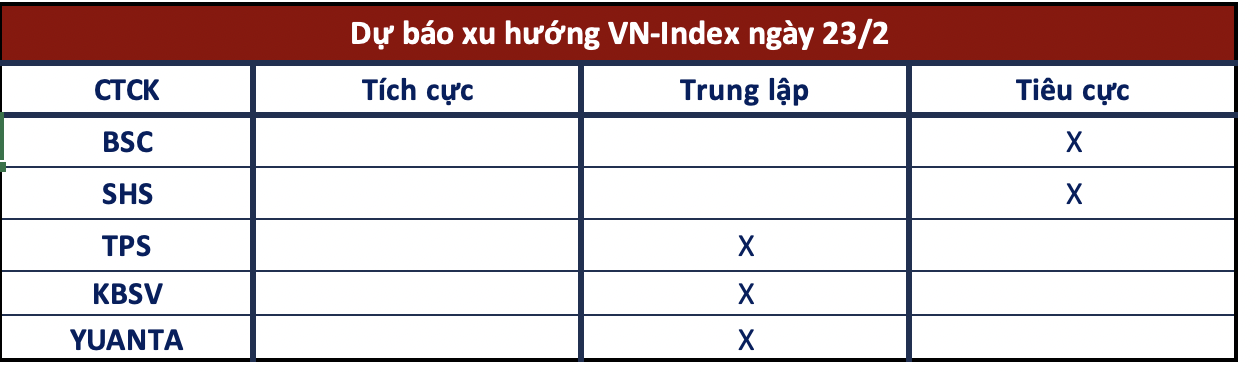

Regarding the market outlook in the coming sessions, most securities companies believe that the VN-Index will continue to face volatility pressures as it approaches the strong resistance level of 1,250 points, but investors can take advantage of buying opportunities in portions.

Volatility will continue prior to the 1,250 challenge

BSC Securities

After a rising period, profit-taking pressures become more apparent, but overall liquidity still supports the upward trend of the VN-Index. The oscillation trend may continue in the upcoming sessions as the index returns to the 1,250 resistance level.

SHS Securities

In the short term, although the VN-Index is in an upward trend, it is facing a real challenge as it approaches the strong resistance level of around 1,250 points, and the possibility of market volatility and significant corrections may occur. In the medium term, the VN-Index is moving within a balanced range to form a new accumulation base, with the market forming an accumulation base within the range of 1,150 – 1,250 points. Currently, VN-Index is almost approaching the upper resistance level of the accumulation channel, so the short and medium-term risks are increasing.

TPS Securities

In the short term, in an optimistic scenario, the VN-Index can continue to rise to the 1,250 – 1,280 range before a correction appears. In a more cautious scenario, the index can retest the strong resistance zone of 1,235 points. If it fails to break through this level, the possibility of the index reversing and retesting the support level of 1,160 – 1,180 points will be quite high.

Early rise returns, take advantage of the correction to buy in portions

KBSV Securities

Although the short-term correction risks still exist, the bullish sentiment is expected to return soon in the coming sessions. Investors are recommended to buy back in portions when individual target stocks return to support levels (depending on the risk tolerance to choose the buying points higher or lower) or when the market index falls to support levels around 1,170 (+-10) (a less likely scenario, corresponding to stocks returning to lower support levels).

Yuanta Securities

The market may continue to fluctuate with alternating ups and downs, and the VN30 index may move sideways around the 1,250 resistance level in the next session. At the same time, stock groups may differentiate, with expectations that Midcaps and Smallcaps groups can maintain their upward trend, while the VN30 group may move sideways or correct. In addition, the continued increase in psychological indicators indicates that investors are still optimistic about the current market situation.