In the latest announcement, Robert Alan Willett, a non-executive member of Mobile World Investment Corporation (MWG), has registered to sell 1.2 million MWG shares. If completed, Robert will reduce his stake from 8 million to 6.8 million shares, equivalent to 0.466% of the charter capital.

The purpose is for personal financial needs. The transaction method is by agreement or matching orders, expected to take place from February 27 to March 27, 2024.

Currently, MWG stock has increased nearly 6% since the beginning of 2024. The price of MWG is currently 45,300 VND per share, calculated by the market price. Robert Alan Willett can earn 54 billion VND if the transaction is completed.

Robert Willett, born in 1946, is a British citizen with a Master’s degree in Business Administration. Robert Alan Willett joined the MWG Board of Directors in April 2013. According to the introduction of Mobile World Investment Corporation, Willett used to be the CEO of BestBuy International and is known as the “guru” of the global retail industry. It should be noted that the stake held by this Board member is received from stock bonus activities or ESOP issuance at preferential prices.

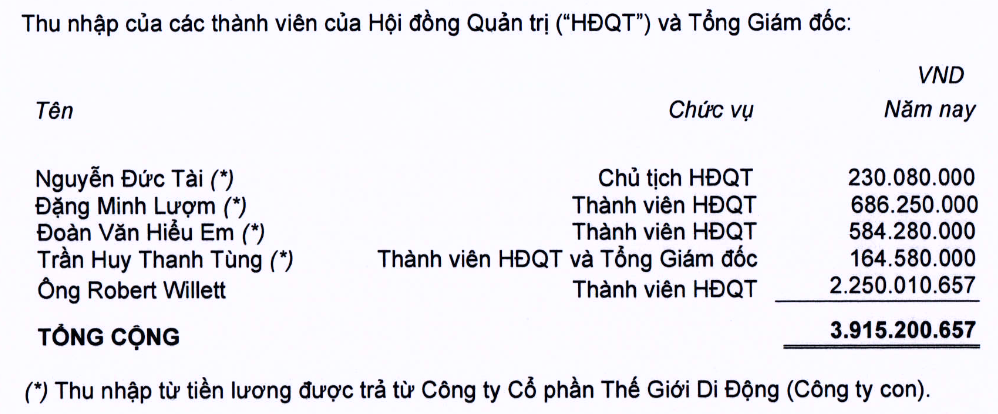

In 2023, foreign Board members “pocketed” over 2.25 billion VND in income, the highest level among senior leaders of Mobile World Investment Corporation.

Source: 2023 consolidated financial statements of Mobile World Investment Corporation

About the business situation, MWG ended 2023 with a revenue of 118.280 trillion VND, a decrease of 11% compared to the previous year and achieved 88% of the target. After-tax profit was 168 billion VND, a decrease of 96% compared to last year and the lowest level since the company’s listing.

MWG plans for 2024 with a revenue of 125.000 trillion VND – an increase of 5% and after-tax profit of 2.400 trillion VND – 14 times higher than the previous year’s performance. Assessing the new year, MWG leadership does not deny that the Vietnamese economy still faces many challenges due to unpredictable macro trends on a global scale; overall consumer shopping demand is stagnant, or even may decrease compared to 2023 for some non-essential items. However, after the comprehensive restructuring starting from the fourth quarter of 2023, MWG is confident that there is room to continue to strengthen revenue and improve profit targets.