The steel stock prices have rebounded quite well in 2023 despite the lackluster business results. If compared to the bottom in October 2023, the three leading steel stocks HPG, NKG, HSG also recorded an impressive increase of 30-40%. The reason is that the quarterly profits of most steel companies have bottomed out earlier than those of most other industries, and steel stocks tend to have higher beta coefficients and more positive trends when the overall market rises.

The steel prices might have hit bottom

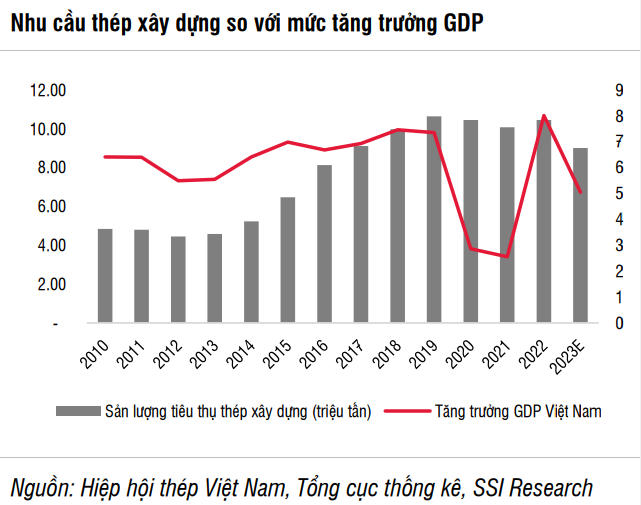

The steel industry outlook report by SSI Research indicates that steel demand in 2024 could recover, especially in the domestic market. Total steel consumption is expected to recover by over 6% compared to the same period in 2024, with domestic consumption reaching nearly 7% growth. Steel consumption in 2024 will be supported by the macroeconomic situation and the more vibrant real estate market. In the previous cycle, construction steel consumption in 2013 increased by about 3% compared to the 2012 bottom.

In addition, the export volume could maintain growth due to positive global demand prospects. According to the World Steel Association, global steel demand is expected to increase by 1.9% in 2024 compared to 1.8% in 2023. Demand from developing economies is expected to grow by 2.8% in 2024 after a 1.8% decline in 2023, with demand from the US and Europe projected to increase by 5.8% and 1.6% respectively after a 5.1% and 1.1% decline in 2022.

On the other hand, steel demand from ASEAN countries (excluding Vietnam) is expected to rise by 5.2% in 2024, higher than the 3.8% in 2023.

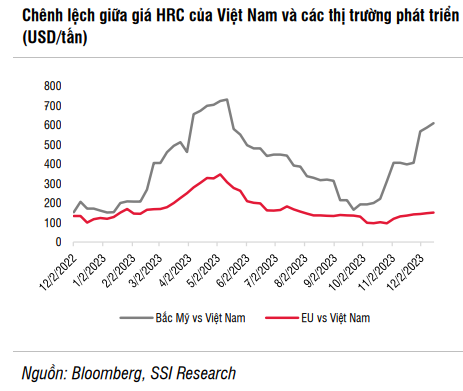

SSI Research expects the export volume to improve in the first quarter, as the price gap between steel in North America and Europe compared to steel in Vietnam continues to increase. In addition, tighter controls on the import of finished steel products produced by Russia by Europe in 2024 will also support Vietnam’s steel exports to Europe.

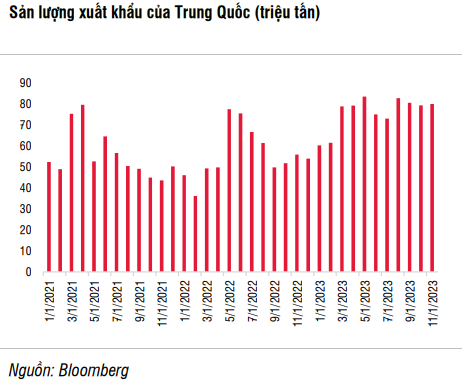

The SSI Research analyst team believes that steel prices might have hit bottom and will recover in 2024 due to a more balanced supply and demand. China’s steel production in November 2023 increased by 1.5% compared to the same period, reaching 952 million tons. However, monthly steel production in China has continuously declined from the peak of 95.7 million tons in March to only 76.1 million tons in November due to weak demand and high raw material costs, while steel companies’ profit margins have decreased to low levels.

The decline in China’s steel production has also led to a decrease in global production from 165 million tons in March to 145.5 million tons in November. Steel inventories in China have significantly declined in recent months, helping alleviate global oversupply pressure in the coming period.

Profit might strongly recover in 2024, but the valuation is high

SSI Research expects steel prices might have hit bottom and will recover in the future. However, strong price increases are unlikely to be expected due to overall weak demand affected by China’s weak demand as the real estate market has yet to show strong growth. On the other hand, the increasing steel prices compared to raw material costs could stimulate the return of production activities in China.

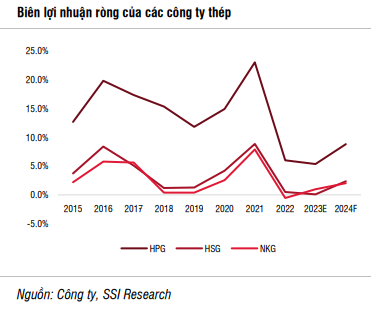

Steel companies’ profits might have hit bottom in 2023 and will recover in the next 2-3 years. The analyst team expects steel companies’ profits to have high growth rates in 2024 from the low base in 2023 thanks to improved consumption, especially of HPG and HSG, and gross profit margins increasing from low levels in many years as steel prices are likely to end the downward trend of previous years.

SSI expects profit growth rates might be higher in the first half of 2024 thanks to the low profit base in the first half of 2023. The recovery trend could be maintained after 2024, although consumption and profit margins are still likely to fluctuate, so steel stocks are suitable for investors with a high risk tolerance.

However, the stock prices are currently priced at high levels, partly reflecting the one-year profit outlook for the industry, with a projected P/E ratio ranging from 15x-17x, exceeding the historical average of about 10x. Steel stocks are often valued high in the profit bottom period. In addition, steel stocks have also been popular in recent years as stocks with high beta coefficients.