Image: TNG

|

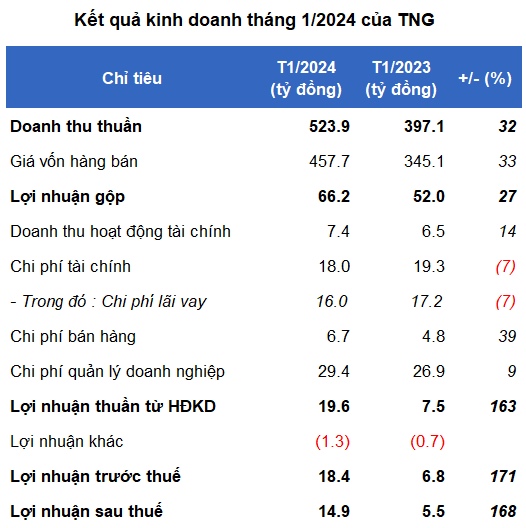

According to the separate financial statements for January 2024, TNG’s gross revenue reached 524 billion VND, an increase of 32% compared to the same period last year and the highest January revenue in the past 5 years for the Company. However, the rapid increase in cost of goods sold compared to revenue resulted in a slight decrease of 0.4 percentage points in gross profit margin to 12.6%.

This month, the financial revenue increased by 27% to over 7 billion VND, but it was not sufficient to compensate for the financial expenses of 18 billion VND. In addition, the selling expenses and management expenses reached 7 billion VND and 29 billion VND, an increase of 39% and 9% respectively compared to the same period last year.

After deductions, TNG achieved a net profit of 15 billion VND, a significant increase of 168% compared to the same period last year. However, this is also the lowest profit level in the past 7 months for the Company. To achieve this result, TNG has signed export garment orders with various partners such as Decathlon, Columbia, The Children’s Place, Sportmaster, Costco, Nike, Adidas, etc. since the beginning of 2024.

At the end of January 2024, TNG’s total assets reached 5,082 billion VND, a decrease of 70 billion VND compared to the beginning of the year. Cash and bank deposits amounted to 256 billion VND, a decrease of 14%; meanwhile, inventories increased by 2% to 906 billion VND.

On the liabilities side, payable debts amounted to 3,386 billion VND, a decrease of 40 billion VND compared to the beginning of the year. Total financial borrowings exceeded 2,500 billion VND, including short-term financial borrowings of over 1,700 billion VND, a decrease of 5%.

Prior to this, TNG announced its business results for 2023 with record revenue of 7,096 billion VND, an increase of 5% compared to 2022, exceeding the set plan. However, the net profit was only 226 billion VND, a decrease of 23% and achieved 76% of the annual profit target.

At the end of the session on February 22, TNG’s stock price stopped at the reference level of 21,000 dong/share, an increase of 8% compared to the beginning of the year and an increase of 23% compared to the short-term bottom at the end of October 2023.

| TNG Stock Price Performance |

In terms of operation status, TNG’s BOD has just approved the plan to organize the Annual General Shareholders’ Meeting in 2024, scheduled to take place on April 21, at Viet Thai Garment Branch – Son Cam Industrial Cluster 1, Son Cam Commune, Thai Nguyen City, according to the list of record shareholders on March 21, 2024.

The meeting agenda includes the report on business results for 2023 and business plan for 2024, dividend distribution for 2023 and expected dividend payment for 2024, election of BOD members, issuance plans, and other content within the authority…