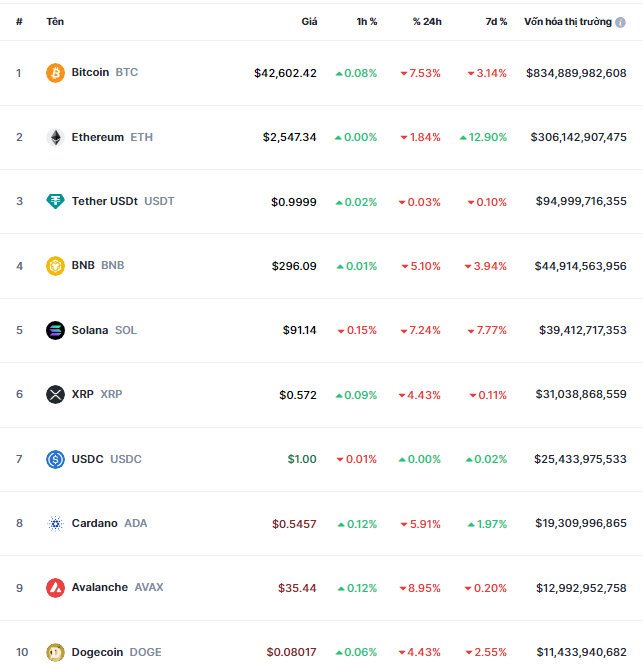

As of January 13, the world’s largest cryptocurrency, Bitcoin, fluctuated around $42,600, a 3% decrease from the previous week. After the approval news of ETF funds, the price of Bitcoin soared up to $49,000 but quickly cooled down afterwards.

Many people had predicted a selling trend in Bitcoin as many investors and cryptocurrency miners had made significant profits. In just three months, the price of Bitcoin had increased by more than 60%. Market participants agreed that Bitcoin would benefit from ETF funds, but it would take time for newcomers to get acquainted with this type of asset.

Meanwhile, Ethereum recorded a strong increase of 13% this week.

“We think that the cryptocurrency market has shifted to a different story, as Ethereum has outperformed Bitcoin. This may be due to expectations of ETF funds for Ethereum being approved,” shared Alex Saunders, an analyst at Citi, in a report on January 12.

The SEC will make a decision on ETF funds for Ethereum in May 2024. BlackRock, Invesco, Ark, and VanEck are among the companies that have filed applications for ETF funds, while Grayscale intends to convert its Ethereum Trust into an ETF fund.

Other cryptocurrencies also experienced losses during the past week, with BNB down 4%, Solana dropping 8%, and Dogecoin decreasing nearly 3%.

Source: CoinMarketCap

|

The U.S. Approves Bitcoin ETF Funds

The U.S. regulatory agencies have approved Bitcoin ETF funds for the first time, marking a breakthrough in the $1.7 trillion cryptocurrency market and expanding access to the world’s largest cryptocurrency. However, Bitcoin only increased by just over 1% despite the anticipation from the cryptocurrency community.

The U.S. Securities and Exchange Commission (SEC) approved Bitcoin ETF funds from major players such as BlackRock, Invesco, Fidelity, as well as smaller companies like Valkyrie. The fund certificates for these funds will begin trading on January 11.

Standard Chartered analysts stated this week that ETF funds could attract $50 to $100 billion in 2024, pushing the price of Bitcoin to $100,000. Other analysts predict that the inflow of capital could reach $55 billion in the next 5 years. Andrew Bond, CEO and financial technology analyst at Rosenblatt Securities, observed, “This is a major positive for the institutionalization of Bitcoin as an asset. The approval of ETF funds will continue to legitimize Bitcoin.”

This approval decision is a rare compromise from the SEC after more than a decade of opposing Bitcoin ETF funds. The first proposal for a Bitcoin ETF fund came from Bitcoin billionaires Tyler and Cameron Winklevoss in 2013.

Prior to this, BlackRock unexpectedly filed an application to establish a Bitcoin ETF fund in June 2023, sparking a rapid surge in the price of Bitcoin in the latter months of the year. Thanks to this anticipation, Bitcoin became the best-performing asset in 2023 with a 160% increase.

“Although we have approved the listing and immediate trading of some Bitcoin ETF fund certificates today (11/01), we do not endorse or support Bitcoin,” stated SEC Chairman Gary Gensler in a statement. “Investors should be cautious about the range of risks associated with Bitcoin and virtual currency-related products.”

When considering the latest proposals, the SEC stated that they had examined the correlation between spot trading and futures trading in various timeframes and concluded that price volatility could occur in futures contracts due to abnormalities on exchanges such as Kraken and Coinbase.

Therefore, the SEC is moving towards a comprehensive surveillance sharing agreement with the CME, where Bitcoin futures contracts are traded. “CME’s surveillance can help detect the impact of anomalies on Bitcoin futures contract prices,” the SEC noted.