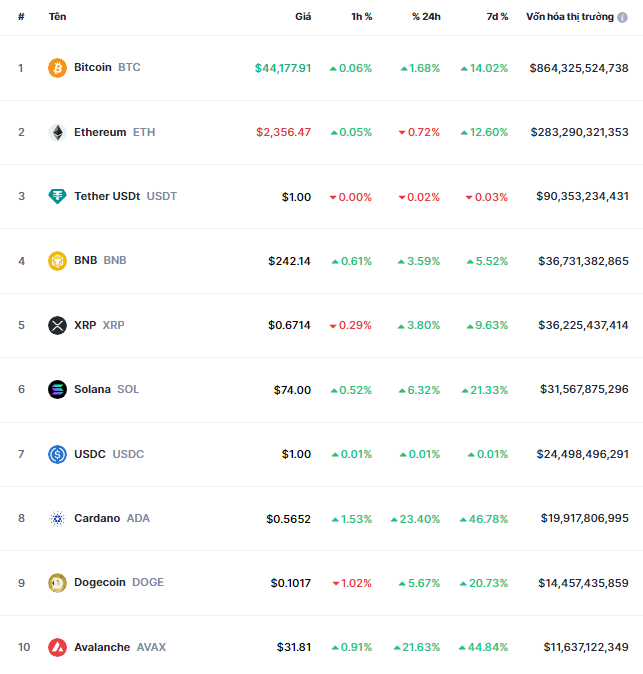

As of the morning of December 9, Bitcoin has been fluctuating around $44,200, a 14% increase compared to the previous week. The second-largest cryptocurrency, Ethereum, has increased by 13% to nearly $2,400.

Other cryptocurrencies in the top 10 have seen even stronger growth, with Solana rising by 21%, Cardano by 47%, and Avalanche by 45%.

The performance of the top 10 cryptocurrencies

The enthusiasm surrounding the prospect of a Bitcoin ETF in the US is the main driving force behind Bitcoin’s continuous climb, which began in the summer of this year. Initially, this news had little impact, but as more applications were submitted and responses were received from the US Securities and Exchange Commission (SEC), investors became more excited and confident in the approval of the fund.

“The biggest motivation behind the price increase of Bitcoin could be the number of registrations for the Bitcoin ETF futures contract that is expected to be approved by the SEC,” Yiannis Giokas, Senior Director at Moody’s Analytics, shared in an email. “The race is heating up, with large fund management organizations starting to take notice of Bitcoin.”

The crypto industry is waiting for the result of the registration of BlackRock’s Bitcoin spot ETF. Bloomberg Intelligence expects that the SEC will approve Bitcoin ETF funds for trading in January 2024.

Bitcoin aims for $48,000

Joel Kruger, a market strategist at LMAX Group, said that Bitcoin’s sudden surge is driven by the combination of the growing interest of institutional investors and the expectation that Bitcoin ETFs will soon be approved by US regulators.

Kruger predicts that Bitcoin will continue to rise until the $48,000-$53,000 range, based on technical analysis of the price levels that the cryptocurrency has reached in March 2022 and September 2021.

Kruger explained: “There is very little resistance between the current price and the peak price in March 2022.” In March 2022, Bitcoin reached a high of around $47,500, while in September 2021, the cryptocurrency surged to nearly $53,000.

Approximately 90% of Bitcoin investors are in profit

The strong rise to $44,000 has helped more and more investors escape losses. Since the beginning of the year, Bitcoin has increased by 163%, bringing profits to about 89.6% of Bitcoin holders, according to data from IntoTheBlock analysis platform.

There are about 45.4 million Bitcoin wallets holding Bitcoin at a price of $43,706, equivalent to 17.6 million Bitcoin. Meanwhile, 10.42% of wallets holding 1.99 million Bitcoin are still in a loss-making position. On average, the losing wallets bought Bitcoin at a price of $52,886, corresponding to the period of Bitcoin price increase in late 2021.

El Salvador has also made millions of dollars in profits from Bitcoin investments. Previously, El Salvador’s investment portfolio was always in a losing position.

In a post on Twitter on December 5, President Nayib Bukele revealed that the Bitcoin investment portfolio of the Central American country had finally become profitable after two years. From late 2022 until recently, El Salvador’s investment portfolio was always in a losing position.

The average price that the country paid for one Bitcoin was $40,480. With the current price of $44,000, El Salvador’s investment has made millions of dollars in profit.

Short sellers burned by Bitcoin’s strong rally

On the other hand, short sellers of stocks related to cryptocurrencies are feeling the heat from Bitcoin’s upward momentum.

“Short sellers are buying to cover their short positions in stocks like Coinbase Global, MicroStrategy, Marathon Digital Holdings, and Riot Platforms. This will further push up the prices of these stocks,” said Ihor Dusaniwsky, Managing Director at S3, in a report on December 5.

Coinbase has caused the most pain for short sellers this year. The stock has surged 290% since the beginning of the year and has resulted in a loss of $3.5 billion for short sellers. MicroStrategy has also galloped more than 300% and caused $1.4 billion in losses for short sellers.

JPMorgan CEO supports crackdown on the crypto industry

In the midst of the cryptocurrency market frenzy, a leader of a major US bank has spoken out against the industry.

“I’ve always been against cryptocurrencies, Bitcoin…” Jamie Dimon, CEO of the largest bank in the US, JPMorgan, said at a hearing before the US Senate Banking Committee on December 6. “This is a way for criminals, drug dealers, money launderers, and tax evaders. If I were the government, I would shut down this whole industry.”

Dimon’s comments are in line with his history of criticizing cryptocurrencies. Previously, he called cryptocurrencies a “Ponzi scheme” and a “fraud.” His latest remarks come after a series of hacks and scandals in the crypto industry. The industry is currently under close scrutiny by US regulators and lawmakers following the FTX incident – the cryptocurrency trading platform belonging to Sam Bankman-Fried.