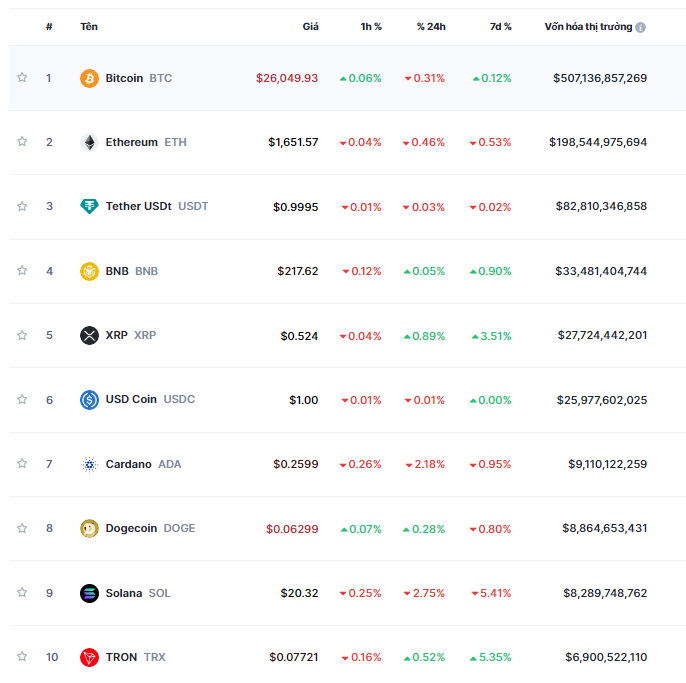

As of the morning of August 26, Bitcoin is at $26,050, almost unchanged from the previous weekend. The second largest cryptocurrency Ethereum has slightly retreated to $1,651.

The other cryptocurrencies in the top 10 are also not fluctuating too much, with XRP increasing by 3.5%, TRON increasing by 5%, and Solana decreasing by 5%.

The performance of the top 10 cryptocurrencies

Source: CoinMarketCap

|

The US Treasury proposes tax rules for cryptocurrencies

The US Treasury has proposed reporting rules for tax information from cryptocurrency brokers, including exchanges and payment processing systems. Under the proposal, these entities will have to provide information about the buying and exchanging of virtual assets by users to the Internal Revenue Service (IRS).

The proposal is part of the efforts of the US Congress and regulatory agencies to prevent cryptocurrency users from evading taxes. The US Treasury Department said Form 1099-DA will help taxpayers determine if they owe taxes and also help cryptocurrency users calculate their profits.

In addition, the new regulations will require virtual asset brokers to adhere to disclosure rules like other brokers, such as bonds or stocks. According to the proposal, the definition of “broker” will include both centralized and decentralized platforms, virtual payment processing systems, and some online cryptocurrency wallets. The rules will also apply to cryptocurrencies as well as NFTs.

According to estimates, the new rules could generate tax revenue of up to $28 billion over a decade.

The cryptocurrency industry has had mixed reactions to the US Treasury’s proposal. Kristin Smith, CEO of the Blockchain Association, believes that “the new rules could help regular cryptocurrency users obtain the necessary information to accurately comply with tax laws.”

Miller Whitehouse-Levine, CEO of DeFi Education Fund, a decentralized finance advocacy group, believes that the proposed approach will not make tax compliance any easier.

“The IRS’s proposal is confusing and prone to misunderstandings. The rules are trying to apply legal frameworks based on the existence of intermediaries that do not actually exist,” he said.

Mastercard ends partnership with Binance

According to Bloomberg, global payment giant Mastercard has terminated its partnership with the cryptocurrency exchange Binance.

Mastercard will end four cryptocurrency card programs in Argentina, Brazil, Colombia, and Bahrain from September 22, a Mastercard spokesperson said.

Many experts in the cryptocurrency world see this as a sign that Binance’s regulatory troubles in recent months are not only increasing but also pose a potential legal liability to their partners.

Binance customers in Europe encounter withdrawal issues

Binance’s difficulties do not stop there, as many customers in Europe have complained about not being able to withdraw money.

Previously, customers of this exchange had reported difficulties in withdrawing cash due to issues related to SEPA. On August 20, Binance’s customer service department wrote on X (the post has been deleted) that the exchange does not have a specific timeframe for the resumption of SEPA transfer operations and also revealed that its payment service provider “can no longer support such transactions.”

In a now-deleted post on X (Twitter), Binance said that unsuccessful withdrawal attempts were due to transactions in Euros (EUR) via the Single Euro Payments Area (SEPA) being temporarily suspended.

In a response to Cointelegraph, a Binance representative said the customer support post on X was a “misunderstanding” and confirmed that “the SEPA deposit and withdrawal service will remain in operation until September 25 as initially announced.”