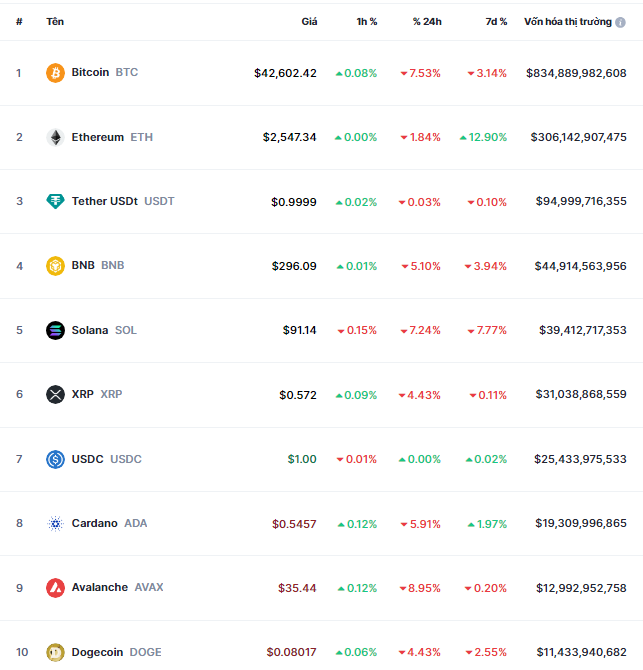

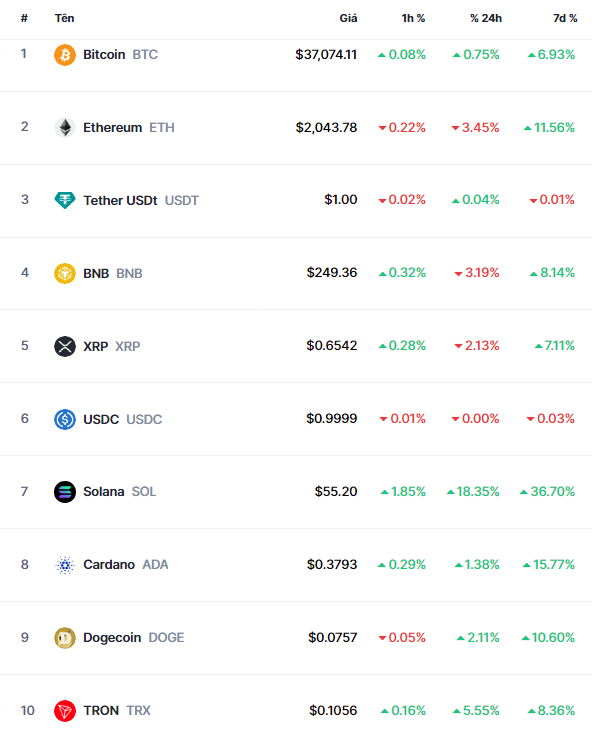

As of the morning of November 11th, the price of the world’s largest cryptocurrency surpassed the $37,000 mark, increasing nearly 7% compared to the previous weekend. Meanwhile, Ethereum soared nearly 12% and fluctuated around the $2,000 mark.

Other top 10 cryptocurrencies saw even stronger growth. Solana surged 37%, Cardano rose 16%, Dogecoin advanced 10%, BNB increased 8%, and Ripple (XRP) climbed 7%.

Top 10 cryptocurrencies

Source: CoinMarketCap

|

The Delaware state business registration website announced that BlackRock’s iShares Ethereum Trust mutual fund was registered on November 9th. On June 8th, one week before BlackRock submitted an application to launch a bitcoin ETF, the iShares Bitcoin Trust was also registered. BlackRock declined to comment on the matter.

The news about the Bitcoin ETF has created a positive atmosphere in the cryptocurrency market. In addition, short selling by various parties has also contributed to the upward momentum.

Clara Medalie, head of research at cryptocurrency data provider Kaiko, said that the strong rise of Bitcoin has sparked a wave of short selling, pushing the price of Bitcoin even higher.

“Over the past year, the cryptocurrency market has been waiting for a suitable catalyst. News about the Bitcoin ETF is something that many people have been waiting for and anticipating. If the Bitcoin ETF is approved, we can expect another price surge,” added Clara Medalie.

Prior to that, Gautam Chhugani, an analyst at Bernstein, said that the company expects the U.S. Securities and Exchange Commission (SEC) to approve a physically-backed Bitcoin exchange-traded fund (ETF) in the first quarter of 2024.

This is considered an important decision and is expected to drive the entire cryptocurrency market in the future. Experts at Bernstein also predict that the price of Bitcoin could increase fivefold from its current level to $150,000 by 2025.

“You may not like Bitcoin, but the objective view of Bitcoin as a commodity shows a change in the cycle. A good idea is only valuable when it is presented at the right time,” commented Chhugani.

This prediction is made in the context of Bitcoin approaching the “halving” phase. During the “halving” process, the rewards for Bitcoin miners will be cut in half. This happens every four years and contributes to the deflationary process of Bitcoin.

In previous cycles, the Bitcoin “halving” process usually occurred a year before the price surge. It is expected that this event will occur again in early 2024.