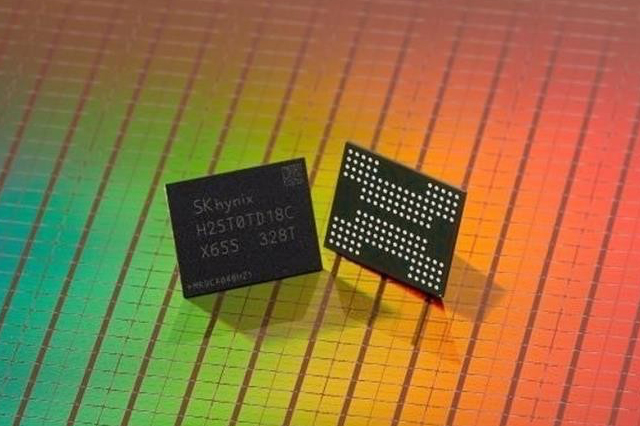

A chip developed by SK Hynix was introduced at Santa Clara, California, USA. (Photo: Yonhap/TTXVN)

|

In October 2023, China’s imports of semiconductor manufacturing equipment (chips) increased by over 90% compared to the same period last year.

This indicates an improvement in the chip production capabilities of the world’s second largest powerhouse, as the supply of chips into China from abroad has been affected by trade control measures imposed by the US and its allies.

According to China’s Customs data, imports of machinery and equipment for the production of semiconductors or integrated circuits increased by 93% in the past three months, until the end of September, to 63.4 billion yuan ($8.7 billion).

Notably, imports of lithography equipment, also known as optical engraving – an important part of the process of creating nanoscale circuit pattern plates, quadrupled during the same period. Most of these products were imported from ASML, a Dutch company. It is a major supplier of the world’s most advanced chip manufacturing equipment.

In the third quarter, China accounted for 46% of ASML’s sales, a much higher proportion than the 14% in 2022.

Senior analyst at Tokai Tokyo Research Institute, Masahiko Ishino, said it usually takes six months for lithography equipment to be delivered after placing an order.

Chinese manufacturers may have realized that accessing chip manufacturing equipment will become more difficult in the future, so they are trying to stock up more than their actual needs.

Similarly, China’s imports of chip manufacturing equipment from Japan increased by about 40% in the same quarter, with the main increase in lithography and engraving equipment.

Meanwhile, imports from the US to China only increased by about 20%. Compared to Q3 2021, the US market share in China’s semiconductor manufacturing equipment imports has dropped to 9%, Japan’s market share is 25%, and the Netherlands’ market share has increased to 30%.

According to the SEMI (US) trade group, China is the world’s largest market for semiconductor manufacturing equipment in Q2 2023, accounting for 29% of global sales./.

Dieu Linh