Illustrative Photo

Weekly oil falls as Fed is not in a hurry to cut interest rates

Oil prices fell nearly 3% and posted a weekly drop after a policy planner at the US Central Bank said rate cuts could be delayed for at least two months.

Brent crude futures fell $2.05, or 2.5%, to settle at $81.62 a barrel while U.S. West Texas Intermediate (WTI) crude fell $2.12, or 2.7%, to settle at $76.49 a barrel.

For the week, Brent was down about 2% while WTI was down more than 3%. However, signs of clean fuel demand and concerns about supply recovery may boost prices in the coming days.

U.S. Federal Reserve policymakers should postpone a rate cut for at least a few months, Fed Governor Christopher Waller said on Thursday, adding that it could slow economic growth and limit oil demand.

The Fed has maintained its policy rate steady at 5.25% to 5.5% since July last year. Minutes of the previous meeting showed most central banks were worried about early policy tightening.

However, some analysts said demand is generally still high despite the impact of high interest rates, including in the US.

JPMorgan’s demand indicators show a 1.7 million barrels per day increase in oil demand from the previous month as of February 21, the analysts said in a note.

Meanwhile, ceasefire talks in Gaza are underway in Paris to prevent conflict in Palestine and the release of Israeli and foreign hostages. The ceasefire talks could ease tension in geopolitics.

However, tension in the Red Sea continues with Houthi militants supported by Iran near Yemen forcing many shipping vessels to divert from trade routes.

U.S. energy companies this week added the most oil rigs since November 2023 and the most in a month since October 2022.

Gold rises as USD weakens, safe haven demand

Gold prices rose as USD softened and safe haven demand increased due to heightened tensions in the Middle East, even as U.S. Federal Reserve officials postponed interest rate cuts early this year.

Spot gold rose 0.8% to $2,040.69 an ounce at 18:51 GMT, heading for a 1.4% weekly gain. U.S. gold futures rose 0.9% to $2,049.4.

The USD index fell 0.1% and is headed for its first weekly decline in nearly two months as investors breathed a sigh of relief after a recent rally built on expectations that the Fed would delay rate cuts. Lower interest rates increase the attractiveness of holding gold bullion.

Silver fell 0.1% to $901.21, while palladium rose 1.9% to $986.56. Silver rose 1% but fell 1.8% for the week.

Iron ore falls 6.5% this week on concerns about Chinese demand

Iron ore futures saw strong weekly declines amid lingering concerns about demand in China, even though prices rebounded in the last session on concerns about potential supply disruptions in Brazil due to a train accident.

The May 2024 contract on the Dalian Commodity Exchange (DCE) fell 0.45% to 899 CNY ($124.91) per tonne, down 6.5% in the week.

The March 2024 iron ore contract on the Singapore Exchange rose 0.43% to $120.2 per tonne but fell 5.6% this week.

Heavy rains in Rio de Janeiro State in Brazil over the past few days caused disruptions on a rail line owned by Vale. The issue is expected to be resolved in the coming days and will not impede Vale’s production or shipments.

Abundant supply and slow recovery in demand continue to act as a headwind in the coming months, limiting price increases for iron ore, analysts said.

Refined copper and coke copper prices fell 0.65% and 0.44% respectively.

On the Shanghai Futures Exchange, prices fluctuated. Most notably, rebar and hot-rolled coil steel changed little, while stainless steel increased 1.63%, and flat steel fell 0.34%.

Global crude steel production in January 2024 fell 1.6% from January 2023 to 148.1 million tonnes, data from the World Steel Association showed on Friday. Crude steel production from China, the world’s leading producer and consumer of metal, fell 6.9% to 77.2 million tonnes this month.

Nickel heading for biggest weekly gain in 7 months

Nickel prices are heading for the biggest weekly gain in 7 months as the West expanded sanctions on Russia.

LME nickel for 3 months increased 0.8% to settle at $17,525/tonne after touching a new high since November 10, 2023 at $17,600. The metal has surged 7% for the week, the most since July.

The market is hopeful that China’s demand will pick up immediately after the Lunar New Year holiday, but that has not materialized, analyst Al Munro of Marex said.

Nickel is also supported by speculation on the slow approval of Indonesia’s mining quotas, which could tighten the supply of ore, CITIC Futures said. Indonesia, the world’s largest nickel producer, is reviewing applications for mining quotas over the next three years. Other minerals are facing similar issues, with the country’s tin exports falling 99% in January.

Zinc prices rose 0.9% to $2,407/tonne, lead increased 0.3% to $2,094.50, and tin rose 0.7% to $26,350.

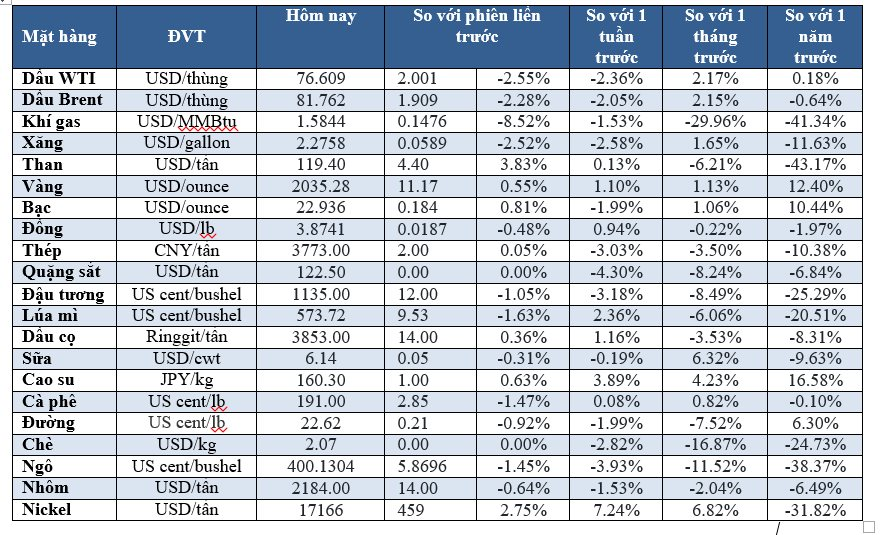

Prices of some key commodities on the morning of February 24, 2024