The Vietnamese stock market experienced a relatively volatile trading session on February 23. The VN-Index maintained a majority of gains throughout the trading time, but in the second half of the afternoon session, selling pressure unexpectedly increased, causing the main index to decline sharply, closing the session down more than 15 points (-1.25%), to the level of 1,212 points. HoSE recorded 414 stocks declining, including 3 stocks hitting the floor, dominating over 98 rising stocks.

It is worth noting that the trading volume exploded with a trading value of over VND 30,000 billion on HOSE, indicating active selling pressure. This is the highest liquidity session since the end of September 2023.

Vietnamese stock market declines sharply on February 23

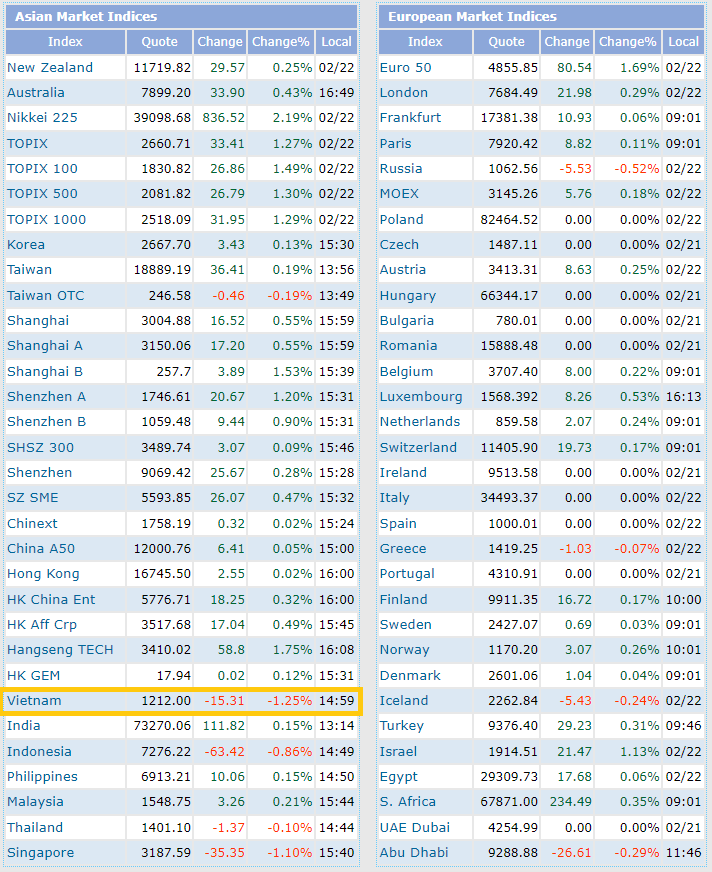

The 1.25% decline has also made Vietnam stock market the largest decliner in Asia for the day. The sharp decline session also wiped out over VND 62,000 billion in market capitalization from HoSE. As of February 23, the market capitalization of HoSE only remained over VND 4.9 million billion.

Vietnamese stock market declines the most in Asia on February 23

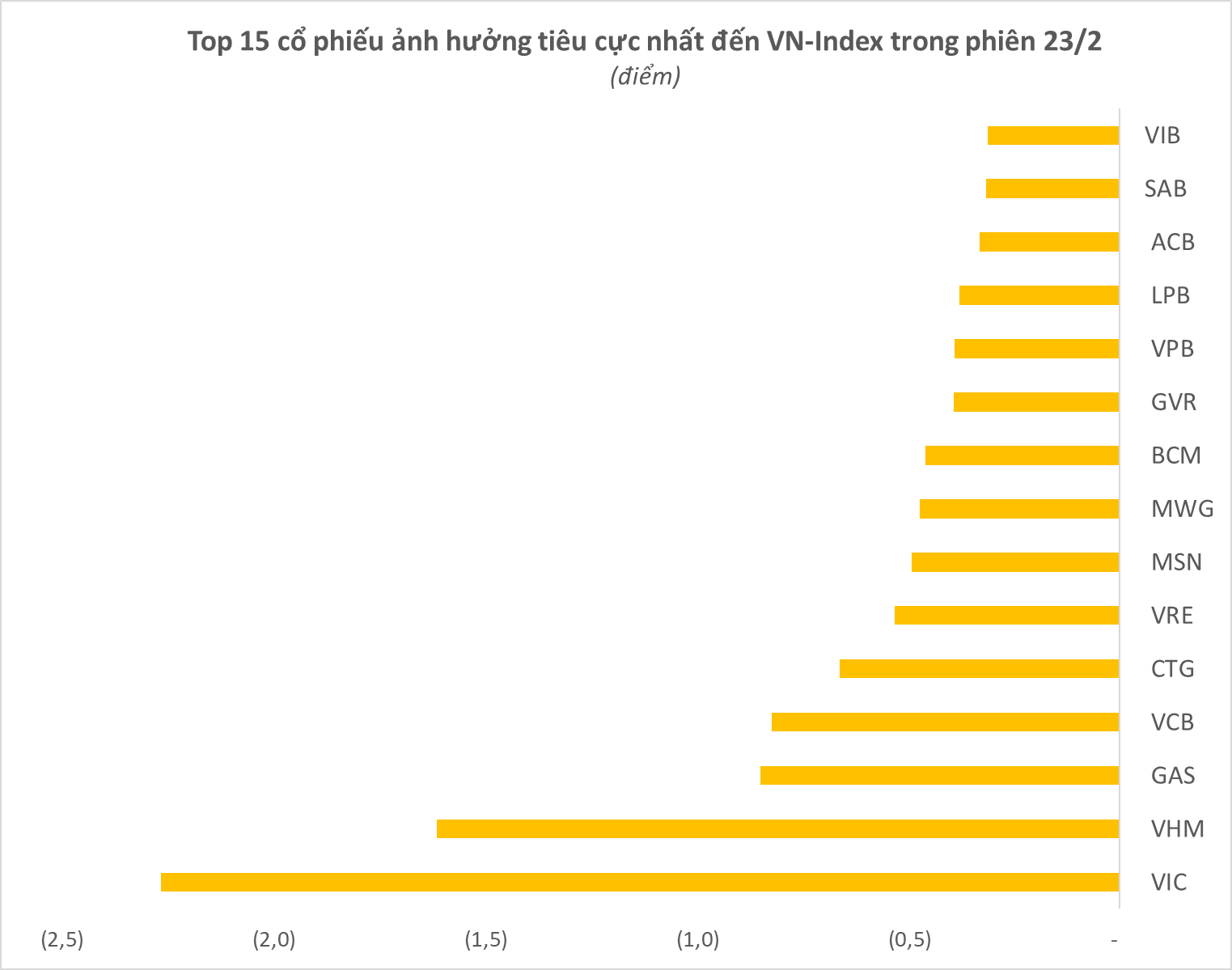

Regarding the contribution level, two Vingroup bluechips, VIC and VHM, have caused a total loss of nearly 4 points for the VN-Index, of which VIC decreased by 5% to VND 45,200 per share, while VHM lost 3.3% to VND 43,300 per share.

Furthermore, GAS continues to be a strong factor affecting the market, taking more than 0.8 points from the VN-Index with a nearly 2% decline in today’s session. Similarly, two banking stocks, VCB and CTG, also took a total of 1.5 points from the main index. In terms of price movement, these leading players in the industry also closed the session with significant declines, with VCB losing 0.7% and CTG dropping 1.4%.

The fact that the largest market capitalization groups in the stock market are simultaneously showing significant declines reveals the negative sentiment of today’s trading session. The top 15 stocks that negatively impacted the VN-Index in this sharp decline session included VN30 bluechips like VRE, MWG, MSN, GVR, as well as the VPB, LPB, ACB, VIB banking group.

In fact, the VN-Index has had a relatively strong recovery since the short-term bottom in early November 2023. Throughout the past three months, the main index of the Vietnamese stock market has increased by over 180 points (18%), surpassing the 1,200 threshold. Therefore, it is not surprising that selling pressure has risen at high price levels, posing correction risks.

In addition to profit-taking pressure from domestic investors, foreign institutional investors have also conducted strong selling, causing buying support to no longer be maintained as it did before Tet holiday. In the last two sessions, foreign investors have net sold over VND 1,700 billion worth of shares on HoSE. The hindrance to foreign capital flow may originate from the market valuation no longer being too cheap after a strong increase, plus the upgrading story is still not really clear.

However, stable macro factors and the recovery of the Vietnamese economy open up prospects for the stock market in the future. In the newly published strategic report, SSI Securities expects that the recovery of the economy is likely to become more evident in the second half of 2024, with increased exports thanks to the global interest rate reduction and the return of consumer confidence. As 2023 is a year with many measures to “buy time” to wait for the real estate and financial market to return to normal state, the recovery this year will help the financial system avoid major challenges.

In terms of cash flow, SSI Research believes that both individual and foreign investor cash flows are favorable for the stock market this year. Record low interest rates will be the main growth driver, especially for retail investors. Bank deposits continue to increase as other investment channels are limited (gold prices have increased significantly, while the real estate and corporate bond sectors need more time to recover). Therefore, this capital flow may return to the stock market in various stages of 2024.

As individual investors accounted for 92.2% of the average daily trading volume of the entire market in 2023, VN-Index is predicted to have significant jumps in 2024 thanks to this individual investor capital flow.