In the latest announcement, Deputy Chairman cum CEO of Quang Ngai Sugar JSC (QNS) Võ Thành Đàng reported completing the purchase of 786,300 shares out of a total of 1 million registered shares. The reason for not buying all is that the market condition is not suitable yet. The transaction took place from January 22 to February 19, 2024.

Based on the market value, Mr. Đàng spent nearly 4 billion to complete the transaction. After the transaction, he currently holds over 29 million QNS shares (equivalent to 8.15%).

Immediately after that, the CEO of QNS continued to register to buy 1 million QNS shares from February 26 to March 26, 2024. If successful, his ownership ratio will increase to 8.43%.

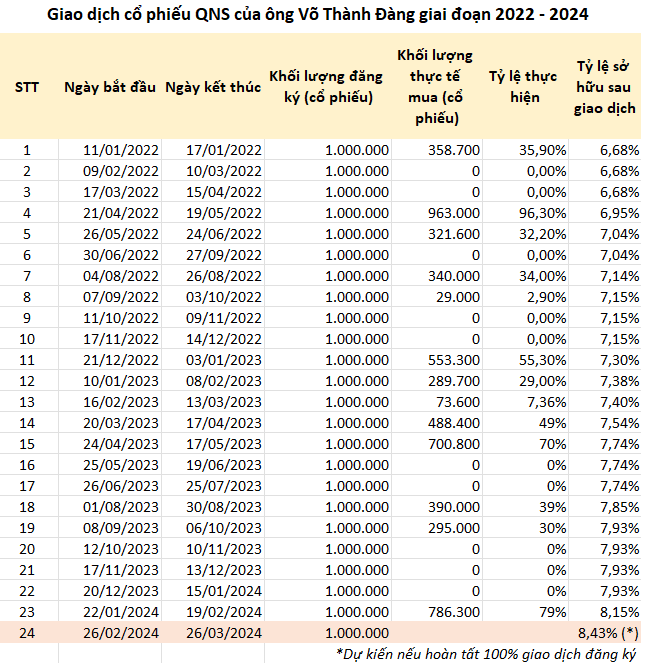

According to statistics, Mr. Đàng has been engaging in the buying of QNS shares in recent years. Specifically, from the beginning of 2022 until now, he has registered to buy QNS shares 24 times with the same quantity of 1 million shares each time. However, it is worth noting that he has never bought 100% of the registered shares, and there have been cases where he couldn’t buy any shares. The reason for all of these is that the market conditions are not suitable. The average purchase rate for the 23 completed purchases is 24% of the total registered quantity.

On the market, QNS shares are on the rise. The stock closed at 48,000 VND/share on February 22, corresponding to a 7% increase since the beginning of 2024.

Quang Ngai Sugar is known as a leading company in the soy milk segment with two famous brands, Fami and Vinasoy. QNS also owns one of the largest sugarcane plantations in Vietnam and the most popular beer brand in Quang Ngai province.

In terms of business performance, in the whole year of 2023, QNS recorded net revenue of 10,023 billion VND and net profit of 2,189 billion VND, up 21% and 70% respectively compared to 2022. In 2024, QNS has a relatively cautious plan, with expected net revenue of 9,000 billion VND and targeted after-tax profit of 1,341 billion VND.