Illustrative image

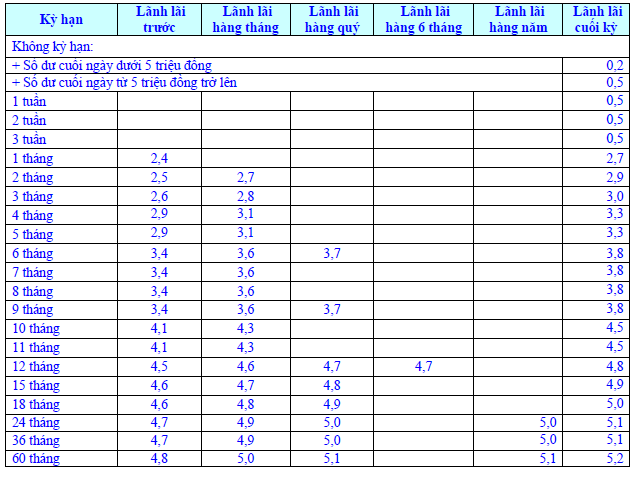

Deposit interest rate at Eximbank counter

With the form of counter deposit and interest payment at the end of the term, the deposit interest rate at Eximbank is fluctuating from 0.2%/year to 5.2%/year.

Specifically, for non-term deposits, customers will receive an interest rate of 0.2%/year for the end-of-day balance below 5 million VND and 0.5%/year for the balance from 5 million VND to less than 100 million VND. For fixed-term deposits, short-term deposits from 1 – 3 weeks have an interest rate of 0.5%/year. These terms all have unchanged interest rates compared to before.

For terms from 1 – 5 months, the interest rates are respectively 2.7%/year (1 month), 2.9%/year (2 months), 3%/year (3 months) and 3.3%/year (4, 5 months);

Terms from 6 – 9 months have an interest rate of 3.8%/year; the interest rate for terms 10 – 11 months is applied at 4.5%/year, 12 months is 4.8%/year; 13 months is 4.9%/year; 15 months is 5%/year; terms from 24 – 36 months have the same deposit interest rate of 5.1%/year;

Eximbank is currently offering the most preferential interest rate of 5.2%/year for deposits with a term of 60 months.

In addition to the end-of-term interest payment method, Eximbank also implements flexible interest withdrawal methods with competitive interest rates: Interest withdrawal rates in advance range from 2.4%/year – 4.8%/year; Monthly interest withdrawal rates range from 2.7%/year – 5.0%/year; Quarterly interest withdrawal rates range from 3.7%/year – 5.1%/year; 6 month interest withdrawal rate is 4.7%/year; Annual interest withdrawal rate is 5.0 – 5.1%/year.

Source: Eximbank

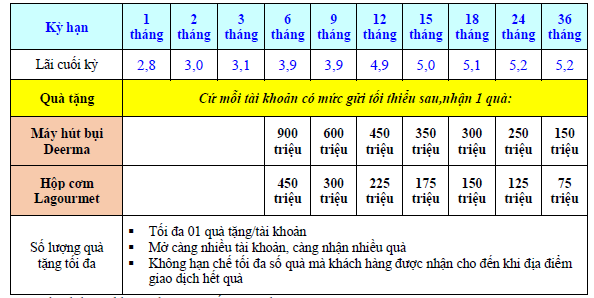

Eximbank online deposit interest rate

For online deposit and end-of-term interest payment methods, Eximbank applies interest rates that are 0.1%/year higher than counter deposit.

Specifically, the interest rates are 2.8% – 3.1%/year for terms from 1 – 3 months; 3.9%/year for 6 – 9 months; 4.9%/year for 12 months; 5.0%/year for 15 months; 5.1%/year for 18 months.

The highest interest rate that Eximbank is applying is 5.2%/year, for terms from 24 to 36 months.

Eximbank online deposit interest rate chart

Source: Eximbank

Eximbank also introduces other saving products such as Eximbank VIP Savings, Customized Term Savings, Fixed Term Savings, Birthday Full Joy with Eximbank, with preferential interest rates and conditions to meet every customer’s needs. At the same time, this bank also implements many attractive gift programs for customers depositing at the counter and depositing online in February 2024.