|

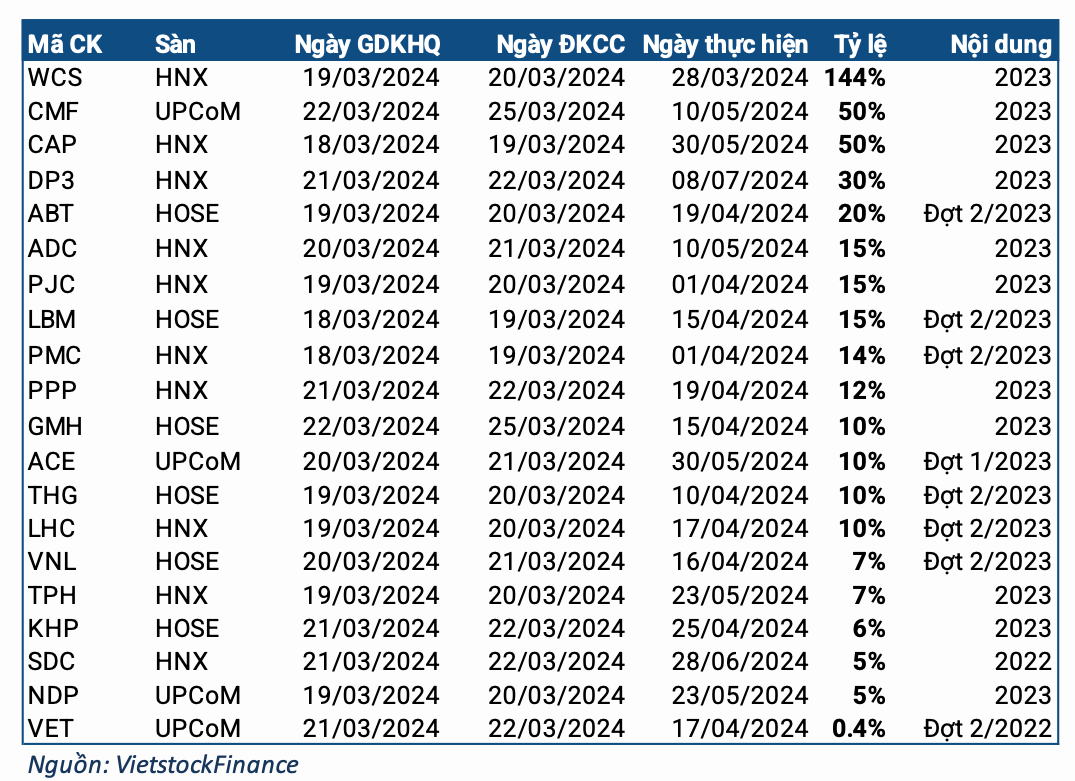

Businesses finalize dividend payment in cash from 18-22/03

|

The West Coach Limited Company (HNX: WCS) is the most prominent name among businesses finalizing dividend payment in cash next week, with a rate of 144%. On the market, WCS has 2.5 million outstanding shares, estimated to require VND 3.6 billion for the advance payment of dividends for shareholders of 2023. The ex-dividend date is 19/03, with payment expected on 28/03/2024.

It is known that the expected dividend rate for payment in 2023 of WCS is not less than 20%. The rate mentioned above is thus beyond expectations for this bus station business.

WCS is famous for being one of the most stable dividend distributing companies on the stock market. Before COVID-19, WCS continuously paid huge dividends with a rate of 400% for 2018 and 516% for 2019. However, for 3 consecutive years (2020, 2021, 2022), it was affected by the pandemic, which caused the dividend rate of the Company to decrease to only 20% (equivalent to VND 2,000/share).

In the second position is Cholimex (UPCoM: CMF) with a rate of 50% – equivalent to VND 5,000/share. With 8.1 million shares outstanding, CMF requires VND 4.05 billion. The ex-dividend date is 22/03, with payment expected on 10/05/2024. The upcoming dividend payment wave also marks the fifth consecutive year that CMF shareholders enjoy a 50% dividend.

Sharing the same cash dividend rate of 50% with CMF is CAP (Lam Agriculture and Food Company Yen Bai. With over 10 million shares outstanding, CAP plans to allocate more than VND 5 billion for cash dividends in 2022-2023. The ex-dividend date is 18/03 and the payment date is 30/05/2024.

Not only cash dividend, CAP is also the only company that will finalize dividend payment in shares next week. The implementation rate is 50% (shareholders holding 100 shares will receive 50 new shares). It is expected that the Company will issue an additional 5 million shares, thereby increasing its charter capital to nearly VND 151 billion after issuance. Thus, CAP has a total dividend rate of 100% including cash and shares.