The Interbank VND Interest Rate Will Continue To Be Low?

Interbank VND interest rate will continue to be low?

Statistics from the money market show that during the week from February 19-23, VND interbank interest rates increased significantly at all maturities in most sessions compared to before. Specifically, at the end of the trading week (February 23), the VND interbank interest rates were around: overnight interest rate is 3.63%/year (+2.49 percentage points); 1 week is 3.57%/year (+2.19 percentage points); 2 weeks is 3.35%/year (+1.83 percentage points); 1 month is 2.74%/year (+0.78 percentage points).

Earlier, VND interbank term trading volumes only increased slightly in January 2024 (+1.9% MoM) due to high liquidity needs before Tet. However, the market situation in the pre-Tet month was quite calm, with almost no successful transactions indicating that the system’s liquidity was still relatively abundant. According to this, the interbank interest rates still remained low. Specifically, interbank overnight, 1-week, 2-week, 1-month interest rates achieved 0.18%/year, 0.44%/year, 1.18%/year, and 1.14%/year respectively.

In the first week of February before the Lunar New Year, there was a sharp increase in the interbank overnight interest rates, showing high liquidity needs. In the 5 working days from February 5-16 (the week before and after the Lunar New Year holiday), the VND interbank interest rate increased sharply in 3 sessions before the Tet holiday and then decreased again in 2 sessions after the Tet holiday in all maturities. On February 16, VND interbank interest rates were around: overnight is 1.14%/year; 1 week is 1.38%/year; 2 weeks is 1.52%/year; 1 month is 1.96%/year.

At this time, the State Bank of Vietnam (SBV) still maintained open market operations (OMO) but no banks “needed” this support. This is a relatively different case when in previous years SBV often had to net pump tens of thousands of billion dong to support liquidity.

However, when the interbank interest rates sharply increased during the week from February 19-23, there were banks that “needed” support from SBV. The updated market developments from the Vietnam Interbank Market Research Club show that in the pledged channel, SBV offered tenders with a maturity of 7 days with a volume of VND 31,000 billion and an interest rate of 4.0%/year. At the end of the week, VND 6,037.51 billion were successfully tendered, with no matured volume. Thus, SBV has net pumped VND 6,037.51 billion into the market.

With recent developments in the VND interbank interest rates, analysts from KB Vietnam Securities Company (KBSV) believe that the increase in interbank interest rates is only seasonal, while the post-Tet credit demand is not too high, which will cause the interbank interest rates to cool down and continue to remain low in the coming period.

Exchange rate pressure may cause interbank interest rates to increase

However, KBSV experts also predict that if the upward momentum of DXY causes pressure on the exchange rate, it may force SBV to intervene by net withdrawal in the open market to increase the interbank interest rates – although the probability of this happening is still considered to be not high.

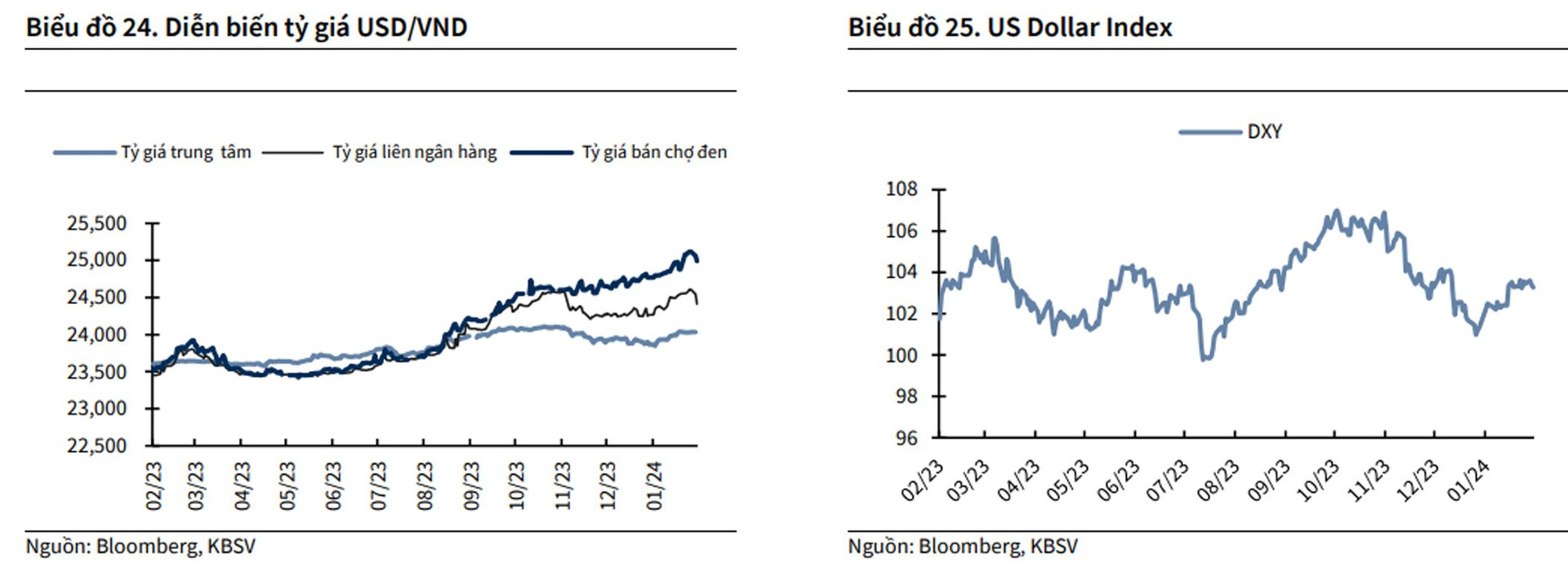

In fact, the USD/VND interbank exchange rate has fluctuated in the range of 24,200 – 24,600 VND/USD, remaining at high levels since January 2023 in the context of: (i) the DXY index rebounded to the range of 104 amid hot inflation data – pushing back market expectations of interest rate reductions; (ii) the USD and VND interest rate spread still remains negatively stimulating carry trade transactions (interest rate spread).

Accordingly, the exchange rate at Vietcombank also fluctuated similarly to the interbank exchange rate, reaching 24,595 VND/USD on January 31. The black market exchange rate under the pressure of increased commercial activities in the pre-Tet period and the domestic and world gold price difference, remained at high levels at 25,000 VND/USD on January 31.

KBSV experts believe that the large USD and VND interest rate spread will make buying and holding USD more attractive, stimulating carry trade speculation transactions (investors using low-interest currencies to buy high-interest currencies to benefit from interest rate spreads). Specifically, the 1-month, 3-month, and 6-month USD-VND interest rate spreads are -4.44%, -2.26%, and -1.83% respectively.

Recent economic data shows signs of a slowdown in inflation. The DXY index and 10-year US bond yields have increased again, while futures contracts estimate only 4 rate cuts this year, with the first one taking place in June.

Regarding domestic factors, the domestic exchange rate is forecasted to continue to be well supported by abundant foreign exchange sources from FDI and remittances. In addition, SBV is expected to continue its loose monetary policy, accepting that the exchange rate will increase to a reasonable extent and will not intervene unless there are unusual fluctuations as inflation is still under control, while the economy needs to continue to be supported for recovery.

“Accordingly, the USD and VND interest rate spread and the risk of DXY price increases will still be 2 risk factors putting pressure on the exchange rate, especially when political risks have not shown signs of cooling down. Accordingly, we forecast the exchange rate to increase by 1.5% this year, reaching 24,600 VND/USD”, KBSV experts forecast.