There is no trace of T+ clearance activity in the afternoon session today, and even the liquidity has decreased by nearly 10% compared to the morning session, but stock prices have increased. The largest market cap blue-chips all increased, pushing the VN-Index to its highest point of the day, up 1.09% compared to the reference price.

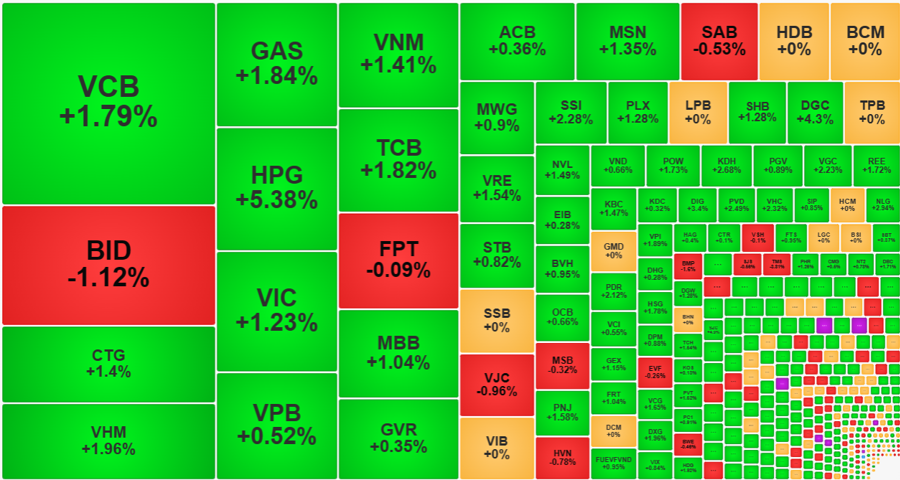

The VN30-Index also increased by 1.18% at the close, while in the morning session it only increased by 0.65%. Only 4 stocks in this group decreased, while the rest increased even more. The large-cap stocks in the top 10 market cap all had significant gains: VCB increased by an additional 1.9% compared to the morning session, closing 1.79% above the reference price; VIC moved away from the reference price, closing up 1.23%; VHM increased by an additional 1.84%, closing up 1.96%. CTG, GAS, VNM, TCB also strengthened. Even HPG made an effort to expand its increase to 5.38%, equivalent to a 0.66% increase in the afternoon alone.

The only stock in the declining group is BID. BID increased slightly by 0.19% at the close of the morning session, but fell by an additional 1.3% in the afternoon. The selling pressure on BID is not significant, with a trading volume of only about 73.3 billion VND in the afternoon session, but the price is weak, showing that the reason is due to weak demand. However, BID only caused the VN-Index to lose about 0.8 points, offsetting the increase of GAS.

The liquidity of the two listed exchanges decreased by nearly 10% compared to the morning session, reaching about 11,070 billion VND. HoSE decreased by nearly 13% to 10,012 billion VND. In the afternoon session, the market welcomed a large volume of bottom-fishing stocks that were transferred to accounts on February 23 (trading in the afternoon of February 23 was over 20.4 trillion VND), but the matching value was only half, indicating that investors tend to hold stocks. This is also a factor supporting the market’s acceleration in the afternoon.

The change in the breadth of the index also reflects this development: At the end of the morning session, VN-Index had 293 stocks up/155 stocks down, closing at 380 stocks up/98 stocks down. 147 of these stocks increased by more than 1% with a trading volume accounting for approximately 65% of the total value matched on HoSE. This increasing amplitude confirms the effectiveness of the capital flow momentum.

The VN30 blue-chip group is still the driving force of the index, with only DGC not belonging to this group among the top 10 stocks with the best points. VN30 ended the session up 1.18%, with 21 stocks up/4 stocks down. The banking stocks still have a certain contribution, with 3 stocks in this group. However, the overall banking group is not strong, with only 5 stocks in the group and an increase of more than 1%: VCB, TCB, CTG, SHB, and MBB. The liquidity of this group also accounted for only 20% of the total matching value on HoSE, the lowest proportion in 6 sessions, with 4,338 billion VND.

Foreign investors are a noteworthy factor in the afternoon session when they made an impressive net purchase of 1,440 billion VND on HoSE alone. The net purchase amount in the afternoon session was +218.4 billion VND, while in the morning session, the net selling amount was 178.6 billion VND. HPG was bought by net about 127 billion VND more in the afternoon. SSI, DGC were also bought by net, with a total of approximately 131.5 billion VND and 89.1 billion VND throughout the session. However, the reversal of the position to net buying of about 39.8 billion VND throughout the session was only thanks to HPG. On the selling side, many stocks were heavily sold, such as STB, VPB, PVD, MWG, VNM, SAB, MSN, TPB, and PC1.

The positive increase in the afternoon session shows that the market is holding on to stocks, despite the good volume of T+ bottom-fishing. This will cause the accumulated inventory to increase with each T+ cycle. For example, yesterday’s trading volume on HoSE and HNX was about 913.5 million shares, but tomorrow afternoon, the accumulated selling volume may be over 1.35 billion shares, including today’s remaining T+ shares.