On March 1, 2024, FTSE will announce the portfolio changes of FTSE ETF, while the reference index of VNM ETF will be announced one week later.

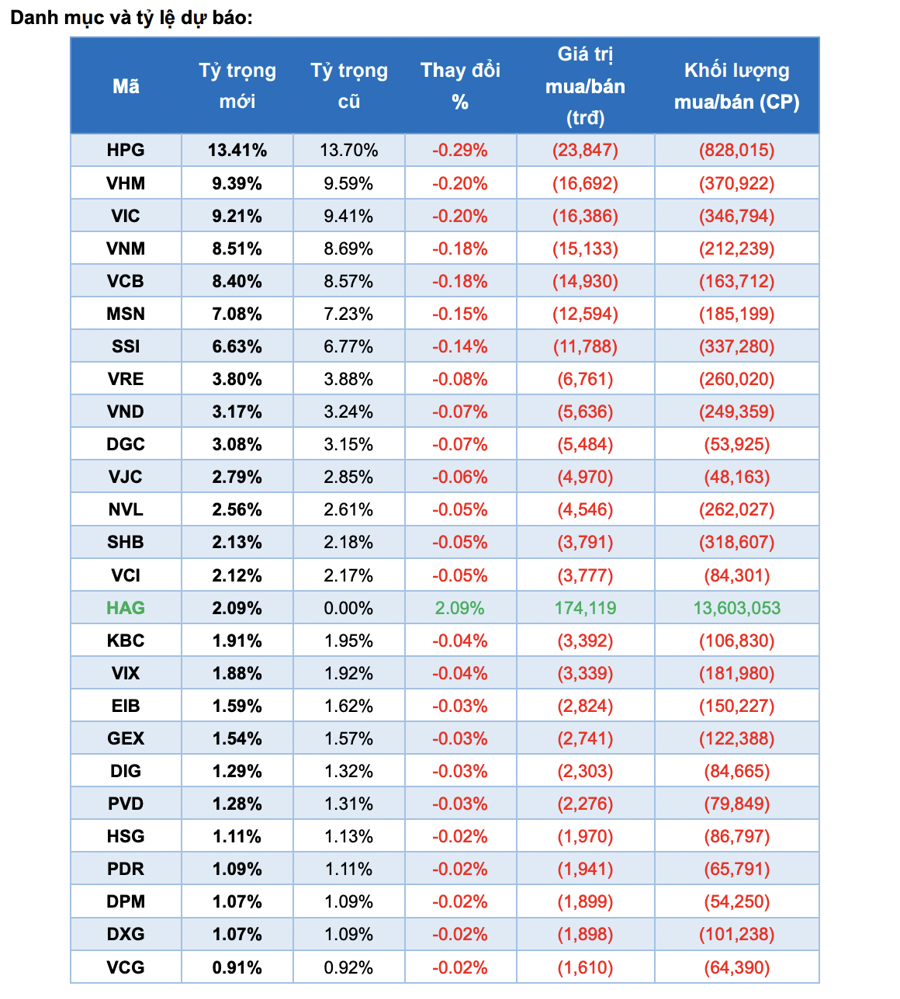

Based on data as of February 23, 2024, Yuanta Securities Vietnam Company predicts that HAG will be included in the FTSE ETF in the upcoming review, with no stocks being excluded. According to the forecast, the FTSE ETF will purchase 13.6 million HAG shares in this round. Most of the remaining stocks in the portfolio will be sold to reduce ownership percentage.

Meanwhile, the Van Eck Market Vector Vietnam Local Index ETF (VNM ETF) will make no additions or deletions to its portfolio in the first quarter 2024 review.

However, VHM will be sold 1.3 million shares, VIC will be sold 1.1 million shares, SSI will be sold 2.1 million shares, in addition to VNM, HPG, and VCB also being sold. On the other hand, all other stocks will be purchased to increase their weightage.

With the aforementioned adjustments, Yuanta Vietnam estimates that both FTSE ETF and VNM ETF will heavily buy 14 million HAG shares. Conversely, 1.5 million HPG shares, 2.5 million SSI shares, and 1.7 million VHM shares will be sold.

Regarding HAG, Hoang Anh Gia Lai Company has just announced that it has received the official registration for a private placement of 130 million shares from investors.

Among them, the expected list of participating investors includes 3 investors: LPBank Securities JSC is expected to purchase 50 million shares, increasing their ownership from 0% to 4.73% of charter capital; Thaigroup Joint Stock Company is expected to purchase 52 million shares, increasing their ownership from 0% to 4.92% of charter capital;

Le Minh Tam, an individual, is expected to purchase 28 million shares, increasing their ownership from 0% to 2.65% of charter capital. Mr. Tam replaces Mr. Nguyen Duc Quan Tung (who initially registered to purchase 20 million shares but later cancelled and did not participate).

The fundraising amount is 1.3 trillion VND, and HAGL plans to use 700 billion VND to supplement working capital and restructure debt for its subsidiary, Hung Thang Loi Gia Lai Co., Ltd., through a loan to support business activities; 330.5 billion VND to partially or fully repay principal and interest of bonds issued by the Company on June 18, 2012, with the code HAG2012.300; and the remaining 269.5 billion VND to restructure debt for its subsidiary, Lơ Pang Livestock Joint Stock Company, through a loan to repay outstanding loans at Tien Phong Commercial Joint Stock Bank.