This afternoon is a good opportunity to lock in profits from bottom fishing stocks, but it seems that many have decided to hold onto their positions, with only half the volume of bottom fishing stocks on February 23rd. This accumulated volume will be released somewhere in the next few days.

VNI saw positive gains today, with leading stocks such as HPG, VCB, GAS, CTG, TCB, VHM, VIC, VNM. However, only HPG, CTG, TCB stood out with new highs. Midcap stocks such as DGC, FRT, and some seafood stocks also performed impressively. In general, the market is providing opportunities for short-term trading with selective stocks rather than overall opportunities, and the upward trend is nearing its end.

Liquidity continues to maintain high levels, with the two exchanges exceeding 23.3 trillion VND and a total of around 25.7 trillion VND for all three exchanges. The amount of high-risk money at this level is still significant, and the opportunity for VNI to truly “retest” the 2023 peak is certain this week. The waiting factor is whether buying power will continue to be added or not, and liquidity will be very high in the next few sessions.

Today, the market did not have any clear selling pressure, as sellers were unable to push prices much and instead retreated, allowing buyers to push up. Liquidity was relatively low in the afternoon, and the expanded price range implies that buyers actively entered orders. The market reached the second session and exceeded the downward range of February 23rd, creating psychological pressure for those who took profits. A volatile situation at such high levels easily stimulates investors. It is not random that liquidity at the peak level is always the largest when everyone is excited and caught in the whirlpool of “correcting mistakes” in short-term positions.

It is still advisable to remain cautious at this time, engage in short-term trading with small positions, move quickly, protect profits, and avoid greed. When speculation reaches a prolonged peak, with a large amount of money and prices unable to decline, the risk becomes greater. The market has repeated such developments, and every day in the uptrend is enthusiastic for everyone, but changes do not need reasons.

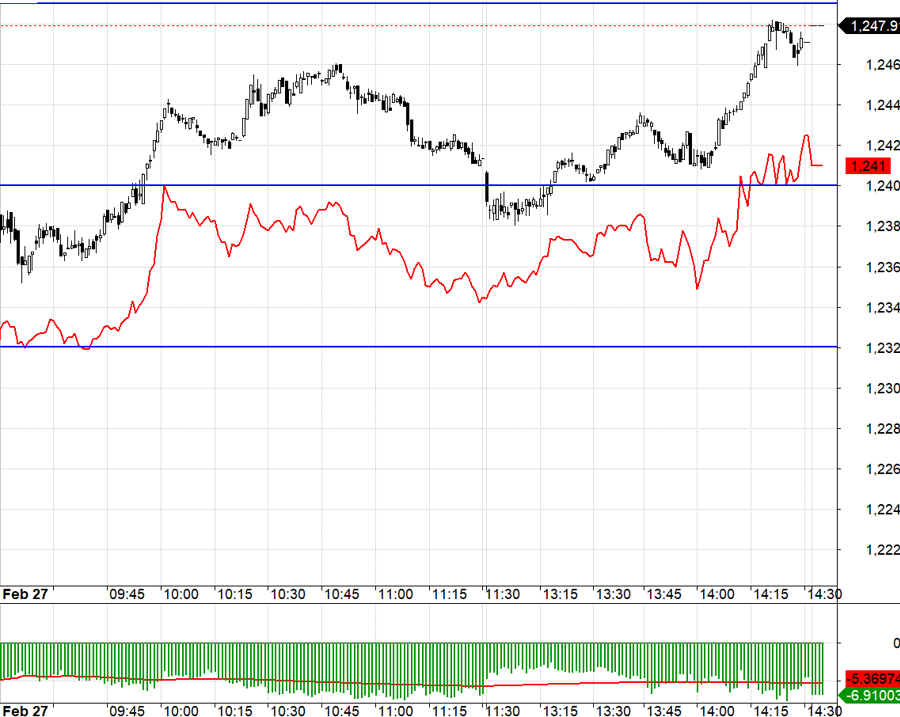

Derivatives market maintained a larger defensive stance today compared to previous sessions, with F1 basis getting wider over time and throughout the session, making it difficult for both Long and Short positions. Setups for both directions are limited by basis range. In the morning, VN30 exceeded 1240.xx without showing inertia to rise to 1249, and even F1 decreased (intraday). Shorting is also difficult because basis is too big. In the afternoon, it needed the last 15 minutes of the continuous phase to have inertia, and when VN30 broke through the morning high, it was also close to the end of trading hours. The increase in F1 range was also negligible. F1 liquidity today increased by 25% compared to yesterday and the basis discount widened significantly, approaching -7 points at the end of the session. In the next 1-2 sessions, if the wide basis discount and OI continue to increase, there is a high chance that this contract is accumulating a very thick Short position.

Some pillars in VN30 are expected to provide momentum for this index to retest the 2023 peak or at least test the peak on February 23rd. If market liquidity is high and there is selling pressure, it is recommended to Short despite significant basis loss. However, it is advisable to wait for the best possible setup and coordination in the pillars.

VN30 closed today at 1247.91. The nearest resistance levels for tomorrow are 1249; 1256; 1261; 1267; 1271. Support levels are 1240; 1232; 1223; 1219; 1211; 1201.

“Stock Blog” is a personal opinion and does not represent the views of VnEconomy. The opinions and evaluations belong to individual investors, and VnEconomy respects the views and writing style of the authors. VnEconomy and the authors are not responsible for any issues arising from the published evaluations and investment opinions.