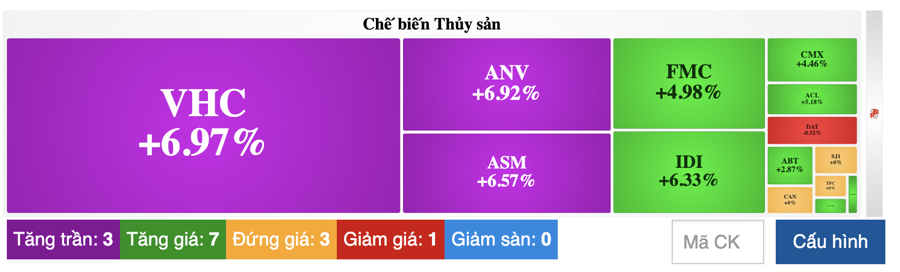

Following a more than 15-point drop in the previous week, the VN-Index is making efforts to recover more than 3 points in this morning’s trading session. In particular, the seafood group has emerged as the focus of the market as a series of stocks have surged significantly, such as VHC, ANV, ASM, and many other stocks.

The strong uptrend in the seafood group comes at a time when several companies have reported positive business results in the first month of 2024.

Specifically, with VHC, the business report for January 2024 recorded revenue of VND 921 billion, marking the highest revenue level in 8 months.

In terms of industry structure, except for value-added products (reaching VND 8 billion, down 36%), most of the revenue from main products has grown positively. Specifically, exports of the main catfish reached VND 448 billion, up 64% compared to the same period last year.

Revenue from secondary products reached VND 175 billion, 3.2 times higher than the same period. Similarly, C&G (Collagen and Gelatin) products brought in VND 74 billion, 3.4 times higher. Rice products (VND 16 billion), puffed rice cakes (VND 40 billion), and other products (VND 160 billion) also increased by 149%, 78%, and 142%, respectively.

Exports to key markets all experienced positive growth in January. Specifically, exports to the US reached VND 185 billion, up 59%; the Chinese market also saw an impressive increase of 259% to reach VND 117 billion. The European market recorded VND 154 billion in the first month of the year, up 33%.

In the domestic market (Vietnam), Vĩnh Hoàn recorded revenue of VND 325 billion, up 137%.

In a recent update on the prospects of the seafood group, SSI Research expects slow recovery in 2024, mainly in the second half of 2024, as Vietnam’s seafood exports continue to trend downward from 2023.

As for the catfish industry, looking back at the previous cycle, the average selling price took 1.5-2 years to bottom out and about 4 years to go through the entire cycle. Therefore, the expectation is that the average selling price of catfish may rebound in the second half of 2024 (two years from peak to bottom). SSI expects that the increase in exports to Europe and China will partially offset the decline in exports to the US in the first half of 2024, and the demand from the US will recover in the second half of 2024 (peak season). In December 2023, the average selling price to the US and China reached $2.5/kg (a decrease of 16% compared to the same period) and $2.1/kg (an 8% decrease), continuing the downward trend since August 2022.

For the shrimp industry, domestic shrimp exporters will focus on high-value added products, and the export value per month is expected to increase at a slow pace.

It is worth noting that among the top shrimp-exporting countries, Vietnam ranks fourth in the US market (after India, Indonesia, Ecuador) and first in Japan, as Vietnam has the advantage of producing high-value added products with skilled labor and advanced processing technologies.

Ecuador/India/Indonesia mainly export unprocessed shrimp at low prices. In December 2023, the export price of shrimp to the US was about $6.8-7.6/kg (a 13% decrease YoY), compared to Vietnam’s export price to the US at $10.6/kg (a 5% decrease YoY).

The average selling price of shrimp may remain stable or slightly increase compared to the same period in 2024 due to weak consumer demand and the need to compete with Ecuador/India/Indonesia (higher discount prices).

Due to weak recovery in order demand, there will be no shortage of shrimp or raw materials supply, and prices will decrease slightly due to weak demand. However, gross profit margin will still decrease compared to the same period in the first half of 2024 due to the decrease in average selling price compared to the same period and the faster decrease compared to raw material input.

In terms of valuation, the valuation level will tend to be on the higher side within the range of the 10-year average P/E of 6x-11x, as investors expect profits to bottom out in 2024, with negative growth in the first half of 2024 and positive growth in the second half of 2024.

SSI expects seafood sector profits to increase by about 20%-30% compared to the same period in 2024 (mainly in the second half of 2024), compared to a decline of about 50%-80% in 2023. Seafood stocks are currently trading at P/E ratios of about 9x-31x, reflecting the expected earnings recovery in 2024.

Stock prices are at historical highs, but there are no clear signs that catfish prices will recover. Assuming catfish prices will rebound in the second half of 2024, 2024 earnings may still be lower than those in the 2021-2022 period. SSI notes that any positive signs of monthly revenue recovery and average selling prices can improve sentiment for shrimp/catfish-related stocks.