In a recent investor letter, Pyn Elite Fund highlighted the reasons to expect good profits from Vietnam in 2024. Based on the performance of the VN index, domestic investors are returning to the buy side. The stock value of PYN Elite has increased by 10% since the beginning of the year. The Vietnamese currency market has normalized, bank liquidity is good, and interest rates have quickly decreased.

The fund believes that listed companies in Vietnam will achieve profit growth of over 20% in 2024. This year will be a positive one for the largest capitalized banking sector on the stock exchange. Stocks on the stock exchange, especially banking stocks, are still undervalued after several years.

“The potential for price increases of these stocks is very high as economic activity continues to rebound with a favorable currency market cycle,” the fund from Finland emphasized.

In a newly published report, Finnish investment fund Pyn Elite Fund stated a growth rate of 6.8% for the fund in January 2024, surpassing the 3% increase of the VN-Index. The fund manages a total asset (AUM) of 702 million Euros, equivalent to about 17.9 trillion dong at the end of January, remaining flat after one month.

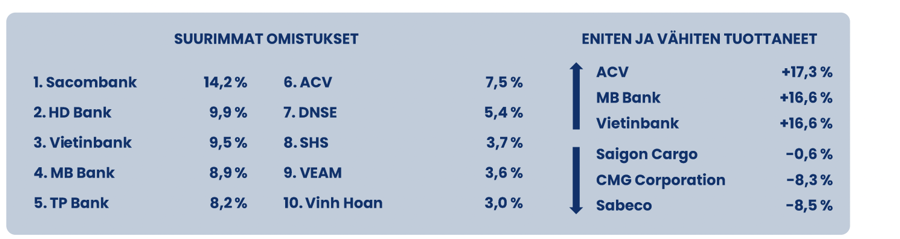

The portfolio had a growth rate of 6.8% in the first month of the year, exceeding the 3% increase of the VN-Index. Among them, the best-performing stocks were ACV, MBB, and CTG, all of which increased by 17%. In contrast, SAB and CMG decreased by over 8%.

The top 10 largest investments at the end of the month included the appearance of DNSE Securities, with a weight of 5.4%. According to previous information, Pyn Elite Fund has agreed to hold 12% of DNSE’s capital. DNSE shares in the current portfolio were purchased at the IPO price of the securities company, which ended on January 24.

In addition, foreign funds own the most shares in STB, HDB, CTG, MBB, TPB, ACV, SHS, VEA, and VHC. On the other hand, VRE and CMG, with ownership ratios of 4.7% and 3.1% of the portfolio at the end of December 2023, are no longer in the Top 10 (replaced by DNSE and VHC).

According to the fund, in Q4/2022, the issue related to SCB Bank caused short-term pressure on the financial market. The government managed this event well. Listed banks that are not involved and not affected are expected to continue to have a promising growth year in 2024.

Macro-economic context analysis, the report by the fund also showed that trade activities were the driving force in January, with export turnover increasing by 6.7% compared to the previous month and 42% compared to the same period; imports increased by 0.1% and 33%, respectively. The manufacturing PMI has returned to the growth zone, reaching 50.3 in January, supported by an increase in the number of orders and new production.

Disbursed FDI increased by 9.6% compared to the same period, while registered FDI increased by 40.2% compared to the same period. Inflation decreased to 3.4% compared to the same period from 3.6% on December 23. Deposit interest rates continue to decrease more deeply across the board, reaching near record lows.