On March 1st, FTSE Russell is expected to announce the stock components of the FTSE Vietnam All-share and FTSE Vietnam Index.

In addition, the FTSE Vietnam 30 Index (the index that the Fubon FTSE Vietnam ETF references) will also be reviewed in the first quarter of 2024.

On March 15th, 2023, it is scheduled to complete the restructuring of the entire portfolio of ETFs referenced by the aforementioned indexes.

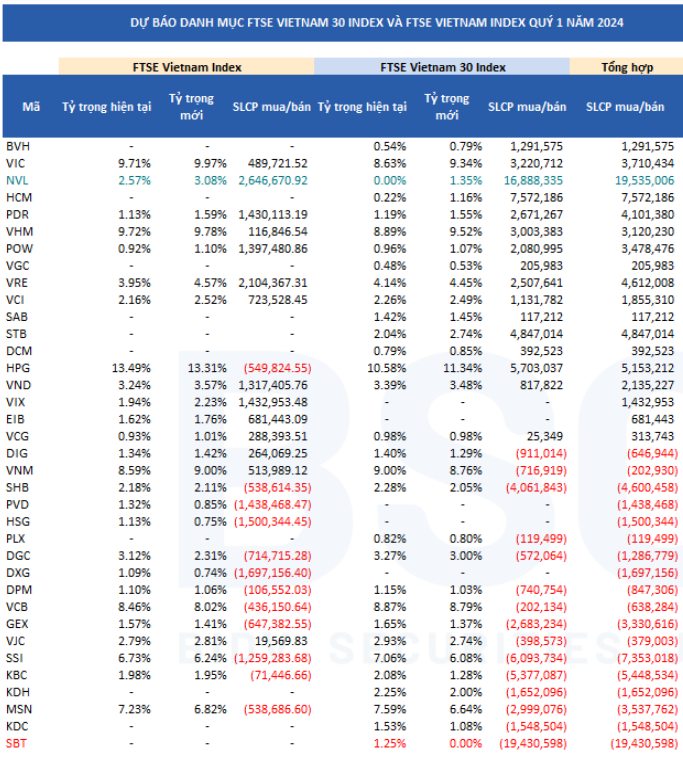

In the latest report, BIDV Securities Company (BSC) has made a forecast for the first quarter 2024 review, including the component stock portfolio and the quantity of shares bought/sold for the ETFs referencing the indexes.

Specifically, with the FTSE Vietnam 30 Index, which is referenced by Fubon FTSE Vietnam ETF, BSC Research projects that the stock code SBT of Thanh Thanh Cong – Bien Hoa Joint Stock Company will be removed from the index basket. Conversely, the stock code NVL of No Va Investment Group Corporation (Novaland) may be newly added.

Under this assumption, BSC estimates that the Fubon ETF will net purchase nearly 17 million NVL shares, bringing the proportion in the portfolio to 1.35%. In addition, HCM Securities JSC will be net purchased 7.6 million shares, Hoa Phat Group JSC may also be net purchased 5.7 million shares, Sacombank will be net purchased 4.8 million shares, etc.

On the other hand, more than 19.4 million SBT shares may be sold by Fubon ETF to remove them from the index basket. Similarly, SSI Securities JSC may be net sold 6 million shares, Kinh Bac City Development Share Holding Corporation may be net sold 5.4 million shares, Saigon – Hanoi Commercial Joint Stock Bank may be net sold 4 million shares, Masan Group Corporation may be net sold 3 million shares, etc.

As of the end of February 26th, 2024, the scale of Fubon ETF’s portfolio reached over 27.5 billion New Taiwan Dollars, equivalent to over VND 21,500 billion. Notably, in the past 2 sessions, this ETF fund has net absorbed approximately VND 83 billion and all of that has been disbursed to buy Vietnamese shares. From the beginning of 2024 to the present, Fubon ETF has net absorbed nearly VND 150 billion.

With the FTSE Vietnam Index, which is referenced by the FTSE ETF, BSC projects that no new/excluded stocks will be added. The report also notes that for the case of FPT Retail International JSC, if the stock is at the threshold of the market capitalization requirement, it may be considered for additional inclusion. The values may deviate due to data application date, free-float ratio, investment weight. As of February 22nd, the scale of FTSE ETF stood at over VND 8,830 billion.

In terms of trading, BSC forecasts that the FTSE ETF may additionally buy NVL (2.6 million shares), VRE (2.1 million shares), VIX (1.4 million shares), PDR (1.4 million shares), etc.

In terms of selling, the stocks that may be sold by the FTSE ETF include DXG (-1.7 million shares), HSG (-1.5 million shares), PVD (-1.4 million shares), SSI (-1.3 million shares), etc.

Source: BSC Research