The stock market had a relatively positive trading session on February 26. After some initial fluctuations, buying pressure helped the VN-Index recover and close in the green at its highest level of the session. The VN-Index increased by 12.17 points to reach 1,224.17 points. Foreign trading was a highlight as net buying totaled around 70 billion VND across the market.

In this context, securities companies recorded net buying of 112 billion VND.

On the HoSE exchange, securities companies recorded net buying of 139 billion VND, with net buying of 181 billion VND in the matched trading channel but net selling of 43 billion VND in the negotiated deal channel.

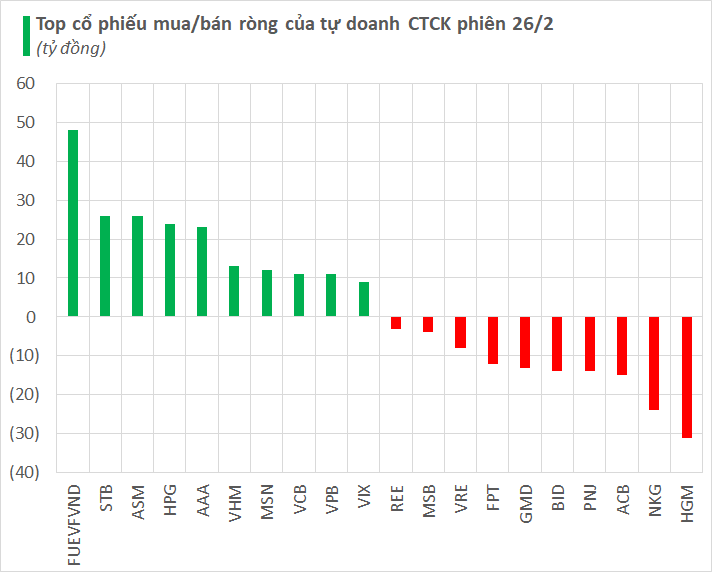

Specifically, securities companies had the strongest net buying in the FUEVFVND fund certificate with 48 billion VND, followed by STB and ASM with net buying of 26 billion VND each. In addition, HPG and AAA were also net bought with 24 billion VND and 23 billion VND respectively. VHM and MSN were also net bought with 13 billion VND and 12 billion VND each.

On the contrary, securities companies focused on net selling NKG and ACB, with net selling values of 24 billion VND and 15 billion VND respectively. In addition, there were also a range of stocks that were net sold in today’s session, including PNJ, BID, GMD, FPT, VRE,…

On the HNX exchange, securities companies net sold nearly 28 billion VND, with HGM being the focus as it was net sold for over 31 billion VND; on the other hand, SHS was net bought for nearly 4 billion VND.

On the UPCoM exchange, securities companies net bought over 1 billion VND, with BSR being net bought for nearly 3 billion VND, while VGT was net sold for nearly 2 billion VND.